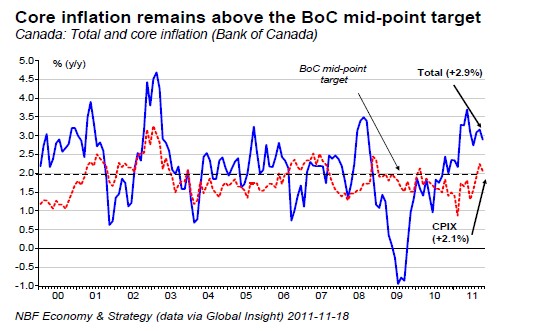

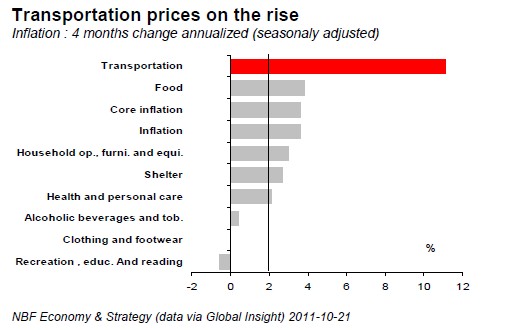

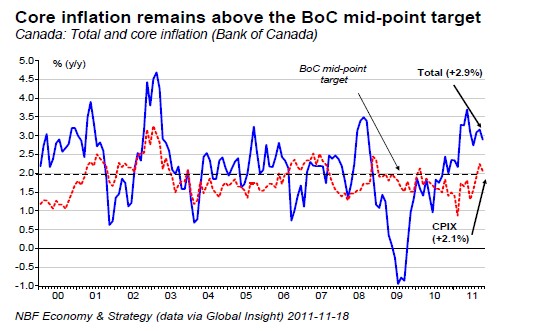

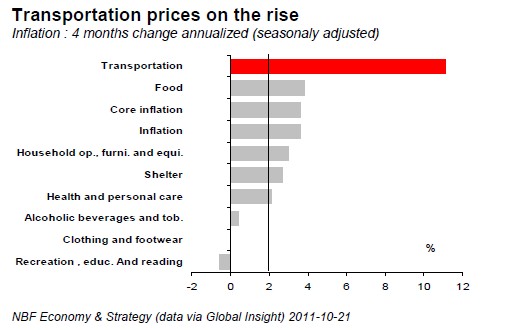

FACTS: Headline CPI decelerated to 2.9% in October from 3.2% in September. Core CPI also moved down to 2.1% year-over-year from 2.2% one month earlier. On a monthly basis, headline CPI rose 0.2%, following an increase of 0.2% in September. Core prices increased (+0.3%) after a strong jumped of 0.5% the month before. On a seasonally adjusted basis, headline CPI rose 0.3% and core prices 0.2%. In October, 5 out of 8 major components were up on the month (s.a.). The largest price increase in September was in transportation (+1.3%) and shelter (+0.6%). Declines were observed in recreation, education & reading (-0.2%) and alcoholic beverages & tobacco products (-0.1%). On a regional basis, almost all provinces experienced inflation decrease (y/y), except Alberta.

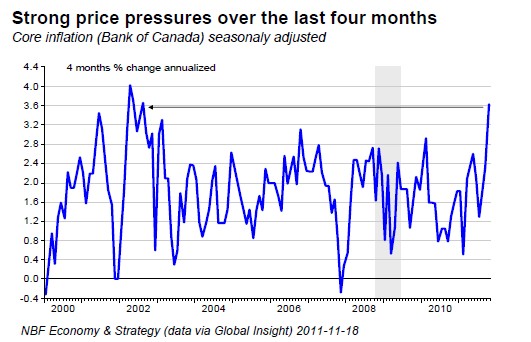

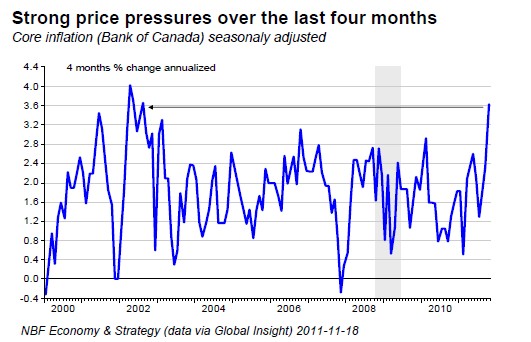

OPINION: Again in October, Canadian CPI came in a bit hotter than expected, with total prices increasing 0.3% and core CPI rising 0.2% (s.a). One must not be fooled by the drop in inflation year-on–year of both measures that occurred because of the base effect. The Canadian economy is experiencing strong prices pressures over the last months in the Bank of Canada inflation preferred measure. More precisely, core CPI increased at a 3.6% annualized pace over the last 4 months, the highest since 2002 (middle chart). That said, a big chunk of the increase is explained by unusual high price increase in purchase, leasing, and rental of passenger vehicles component which recouped an unusual plunge in June. Note also that there has been huge price increases in electricity in Alberta since last June which also contributed to push the core higher (October was also very strong). The fact remains that since June, only three of the eight broad components are experiencing inflation below the BoC midpoint target indicating that price pressures are coming from several sources. That, however, won’t change the BoC’s highly stimulative monetary policy for now given the huge risks that Canada faces in the form of a possible European-triggered global financial crisis.

