The Friday session offers very little in the way of economic announcements, with almost everything coming out of Canada. We have nothing coming out of Europe, or Asia. With that, it appears that the markets will probably be very quiet during the day and as a result we feel that the market may be somewhat technically driven.

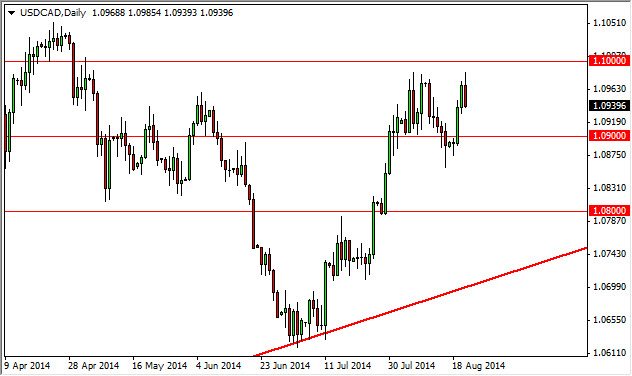

However, we have to remember that the Canadian CPI Core numbers come out year-over-year for the month of July, anticipated to be 1.9%. With that, we will be paying attention to the USD/CAD pair, and as a result if the number from Canada’s very weak, we anticipate that the USD/CAD pair could very easily break above the 1.10 level. If we have that happen, the market will suddenly become a buy-and-hold type of opportunity.

Janet Yellen of the Federal Reserve is speaking at Jackson Hole during the US session, as is the ECB’s Draghi. With that, we believe that the market could be pushed around by the comments coming from there, but at the end of the day this will be long after the Asians are done, and most certainly the Europeans as well. Ultimately, we believe that most of this day will be about the North American markets, and as a result we would prefer to see some type of pullback although we recognize that if Janet Yellen says something about easy money, we could very easily see the S&P 500 break above the 2000 level. Once that happens, that market becomes a buy-and-hold situation.

Any pullback at this point in time in the stock markets will more than likely invite buying at lower levels. A supportive candle will be used in order to go long, but we would anticipate that it needs to be on the daily chart, meaning that Friday may be very quiet indeed.