The USD/CAD has been a star performer of late on the back of a surging US dollar sentiment. However, technical analysis of the pair is signalling the potential for some sharp falls ahead as the bulls run out of steam.

As most keen traders will note, markets regularly fall in to semi-predictable chart patterns that can be a harbinger of things to come. In the case of the Canadian Dollar, the pair has recently rallied strongly to the top of its range and now faces an unbroken area of resistance around the 1.34 handle.

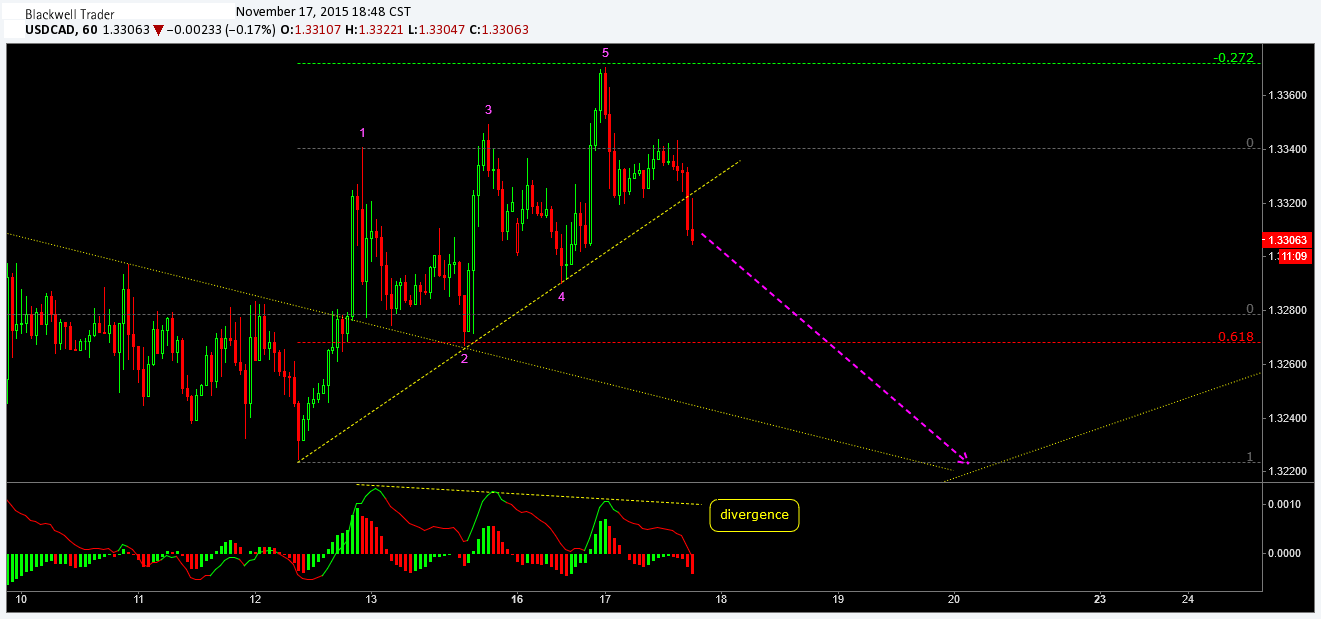

Despite the strong rally, taking a look at the hourly chart shows an ending diagonal pattern that appears to have just been broken. Given the recent breach of the short term bullish trend line, the cessation of the diagonal could signal selling ahead for the venerable Loonie. In addition, there has also been some divergence from the MACD indicator as the highs became lower in contrast to the price action.

Currently, the price action is being dynamically supported by the 30EMA and the pair will subsequently need to break through that level to cement a move lower. However, given the MACD divergence, price action’s position within a zone of resistance, and the cessation of the diagonal pattern, the odds are weighted to the short side.

However, the looming release of the FOMC minutes could impact the pair strongly given the volatility surrounding Fed announcements of late. Subsequently, the tone and tenor of the monetary policy minutes should be analysed closely for any sign of additional hawkishness that could invalidate any short bias.

Overall, the pair is in an ideal position for a short push targeting the bottom of the bullish trend line at 1.3225. As long as the US Fed’s jawboning remains within the bounds of their typical playbook we might just see some significant moves from the Loonie in the coming days.