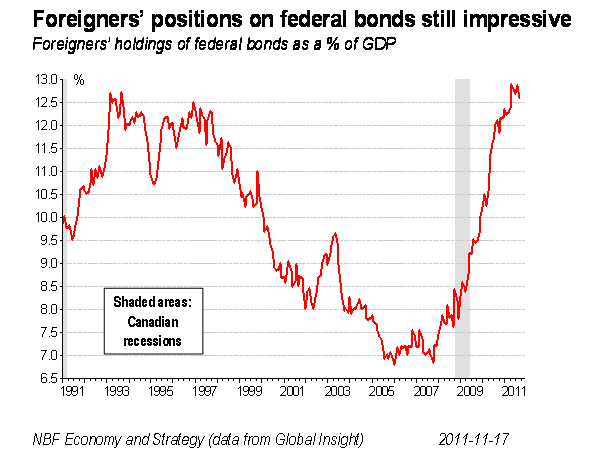

Foreigners’ positions on federal bonds still impressive

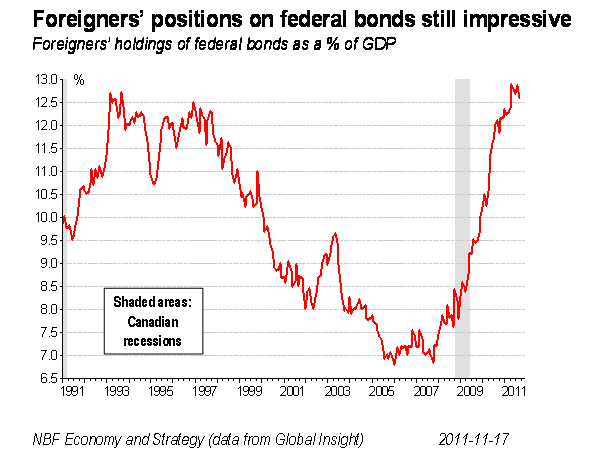

In September, foreigners were quite willing to finance Canada’s current account deficit through portfolio investments. They acquired $7.4 billion of Canadian securities, an amount that represents, when annualized, 5.2 % of GDP. But money markets instruments ($7.2 billion) accounted for the bulk of the increase, while holdings of federal bonds (government and federal enterprises) declined $6 billion. Is this an indication that Canada bonds are suffering from the current uncertainty over sovereign debt? We do no think so. First, the drop in holdings of federal bonds is mostly explained by

retirements of federal enterprise bonds. Second, foreigners’ positions on federal bonds are still impressive. As today’s Hot Chart shows, even after September’s decline, foreigners’ positions on federal bonds is tantamount to 12.6% of GDP, close to the 12.9% level reached last May, the highest on record. Given the federal government fiscal situation, we do not think that September’s drop in foreigners’ holdings of federal bonds is the beginning of a trend.

