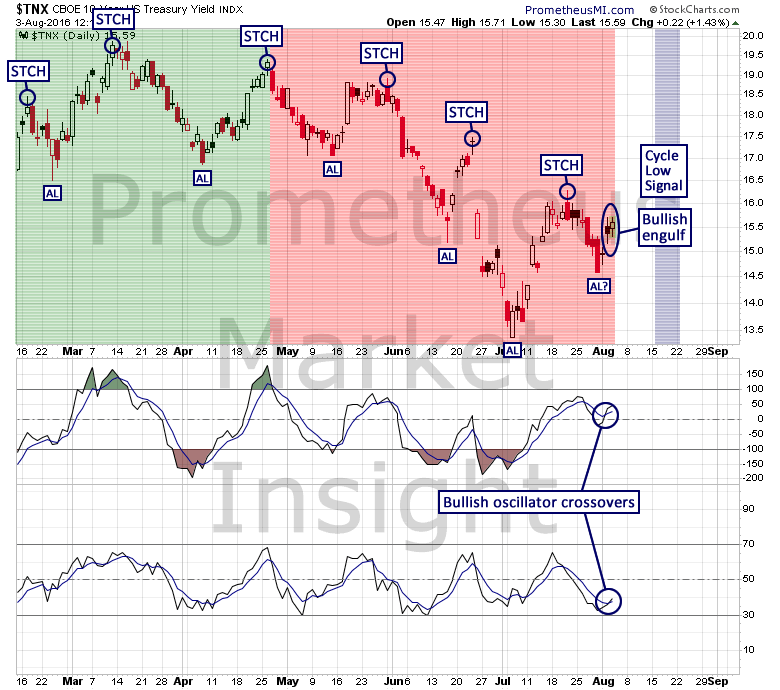

The 10-Year Treasury's advance yesterday has caused both short-term cycle oscillators to experience bullish crossovers and a bullish engulf pattern has formed on the daily chart. A close above 1.55% would generate a cycle low signal and indicate that the alpha low (AL) of the current short-term cycle likely formed on July 29.

Cycle translation is in question. A quick reversal followed by an extended decline phase that moves below the previous AL at 1.34% would reconfirm the current bearish translation and favor additional short-term weakness. Alternatively, an extended rally phase that moves well above the last STCH at 1.63% would signal the likely transition to a bullish translation.