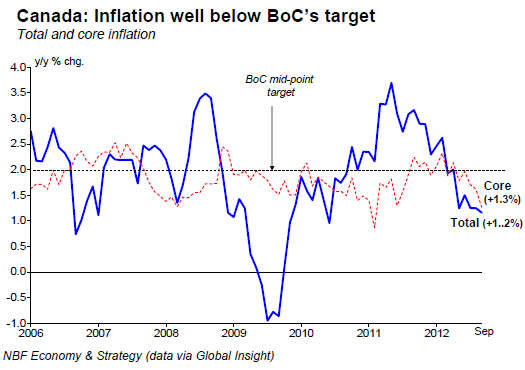

Canada’s consumer price index rose 0.2% in September leaving the year-on-year inflation rate unchanged at 1.2%. In seasonally adjusted terms, CPI also rose 0.2%, although just three of the eight broad categories saw increases. Higher prices for clothing/footwear (+0.1%), household operations and equipment (+0.2%), and transportation (the +0.9% print boosted by gasoline) were enough to offset price declines for shelter (-0.2%), food (-0.2%), health/personal care (-0.8%), recreation/education (- 0.3%), and alcohol/beverages (-0.1%). Core CPI also rose 0.2%, taking the year-on-year core inflation rate down three ticks to 1.3%, the lowest since June of last year (top chart).

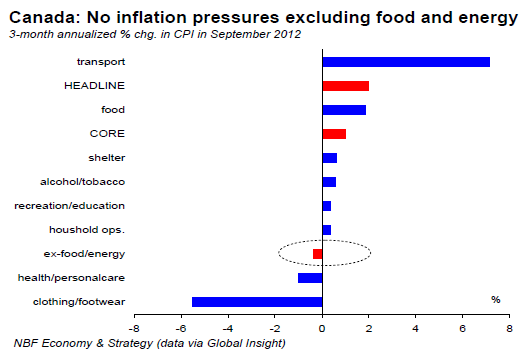

In seasonally adjusted terms, core prices were flat in the month, leaving the 3-month annualized core rate at a very mild 1%. The latter could have been even softer were it not for the fact that it contains some food items. Excluding food and energy, prices are in fact declining on a 3-month annualized basis (middle chart). Looking at provinces, the annual inflation rate is above the national average in Atlantic Canada, Manitoba and Alberta, as well as Quebec (the uptick in the QST early this year explains the latter), while Ontario and BC are both lagging at just 0.7%.

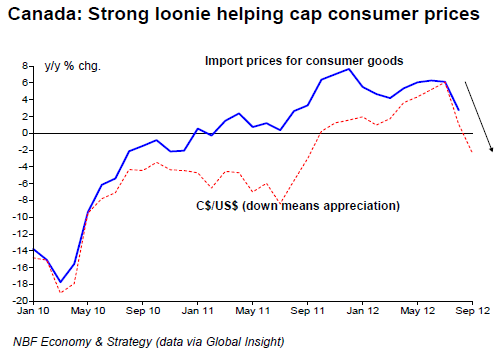

OPINION: The CPI report confirms that inflation remains very tame in Canada. Slow economic growth and a strong Canadian dollar (bottom chart) are clearly helping restrain prices. With September's results, core CPI ended up well below the Bank of Canada's Q3 estimates, i.e 1.5% versus the BoC's 1.9% estimate. Canadian GDP is set for tepid growth in Q4 as well, with a soft domestic economy and weak trade keeping price pressures well under wraps. We're accordingly anticipating a downgrade in both inflation and growth forecasts in next week's Monetary Policy Report, and, to the very least, a tone down in the BoC's hawkish language.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canada: Core Inflation Drops Further In September

Published 10/22/2012, 02:09 AM

Updated 05/14/2017, 06:45 AM

Canada: Core Inflation Drops Further In September

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.