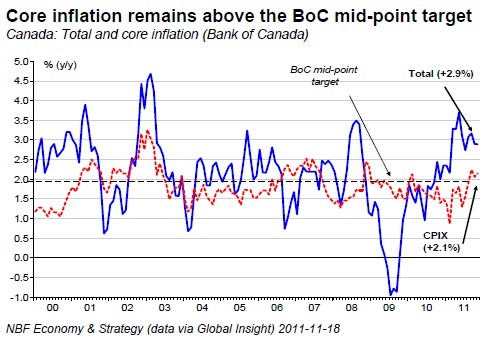

Headline CPI remained unchanged at 2.9% in November. Core CPI also remained unchanged at 2.1. On a monthly basis, headline CPI rose 0.1%, following an increase of 0.2% in October. Core prices increased 0.1% after rising 0.3% the month before. On a seasonally adjusted basis, headline CPI rose 0.1% and core prices 0.1%. In November, 4 out of 8 major components were up on the month (s.a.). The largest price increase in September was in transportation (+0.5%) and household operations, furnishings & equipment (+0.3%). Declines were observed in clothing and footwear (-0.8%) and shelter (-0.2%). On a regional basis, 6 provinces experienced inflation decrease (y/y). Inflation increased in Newfoundland & Labrador (from 3.5 to 4.1%) and in Manitoba (from 3.0% to 3.1%). Inflation remained unchanged in Prince Edward Island and British Colombia.

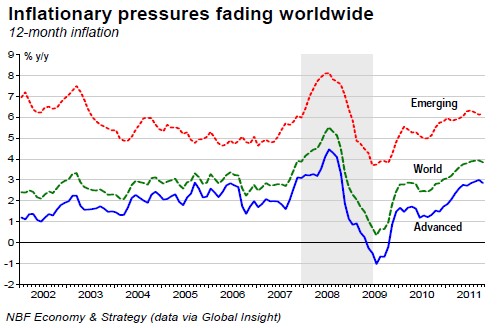

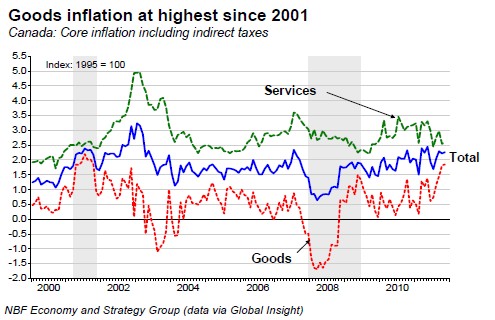

OPINION: No major surprise in this morning CPI report as headline and core CPI were roughly in line with consensus expectations. Overall, prices growth in Canada has been low in November. Total CPI is clearly in a downward trend due to the recent decline of commodity prices, in response to a decline of physical and financial demand and to the rise of the U.S. dollar. In this context, inflation peaked worldwide and should continue its downward trend going forward (middle chart). Given actual economic uncertainties and inflation fears dissipating, a number of central banks, especially in emerging countries, could put their shoulders to the wheel. However, do not expect the Bank of Canada to go into the dance. Core inflation was soft in November but it experienced a 3.1% annualized rhythm over the last 5 months, its highest since 2002. Note also that the goods component in core inflation (including indirect taxes) is presently rising at its fastest pace since 2001 (bottom chart). That said, there are so many downside risks to the economy that the BoC is likely to play safe and leave monetary policy highly stimulative for the foreseeable future.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Core CPI Remains at 2.1%

Published 12/20/2011, 10:10 AM

Updated 05/14/2017, 06:45 AM

Canadian Core CPI Remains at 2.1%

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.