FACTS: Both headline (+0.8% y/y) and core CPI inflation (+1.2%) decreased in November. On a monthly basis, headline CPI was down (-0.2%) and core inflation remained unchanged (0.0%). On a seasonally adjusted basis, results are the same with headline CPI down -0.2% and core prices flat. In November, losses are not generalized with only two categories of the eight broad being down (on a seasonally adjusted basis).

There were notable prices decreases for transportation (-1.2%) and a slight setback in shelter (-0.1%) while recreation, education & reading (+0.5%) and alcoholic beverages & tobacco products (+0.4%) registered the most significant increase. On a regional basis, all provinces except Alberta experienced lower price pressures in November (y/y). Th sharpest decrease were observed in Newfoundland & Labrador (from 2.2% to 1.1%) and in New Brunswick (from 1.4% to 0.6%).

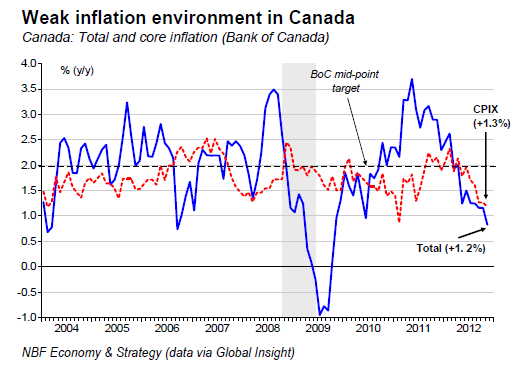

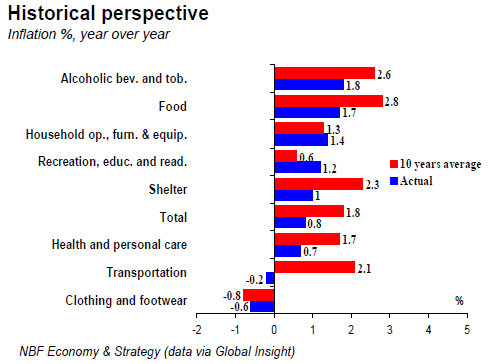

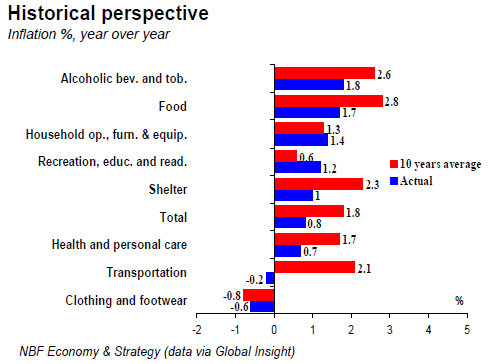

OPINION: Both the headline and core inflation rates were below expectations in November. Headline inflation is now running at its slowest pace since October 2009 (top chart). Even if this month’s weakness was largely explained by the transportation category (particularly gasoline and vehicles price) the big picture indicates a generalized tame inflation environment in Canada. On a y/y basis, 5 of the eight broad categories are progressing significantly below their historical average while only one, recreation, education and reading, is experiencing above average pressure (middle chart).

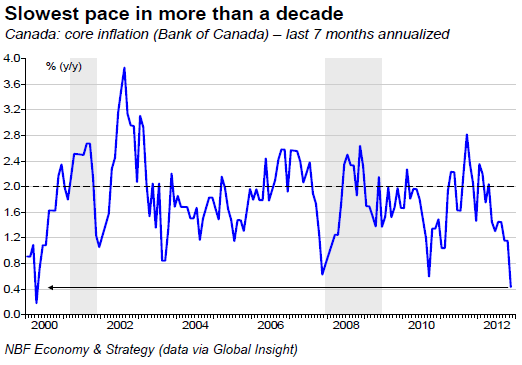

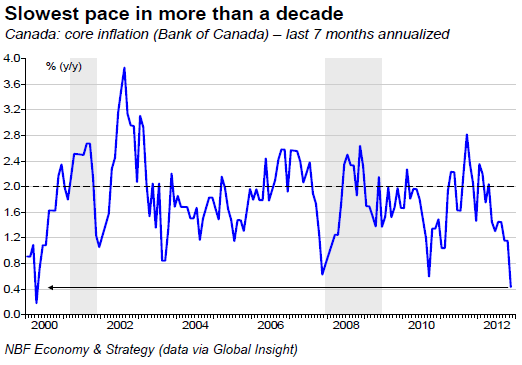

The weakness is also widespread regionally with no less than half of the ten provinces experiencing inflation below 1%. Core CPI, the BoC’s preferred gauge, is particularly soft over the last three months with an annualized increase of only 0.3%. But the weakness began well before that as shown by the last 7-months annualized core inflation showing a modest 0.4% advance, the lowest since April 2000 (Bottom chart). Even assuming a return to normal inflation in the months ahead (2% annualized), core inflation should average 1.3% in 2012Q4 and 2013Q1. That's well below the Bank of Canada's estimates of 1.6% and 1.7%, respectively.

There were notable prices decreases for transportation (-1.2%) and a slight setback in shelter (-0.1%) while recreation, education & reading (+0.5%) and alcoholic beverages & tobacco products (+0.4%) registered the most significant increase. On a regional basis, all provinces except Alberta experienced lower price pressures in November (y/y). Th sharpest decrease were observed in Newfoundland & Labrador (from 2.2% to 1.1%) and in New Brunswick (from 1.4% to 0.6%).

OPINION: Both the headline and core inflation rates were below expectations in November. Headline inflation is now running at its slowest pace since October 2009 (top chart). Even if this month’s weakness was largely explained by the transportation category (particularly gasoline and vehicles price) the big picture indicates a generalized tame inflation environment in Canada. On a y/y basis, 5 of the eight broad categories are progressing significantly below their historical average while only one, recreation, education and reading, is experiencing above average pressure (middle chart).

The weakness is also widespread regionally with no less than half of the ten provinces experiencing inflation below 1%. Core CPI, the BoC’s preferred gauge, is particularly soft over the last three months with an annualized increase of only 0.3%. But the weakness began well before that as shown by the last 7-months annualized core inflation showing a modest 0.4% advance, the lowest since April 2000 (Bottom chart). Even assuming a return to normal inflation in the months ahead (2% annualized), core inflation should average 1.3% in 2012Q4 and 2013Q1. That's well below the Bank of Canada's estimates of 1.6% and 1.7%, respectively.