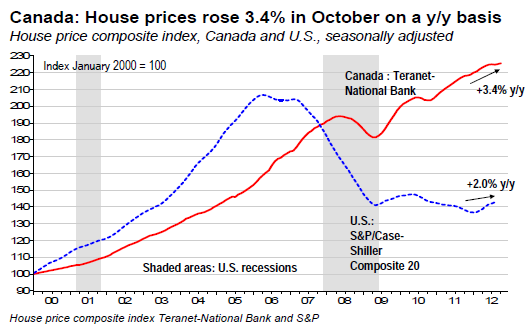

On a y/y basis, the Teranet–National Bank National Composite House Price IndexTM rose 3.4% in October (top chart). Over the 11 metropolitan areas covered, 12-month price changes vary widely. Four largely exceeded the national average: Halifax (+8.9%), Hamilton (+7.2%), Toronto (+6.4%) and Winnipeg (+5.9%). Two were very close to the average: Montreal (3.6%) and Calgary (3.5%). Five were below: Quebec City (+2.6%), Edmonton (+2.6%), Ottawa-Gatineau (+2.5%) with price deflation in two regions: Vancouver (-1.0%) and Victoria (-1.7%).

On a monthly basis, the Composite index declined 0.2% in October, after a 0.4% drop in September. In October, the index declined in 7 of the regions covered: Quebec City (-0.9%), Victoria (-0.6%), Toronto (-0.6%), Ottawa-Gatineau (-0.4%), Montreal (-0.3%), Calgary (-0.2%) and Halifax (-0.1%). Prices were flat in Winnipeg, and were up in Vancouver (0.1%), 0.3% in Edmonton and 0.4% in Hamilton.

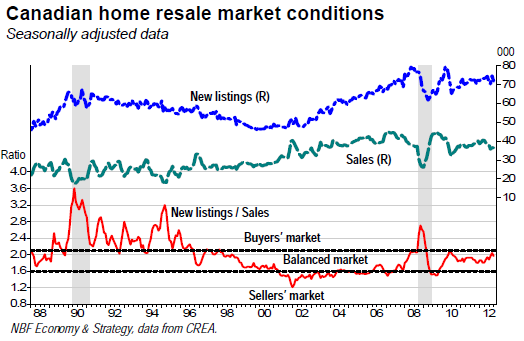

OPINION: Recent monthly changes in the Composite House Price Index are consistent with a sequence of declines in (seasonally adjusted) existing home sales, and the resulting loosening of market conditions (middle chart).

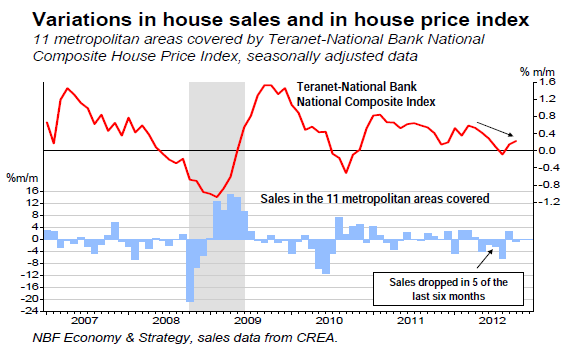

This view is not changed even if the Index, when seasonally adjusted, increased slightly in September and October instead of decreasing (bottom chart).

In any event, the Teranet – National Bank House Price Index is much more representative of house price changes than median or average prices of homes sold published by real estate boards. The latter are biased by change in the composition of homes sold by price brackets. For instance, the recent changes in mortgage rules have discouraged would-be first-time home buyers, who typically target low-end houses. It results in an increase in average or median prices of homes sold not representative of an actual rise in real estate prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canada: Home Price Inflation Decelerates To 3.4% In October

Published 11/22/2012, 02:06 AM

Updated 05/14/2017, 06:45 AM

Canada: Home Price Inflation Decelerates To 3.4% In October

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.