–The Labour Force Survey showed a 34.3K increase in employment in August. That was well above consensus expectations which were at +10K. The job gains allowed the unemployment rate to stay unchanged at 7.3% despite the one-tick increase in the participation rate to 66.6%. Private sector employment rose 30K, buoyed by services (+71K, with strong gains in transportation and warehousing).

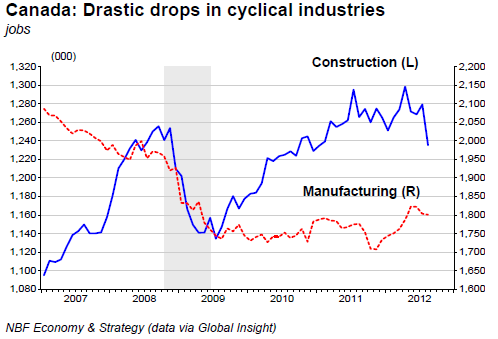

The goods sector lost 36K jobs, a third consecutive monthly decline. Employment fell in cyclical sectors like construction (-44K, the worst monthly decline since 2008) and manufacturing (-3K, representing a third consecutive decline). Full time employment fell 13K, reversing part of the strong gains in prior months. All of the job gains in August were therefore part-time. So little surprise that hours worked fell 0.3%.

The LFS report is worse than it looks, with employment propped up by part-time positions, with significant declines in cyclical industries like construction and manufacturing. Moreover, the stunning performance of education casts some doubt about recent strength in the LFS. We expect a reversal in that particular sector soon. With August's drop, hours worked are now tracking +1.7% annualized in Q3, a deceleration from Q2's 2.6% pace. All told, the details of the report warrant caution about the real economic picture in Canada.

As widely expected, the Bank of Canada left interest rates unchanged at 1.00%. The BoC again stuck to its guns by leaving intact in its statement the phrase "some modest withdrawal of the present considerable stimulus may become appropriate." To support this, the BoC explained that global growth prospects are unfolding in line with the July MPR forecasts.

As for Canada, the BoC viewed growth as roughly in line with the economy's potential, expecting it to pick up in 2013 thanks to consumption and business investment. But the BoC gave itself some room in case it wants to turn more dovish later by saying that there are "tentative signs" of a slowing in household spending.

The Bank of Canada had to work hard to keep its tightening bias. Not only did it downplay the soft inflation data, but it also omitted mentioning the declining corporate profitability and softening in the labour market. But there’s a limit to how long the BoC can hold that line, particularly if headline inflation, currently at 1.3% y/y, remains well below its 2% target for an extended period of time.

Core inflation is also soft with the three-month annualized rate running at -0.3%, the first time that measure falls below zero since end-2007. If, as we expect, the labour market fires blanks in the coming months, consumption will continue to tread water. And with likely liquidity injections from the ECB and the Fed, which would prop up commodity prices, the strengthening CAD would act as an even bigger brake on an export sector that's already struggling. All told, those extra headwinds could allow the BoC to turn a bit more dovish when it publishes its updated forecasts in October's Monetary Policy Report.

United States – The US labour market remains fragile as evidenced by the weak nonfarm payrolls (only 96K jobs added in August, with downward revisions of 41K to the prior two months). Private sector employment rose just 103K in August, after a 162K increase the previous month. The manufacturing sector (-15k) lost almost all July's gain.

The government continued to shed jobs with a 7K drop in payrolls. Average hourly earnings was essentially flat and total hours worked increased just 0.1%. The household survey wasn’t any better, showing a second successive decline in employment (-314K in the last 2 months). True, the unemployment rate fell to a four-month low of 8.1%. But that’s entirely due to people giving up the job search as reflected by the drop in the participation rate to 63.5%, the lowest since 1981.

The small gains in full-time jobs in August did little to significantly alter a trend that’s been apparent since Q2, with a move away from full-time and towards part-time jobs. That has contributed to limit growth in hours worked to less than 0.5% annualized over the Q2-Q3 period, impacting output as a result. We haven’t seen such weakness since 2009.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canada Labor Force Survey Shows Employment Increased By 34.3K In August

Published 09/12/2012, 12:47 AM

Updated 05/14/2017, 06:45 AM

Canada Labor Force Survey Shows Employment Increased By 34.3K In August

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.