The Canadian dollar has edged higher in the Tuesday session. Currently, USD/CAD is trading at 1.2828, down 0.22% on the day. On the release front, there are no Canadian releases on the schedule. The US will release PPI, an important inflation indicator. On Wednesday, the Federal Reserve is expected to raise rates to a range between 1.25% to 1.50%. As well, the US releases CPI reports.

The markets are expecting a quarter-point rate hike from the Fed later on Wednesday. Even though this move has been priced in, rate hikes tend to trigger a surge of confidence among investors, and also makes the US dollar more attractive against its rivals. Traders should therefore be prepared for the US dollar to record gains after the rate announcement. Another rate hike is expected in January, with fed futures pricing a rate hike at 87%. The Fed has hinted that it could raise rates up to three times in 2018, and this upward movement in rates will likely propel the US dollar upwards. The US labor market remains at full capacity and various sectors in the economy are reporting a lack of workers. Still, this has not translated into stronger wage growth, despite predictions from Janet Yellen and other Fed policymakers that a lack of workers is bound to push up wages.

Canada’s economy has been sending mixed messages of late, so strong housing data last week was welcome news. On Friday, Housing Starts in November jumped to 252 thousand, well above the estimate of 214 thousand. This marked the strongest reading since March. On Thursday, Building Permits posted a strong gain of 3.5%, crushing the forecast of 1.7%. Meanwhile, the Bank of Canada did not pull any surprises and maintained the benchmark rate at an even 1.00%. The BoC is casting a worried look at NAFTA, as a protectionist-minded US administration has threatened to torpedo the free-trade agreement unless Canada and Mexico make major concessions. An additional headache for the BoC is that the Federal Reserve is expected to raise rates in December and January. The BoC will have to follow suit with a raise of its own, or watch the Canadian dollar head lower against the greenback.

USD/CAD Fundamentals

Tuesday (December 12)

- 6:00 US NFIB Small Business Index. Estimate 104.6

- 8:30 US PPI. Estimate 0.4%

- 8:30 US Core PPI. Estimate 0.2%

- 13:01 US 30-year Bond Auction

- 14:00 US Federal Budget Balance. Estimate -135.2B

Wednesday (December 13)

- 8:30 US CPI. Estimate 0.4%

- 8:30 US Core CPI. Estimate 0.2%

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:00 US FOMC Press Conference

*All release times are GMT

*Key events are in bold

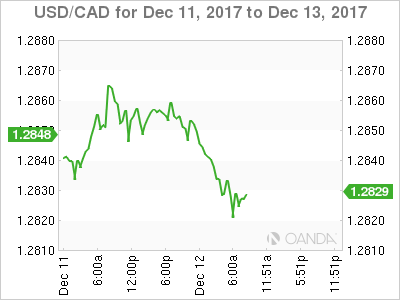

USD/CAD for Tuesday, December 12, 2017

USD/CAD, December 12 at 8:00 EDT

Open: 1.2856 High: 1.2813 Low: 1.2862 Close: 1.2828

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2494 | 1.2630 | 1.2757 | 1.2860 | 1.3015 | 1.3161 |

USD/CAD has posted small losses in the Asian and European sessions

- 1.2757 is providing support

- 1.2860 is under pressure in resistance

- Current range: 1.2757 to 1.2860

Further levels in both directions:

- Below: 1.2757, 1.2630, 1,2494, and 1.2368

- Above: 1.2860, 1.3015 and 1.3161

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Tuesday session. Currently, long positions have a majority (52%), indicative of slight trader bias towards USD/CD reversing directions and moving higher.