Except for some minor and short-term pullbacks, the Canadian dollar has been rising steadily since March 2020. Both 14 months of a continuous uptrend and the scale of growth of the Canadian currency are quite impressive.

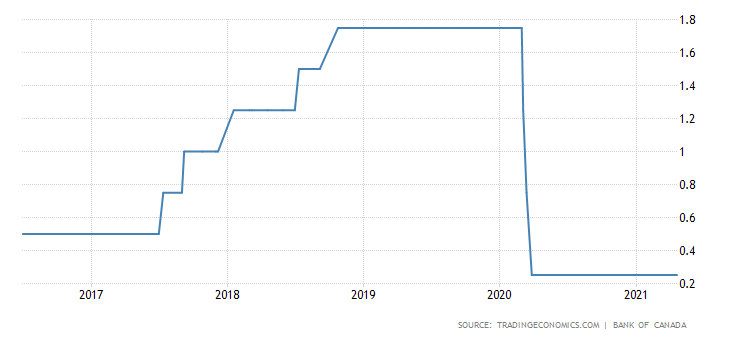

So, it is safe to say that a large-scale correction is coming soon. However, some strong reasons are needed to start the correction. Notably, CAD began its uptrend right after the policy meeting of the Bank of Canada. Back then, the regulator decided to cut its interest rate from 1.75% to 0.25%. This time, the statement from the central bank may cause a correction in the national currency. Today, the Bank of Canada will hold its next policy meeting. It is expected that the current monetary policy will remain unchanged.

Bank of Canada’s interest rate

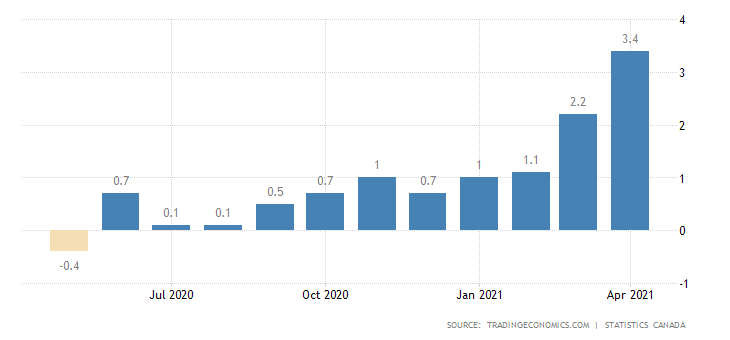

At the same time, the Canadian dollar has been moving up for so long that there is no need for immediate changes in the monetary policy to influence its trajectory. Just a slight hint of a possible rate hike in the near future will be enough for this, especially amid current conditions when inflation in Canada has reached its peak levels in the past ten years. Last time a higher inflation rate was observed in 2011. Moreover, it is accelerating at an incredibly fast pace. In May 2020, there was deflation in Canada, and consumer prices were going down. Today, the prices climbed by 3.4%, and it seems that inflation will continue to rise. In other words, the Bank of Canada simply has no other choice but to raise its interest rate since this is the only tool the monetary authorities can use to reduce inflation. Although the Bank of Canada left everything unchanged, it may soon announce a gradual tightening of its monetary policy which will definitely trigger a full-fledged correction in the Canadian dollar.

Inflation in Canada

USD/CAD has been trading in the sideways channel for 17 sessions in a row, with the boundaries found between 1.2000 and 1.2150. The process of accumulation of trading volumes within this range is obvious. However, we have a number of technical details here. First of all, it is worth noting that the Canadian dollar has been rising for more than a year and has gained nearly +18%. It is actually stunning how CAD has been overbought against its American counterpart. However, this does not stop traders from buying more of the Canadian currency. Secondly, the pair has reached its local low from September 2017 and managed to break through it, thus approaching the level from 2015.

Given the current trajectory of the pair, it is likely to continue trading within the current range with high concentration of trading volume.

As for the trading strategy, it is best to trade on a breakout of either boundary of the existing channel of 1.2000/1.2150 following the momentum. To put it simply, the overbought conditions of the Canadian dollar will not necessarily lead to its correction due to the accumulation process that speculators will definitely benefit from.

According to the comprehensive indicator analysis, the indicators on the 1-minute and 1-hour time frames generate a variable signal due to the amplitude movement. Meanwhile, on higher time frames with a sell signal in place, the price is moving within a medium-term downtrend.

Sincerely, InstaForex Group analyst, DEAN LEO