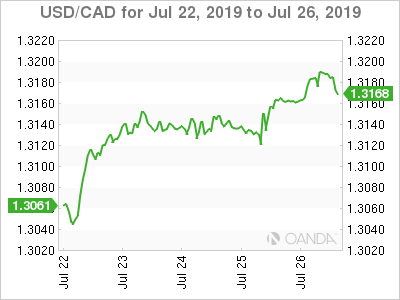

The Canadian dollar fell 0.92 percent against the U.S dollar in the last five trading sessions. The loonie is trading at 1.3180 versus the USD after the GDP data lifted the American currency higher by beating expectations. The data shows a slowdown of the U.S. economy, but the fact that consumer spending is strong backs the view of the Fed on the transitory nature of the current slowdown.

The Fed is heavily anticipated to make the first interest-rate cut of a new monetary policy easing cycle on July 31. The improved GDP data does not change the forecast on that, but it does reduce the probability of a potential 50-basis point cut and the number of rate cuts for the rest of 2019.

Canadian data has declined and investors will be looking at GDP data on Wednesday ahead of the main event of the week when the Fed delivers its rate statement. Later in the week, employment data will hit the wires for both the U.S. and Canada. The American number will be heavily scrutinized looking for arguments to validate the Fed’s views from the FOMC statement and press conference.

The U.S. non farm payrolls (NFP) is forecasted to show a gain of 170,000 jobs added to the economy in July, while in Canada the expectations are for a bounce of the losses last month, to add around 10,000 jobs.

Fed To Lead Central-Bank Easing Once Again

The U.S. dollar is higher across the board against major pairs. The better-than-expected GDP data drove the greenback, even as the Fed will is on deck next week to restart an easing monetary policy cycle with an interest rate cut. The market has already priced in a 25-basis point rate cut but given the strong fundamental data of late, a 50-basis points slash is looking unlikely.

The week will be packed to the brim with central banks: Bank of Japan (BOJ), Bank of England (BoE) and the Federal Open Market Committee (FOMC) and economic data: U.S. consumer confidence, Chinese manufacturing PMIs and the release of employment data in the U.S.

The Federal Open Market Committee (FOMC) will wrap its two-day meeting on July 31 with the publication of the interest-rate statement at 2:00 pm EDT to be followed by a press conference hosted by Fed Chair Jerome Powell at 2:30 pm EDT. The actions of the Fed could be limited by improving economic indicators, but Powell is expected to continue a dovish rhetoric line that puts downward pressure on the USD.

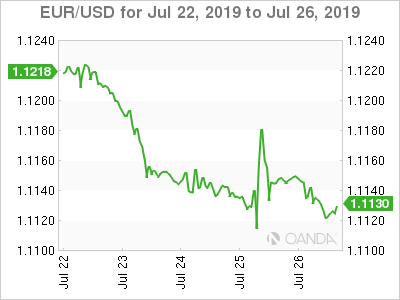

Euro Closes Gap On USD As ECB Disappoints With Lack Of Action

The EUR/USD lost 0.84 percent in the last five trading sessions. The single currency is trading at 1.1126 and is the major currency that depreciated less versus the dollar. The European Central Bank (ECB) held its monetary policy meeting on Thursday with anticipation of stronger dovish rhetoric and a possible interest rate cut, putting the benchmark rate deeper into negative territory.

ECB President Mario Draghi laid the groundwork for further easing in the next meeting to take place in September, but despite hitting all the right dovish notes, like the overuse of “worse” in describing the outlook for manufacturing and services, he was not dovish enough for the market with the euro bouncing back with every answer the ECB chief gave to reporters.

Draghi will step down from the ECB in October and at this point looks to keep the central bank steady, ahead of the change in leadership. Former IMF chief Christine Lagarde will take the reins of the ECB, but only after Mario Draghi takes one more chance at “whatever it takes”.

Bank Of Japan

The BOJ is in the same boat as the ECB. There is a small probability of adding more stimulus in July rather than waiting for the effects of the Fed rate cut to trickle down. The U.S. dollar has risen both due to the safe-haven appetite and the Fed’s plans to cut interest rates in 2019.

A surprise rise in domestic demand has offset the drop in exports, but it is hard to depend on Japanese consumers finally stepping up against the backdrop of rate cuts from other major central banks.

The BOJ is expected to tweak the guidance and be vigilant of market conditions before adding more stimulus.

Federal Open Market Committee

Financial news services are conducting polls where economists and analysts are putting down a 25-basis points cut as the most likely outcome at the end of the two-day FOMC meeting. The market could still read that as disappointing given the dovish turn of the Fed since January.

Fed members have talked down the probability of a 50-basis points cut as they want to stress the central bank is playing the long game. The press conference will be key as the Fed Chair will get the last word on how dovish the central bank really is about the economy as the U.S. will be back in talking terms with China on trade.

The U.S.-China trade war is the biggest headwind for the Fed, but in the background the White House has been on a constant campaign to get lower rates. A deal with China might be reached, but the Trump administration will continue to harp about lower rates.

Bank Of England

As Boris Johnson takes over from Theresa May, the BoE is under market pressure to cut rates. A no-deal Brexit is back on the table with Johnson at the helm, but even then, the BoE’s Chief Economist says it’s not an automatic rate cut. The central bank would like to see a short economic downturn in order to act. Holding rates unchanged until there is a reason to change them might sound like sound advice, but this is the bigger question facing central banks: what happens if by waiting they add to the stress of the economy and worsens the outcome?

Mark Carney’s term will finish in January 2020 leaving the rock-star central banker plenty of time to influence monetary policy and respond to a crisis if needed. The market has lost some trust in the BoE as economic forecasts, in particular inflation, have recorded big misses. This time around by sticking to its economic guns, the BoE sees a rate hike more likely than a cut, even as other major central banks have joined the dovish choir.