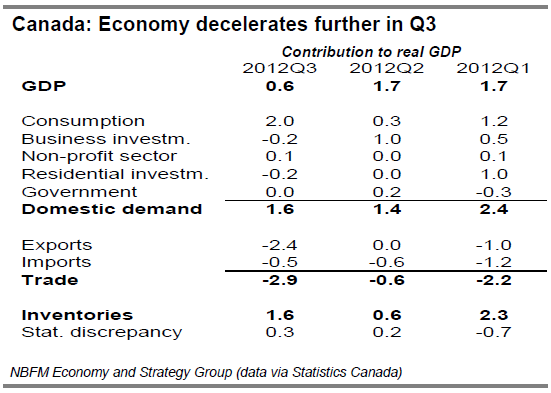

In 2012 Q3, GDP expanded merely 0.6% annualized, two ticks short of consensus expectations. To make matters worse, Q2 growth was revised down a tick to 1.7%. Domestic demand was restrained as weakness in investment, government spending, and residential construction offset healthy gains in consumption spending.

Consumers were able to spend more thanks to an improvement in disposable income. However, they evidently also dipped into their reserves, seeing how the savings rate fell three ticks to 3.9%. Trade was a massive drag on growth, as real exports contracted 7.8%, their worst decline since the 2009 recession. This was not surprising given the weakness of the global economy in the quarter. For a third quarter in a row, inventories helped boost GDP, with final sales actually retreating 1% in Q3.

There was no solace to be found in the details of the Q3 GDP report. Indeed, the fact that much of the growth came from inventory accumulation is a clear negative for future production. In addition, though consumption spending regained some vigour in Q3, it now faces the challenges of a softer labour market, a mounting debt load, a less favourable housing wealth effect, and fiscal retrenchment in the larger provinces.

As a result, Canadian GDP growth is likely to remain below potential for the next little while The current account, which is the broadest measure of trade, recorded a deficit of C$18.9 billion in 2012Q3 (roughly 4.2% of GDP). This constitutes a CAD 0.5-billion deterioration from the downwardly revised CAD 18.4-billion deficit posted in Q2.

The weakness in Q3 stemmed largely from the fact that the merchandise trade deficit deteriorated by CAD 1.2 billion to CAD 4.8 billion. The services account saw a small deterioration as well, as its deficit widened CAD 0.3 billion to C$6.3 billion. This more than offset the improvement in the investment income account, which nevertheless remained CAD 6.3 billion in the red.

The current account deficit was financed primarily by short-term capital flows, including net portfolio inflows and currency and deposits. There was also a small inflow of the more stable sort from foreign direct investment. 2012Q3 produced the second largest Canadian external deficit in history and reflected both the global economic slowdown and the Canadian dollar's over-valuation. The massive current account deficit means that the Canadian dollar remains dependent on capital inflows.

The fact that the bulk of these inflows in Q3 came in the form of easily reversible portfolio investments and deposits renders the loonie vulnerable to a correction, particularly if a significant shift occurs towards risk aversion. The potential triggers in this regard are numerous.

They include further deterioration in Europe and/or Japan, weaker-than-expected pickup in China, and the absence of resolution with respect to the U.S. fiscal cliff. So, while we remain bullish about the loonie's prospects over the longer term, there is a real chance of seeing the currency depreciate temporarily towards 1.04, our USD-CAD exchange rate target for the end of 2013Q1.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canada: GDP Expands 0.6% In 2012 Q3

Published 12/04/2012, 06:28 AM

Updated 05/14/2017, 06:45 AM

Canada: GDP Expands 0.6% In 2012 Q3

Canada:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.