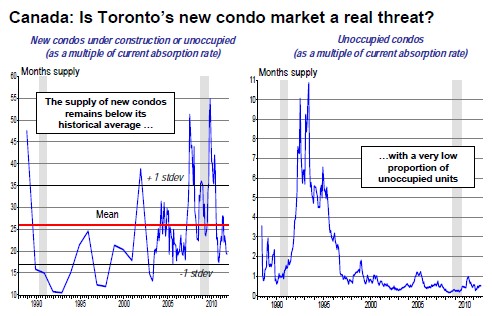

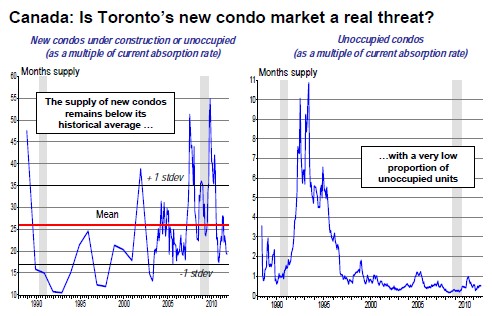

While in NYC yesterday to discuss the Canadian economic outlook, one of members on our panel argued that the oversupply of new condominiums in Toronto posed a great risk to CMHC and the Canadian economy. We disagree with that statement. As today’s Hot Chart shows, the supply of new condominiums in Toronto (under construction or completed and unoccupied) currently stands at 19.3 months. This is almost onestandard deviation below the historical average of 26 months and a very far cry from the more than four-year supply observed in 1990, 2007 and 2010. As shown, we also note that a very low proportion of the current supply is actually unoccupied units (less than one month vs. over 10 months in the early 1990s). While it may be true that the residential market in Canada is vulnerable to price declines in the advent of an economic slowdown, the source of the problem is more likely to come from a credit-crunch induced global recession, not the Toronto new condo market.