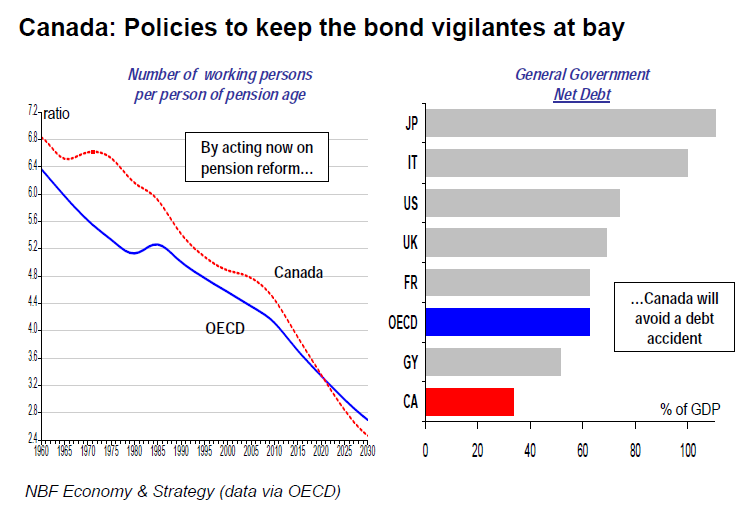

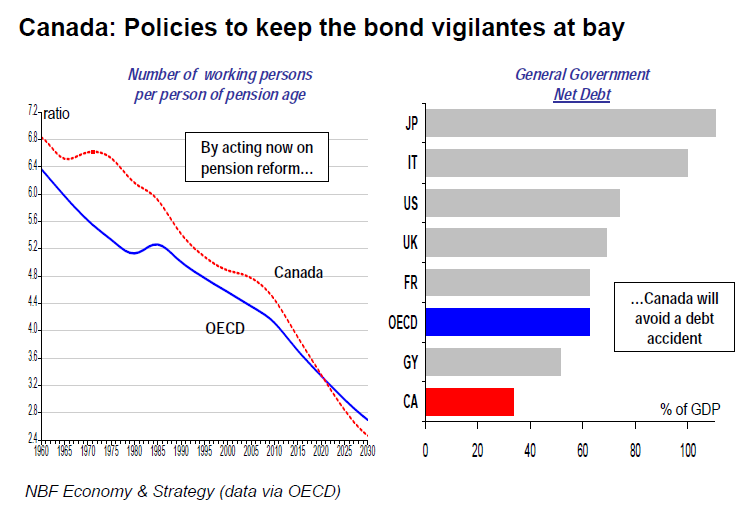

Prime Minister Harper delivered a very important speech in Davos this week on the need to adopt new measures to ensure the long-term sustainability of social programs in Canada. After his recent warnings on the need to control healthcare spending, the PM is now calling on the need to better fund the retirement income system. We think that this decision comes at an opportune time. Back in the early 1960s when the bulk of social programs where introduced, there were about 7 workers per retired person in Canada. As today’s Hot Chart shows, this ratio now stands at 4.4 and is expected to plunge to 2.4 by 2030. Such a development, if left unaddressed, would risk causing a debt spiral that would certainly catch the attention of the bond vigilantes. Fortunately, Canada is one of the few countries where money is already set aside for public pensions. This explains why our net debt is considerably lower than that of other G7 economies. (see chart). This means that by acting now to insure that the system is even better funded, the effort that will be required from Canadians will be much less painful than that likely to be endured by citizens of the euro zone who have relied for too long on pay-as-yougo public systems.