Further CAD weakness expected

Oil prices continue to trade lower as news that in an effort to help budget negotiations the US could sell 58 barrels from their strategic reserves hit the market. In addition, oil inventories headed higher according to the American Petroleum Institute data. Commodity currencies specifically the CAD and NOK which are correlated to oil, underperformed. The weaker CAD has given the economy a well needed stimulus kick, which should see GDP rebound from the lows. However, a pickup in growth will do little to influence the BoC to change their dovish tone. Recent comments from BoC members indicate that there is no need for further easing measures as underlying inflation dynamics should ensure reaching the bank’s target. However, inflation remains subdued and it is uncertain that a marginal pick up in exports will translate into price pressure. With oil looking to head lower its unlikely that Canada will exhibit anything but baseline growth and a vigilante central bank. This should allow USD/CAD to continue to appreciate. USD/CAD bullish reversal should have traders refocused on 1.3422.

Riksbank goes proactive

In an unexpected move, the Riksbank has extended its government bond buying program by SEK 65bn. The extension will take the purchase program to SEK 200bn and will last until June 2016. The repo rate was left unchanged, however the bank expressed the view that the repo paths average in 2016 will be lower at 0.40% from 0.35% currently. The rationale being that as global conditions were damaging demand leading to weaker inflation expectations. The bank downgraded its 2016 CPI inflation forecast to 1.4% from 1.6%. Finally the Riksbank stated that it stood ready to buy additional securities (balance sheet remains low), cut interest rates and even direct FX interventions should the conditions warrant. Last week’s ECB meeting, which saw Draghi signaling further easing has prompted global central banks to move proactively. The Riksbank referenced that international interest rates are expected to stay low and that Sweden’s monetary policy would need to take this into consideration. The resulting broad Euro weakness can clearly be viewed as the next phase in competitive devaluations and we anticipate other central banks to react as the PBoC and Riksbanks have. EUR/SEK reversed its bearish momentum but will need to clear 9.4345 to negate the current corrective phase.

The Risk Today

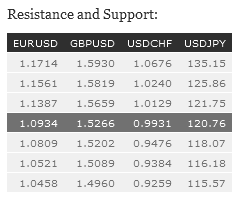

EUR/USD is now consolidating after breaking hourly support at 1.0989 (23/10/2015 low). Hourly resistance is given at 1.1387 (20/10/2015 low). Stronger resistance can be found at 1.1561 (26/08/2015 low). Expected to show continued consolidation of the pair. Since March 2015, the pair is improving. Key supports can be found at 1.0458 (16/03/2015 low) and 1.0000 (psychological support). The technical structure favours an eventual break higher. Strong resistance is given at 1.1871(12/01/2015).

GBP/USD keeps declining. Support lies at the 50% Fibonacci retracement and stronger support can be found at 1.5202 (13/10/2015 low). Hourly resistance is given at 1.5529 (18/09/2015 high). The short-term technical structure suggests a downside momentum. Expected test of the hourly support at 1.5202. In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY is still trading above 120.00. Strong resistance is given at 121.75 (28/08/2015 high). Hourly support can be found at 118.07 (15/10/2015 low). Expected to show continued increase before targeting again resistance at 121.75. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is increasing and has broken resistance at 0.9903 (11/08/2015 high). The pair is ready to challenge psychological resistance at 1.0000. Hourly support is given at 0.9476 (15/10/2015 low). Expected to show continued strengthening. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).