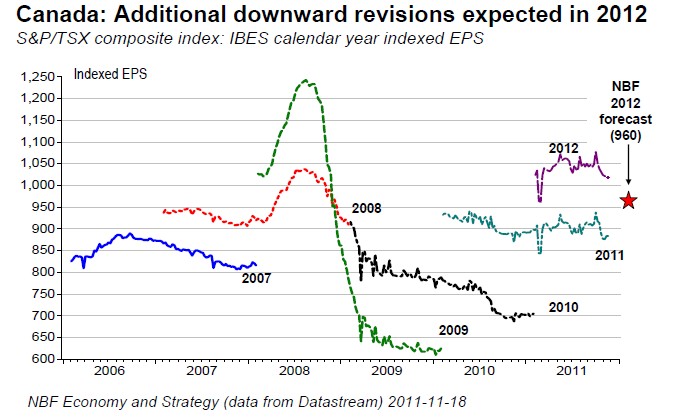

Canada: Additional downward revisions expected in 2012

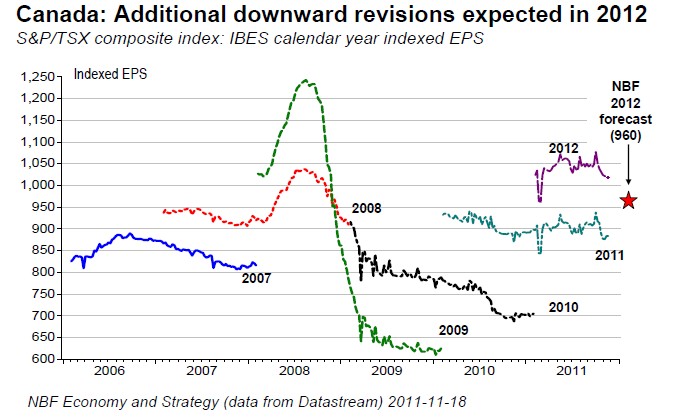

The Canadian Q3 earnings season is almost over with more than 90% of S&P/TSX composite companies having reported. Bank stocks are the only major group yet to report and are scheduled to do so the first week of December. At this writing earning results have been overall positive with EPS growth at 37.9% which includes a 7.9% positive surprise factor. Sectors with the largest EPS surprise are Financials, Health Care and Energy. Despite a strong EPS surprise factor, more than half of companies failed to beat expectations. The story is relative similar from a sales perspective where sales growth has been robust at 18.4% accompanied with a 10.8% surprise. But only 48% of companies reported better than expected sales. In addition only the financial sector saw a majority of its companies beating sales expectations. This lack of positive breadth suggests expectations were generally too optimistic. This is supported by relatively large revisions in EPS forecast since the first week of October. The IBES EPS estimate for calendar year (CY) 2011 and CY 2012 have decreased by 5.8% and 5.4% respectively over this time. This implies an annual EPS growth of 25.2% for CY 2011 and 15.4% for CY 2012. 2011 estimates are now in line with our own while 2012 estimates seem relatively high to us. We expect further downward revisions of 6-7 percentage points for 2012 EPS forecasts given our estimate of 8% EPS growth next year. This reflects a topping out in profit margins and softer sales growth next year.

OPINION: Again in October, Canadian CPI came in a bit hotter than expected, with total prices increasing 0.3% and core CPI rising 0.2% (s.a). One must not be fooled by the drop in inflation year-on–year of both measures that occurred because of the base effect. The Canadian economy is experiencing strong prices pressures over the last months in the Bank of Canada inflation preferred measure. More precisely, core CPI increased at a 3.6% annualized pace over the last 4 months, the highest since 2002 (middle chart). That said, a big chunk of the increase is explained by unusual high price increase in purchase, leasing, and rental of passenger vehicles component which recouped an unusual plunge in June. Note also that there has been huge price increases in electricity in Alberta since last June which also contributed to push the core higher (October was also very strong). The fact remains that since June, only three of the eight broad components are experiencing inflation below the BoC midpoint target indicating that price pressures are coming from several sources. That, however, won’t change the BoC’s highly stimulative monetary policy for now given the huge risks that Canada faces in the form of a possible European-triggered global financial crisis.

Foreigners’ positions on federal bonds still impressive

In September, foreigners were quite willing to finance Canada’s current account deficit through portfolio investments. They acquired $7.4 billion of Canadian securities, an amount that represents, when annualized, 5.2 % of GDP. But money markets instruments ($7.2 billion) accounted for the bulk of the increase, while holdings of federal bonds (government and federal enterprises) declined $6 billion. Is this an indication that Canada bonds are suffering from the current uncertainty over sovereign debt? We do no think so. First, the drop in holdings of federal bonds is mostly explained by

retirements of federal enterprise bonds. Second, foreigners’ positions on federal bonds are still impressive. As today’s Hot Chart shows, even after September’s decline, foreigners’ positions on federal bonds is tantamount to 12.6% of GDP, close to the 12.9% level reached last May, the highest on record. Given the federal government fiscal situation, we do not think that September’s drop in foreigners’ holdings of federal bonds is the beginning of a trend.

Canada: Additional downward revisions expected in 2012

The Canadian Q3 earnings season is almost over with more than 90% of S&P/TSX composite companies having reported. Bank stocks are the only major group yet to report and are scheduled to do so the first week of December. At this writing earning results have been overall positive with EPS growth at 37.9% which includes a 7.9% positive surprise factor. Sectors with the largest EPS surprise are Financials, Health Care and Energy. Despite a strong EPS surprise factor, more than half of companies failed to beat expectations. The story is relative similar from a sales perspective where sales growth has been robust at 18.4% accompanied with a 10.8% surprise. But only 48% of companies reported better than expected sales. In addition only the financial sector saw a majority of its companies beating sales expectations. This lack of positive breadth suggests expectations were generally too optimistic. This is supported by relatively large revisions in EPS forecast since the first week of October. The IBES EPS estimate for calendar year (CY) 2011 and CY 2012 have decreased by 5.8% and 5.4% respectively over this time. This implies an annual EPS growth of 25.2% for CY 2011 and 15.4% for CY 2012. 2011 estimates are now in line with our own while 2012 estimates seem relatively high to us. We expect further downward revisions of 6-7 percentage points for 2012 EPS forecasts given our estimate of 8% EPS growth next year. This reflects a topping out in profit margins and softer sales growth next year.