As the ongoing war between OPEC and US shale oil producers continues to rage, so too does the collateral damage of the global supply glut. The latest casualty of the commodity war appears to be Canadian oil producers as activity in the Alberta tar sands area declines rapidly.

As OPEC moved to counter the growing threat from US producers, a strategy of maintaining an over-supply was pursued. The strategy was designed to damage the higher cost basis of the US producers but 17 months later the gamble continues as the US Shale industry remains resilient. However, given the difference in cost structures between the countries, it has primarily been Alberta-based producers that have felt the pinch of low prices.

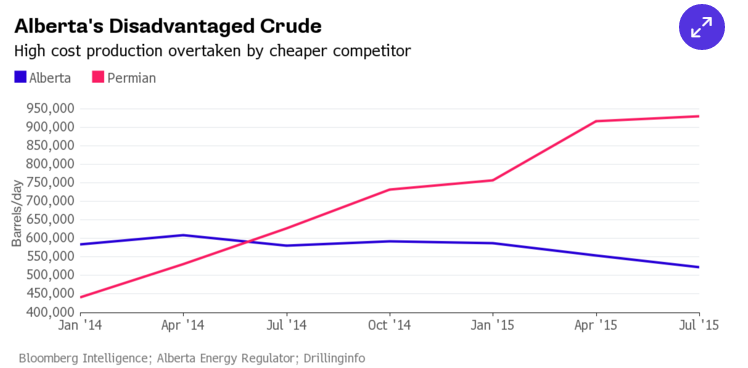

Canada’s bitumen oil industry has struggled to find new efficiencies given the intensive production process. Subsequently,it has been difficult for the fledging industry to compete in a commodity market largely dominated by a growing supply glut. In contrast, US producers in the Permian Basin have discovered new efficiency and, as a result, US Shale production continues to rise.

Subsequently, oil production in the Alberta region has taken a strong nose-dive over the past 12 months from a high of over 600,000 barrels per day to levels well below 450,000.This year alone, bitumen production has fallen over 13% and the production figure is likely to continue falling into 2016 as long as extraction costs remain above market prices.

If OPEC continues to pursue the current strategy, global oil supply is likely to be indelibly damaged for years to come. However, the damage is unlikely to remain evenly spread across the industry and US shale producers are likely to persist as a thorn in the side of OPEC. Subsequently, when oil markets eventually return to some level of normality, the operating landscape could significantly differ from what exists today.

In summary, OPEC clearly views its current strategy as working to crimp off the western supply of crude. in reality however, all the strategy has managed to achieve is a transition of production from Canada to the US where the Bakken and Permian basin operators are incentivised to discover new and more efficient production methods. These advances are significant enough that OPEC might just rue the day they failed to take a longer term view of the oil industry.