Some Relief For Boomers, But Not For Civil ServantsHighlights

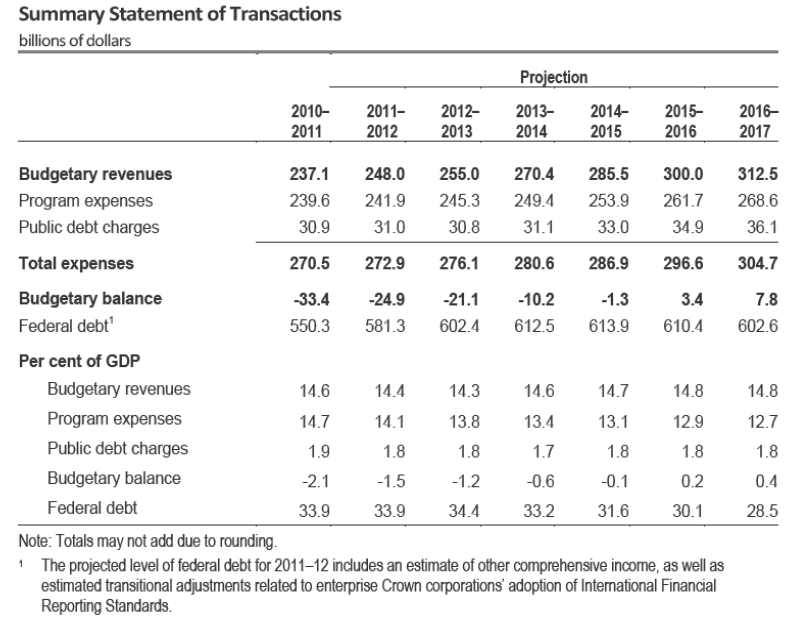

- The deficit for 2011-12 is estimated at $24.9 billion, $6.1 billion less than in last November’s update. Of this improvement, $3 billion comes from the removal of the adjustment for risk (since risks have not materialized), and $3.1 billion from upwardly revised revenues and downwardly revised expenses, despite a $500 million increase in spending due to new measures.

- The deficit for 2012-13 is projected at $21.1 billion, $6.3 billion less than in the update, $1.5 billion coming from a change in the adjustment for risk, $1.1 billion from budget measures and $1 billion from lower debt charges. The deficit is then projected to fall to $10.2 billion in 2013-14, to $1.3 billion in 2014-2015, with a surplus forecasted for 2015-2016, as in November’s update.

- The Budget incorporates the results of the Government’s review of departmental spending, which amount to $5.2 billion in ongoing savings (impact of $1.8 billion in 2012-13). Over a three-year period, 12,000 government positions are expected to be eliminated.

- The Budget confirms last December’s announcement about the future growth path of transfers to provinces. Starting on April 1, 2023, the age of eligibility for Old Age Security (OAS) and Guaranteed Income Supplement (GIS) benefits will be gradually increased from 65 to 67.

- One-year extension of the Hiring Credit for Small Business.

- Employment Insurance (EI) premium rate increases will be limited at no more than 5 cents each year until the EI Operating Account is balanced.

- The Government will introduce enhancements to the governance and oversight framework for CMHC for the purpose of stability of the housing market.

- The Government will propose legislative amendments to allow public pools of capital to make direct financial investments in financial institutions.

- Starting Fall 2012, the Royal Canadian Mint will no longer distribute pennies.

- In 2012-13, the level of net bond issuance is planned to be about $97 billion, $3 billion higher than in 2011-12.

- The federal debt-to-GDP ratio is forecasted to peak at 34.4% in 2012-13 and then to go down to 28.5% in 2016- 17

Summary

The new measure of the Budget that has the largest fiscal impact is the Government’s review of departmental spending. It results in $5.2 billion in ongoing savings, representing 6.9% of an aggregate review base of $75.3 billion, or 1.9% of total expected program spending in 2016-17. This reduction in spending is expected to eliminate 12,000 government positions over a three-year-period.

Taking into account attrition through retirements and voluntary departures, federal employment will be reduced by 19,200, or 4.8%. To put this percentage in perspective, it is about one-third of that experienced during the 1990s program review. It would reverse about 20% of the increase in federal employment that has occurred since the late 1990s, where federal employment grew by about a third. Other expense reductions are achieved through the deferral of $3.5 billion in National Defence funding over seven years into the future period when purchases will be made. Other measures included in the Budget increase spending by less than $1 billion per year. The production of a penny costs 1.6 cents, and its elimination from Canada’s coinage system will save an estimated $11 million a year.

The Economic Action Plan 2012 supports research and innovation through a variety of initiatives. The fiscal impact over the next two years amounts to $521 million. Among other things, it will make available $400 million for venture capital activities, confirms the commitment for an additional $100 million to support the venture capital activities of the Business Development Bank of Canada, devotes $110 million per year to double support for companies through the Industrial Research Assistance program and $105 million over two years to support the continued transformation of the forestry sector. Starting 2014-15, $500 million will be allocated over five years to the Canada Foundation for Innovation.

Budget 2011 announced a temporary Hiring Credit for Small Business of up to $1,000 per employer, applied to the increase in the employment insurance premiums. Budget 2012 extends this credit for one year. The extension will have a fiscal impact of $205 million.

Limiting increases in EI premium rates to 5 cents a year means that the premium rate per $100 of insurable earnings is projected to be $1.88 in 2013-2014 instead of $1.93, and $1.93 in 2014-15 instead of $2.03 and $1.98 in 2015-16 instead of $2.10. The EI Operating Account is expected to be balanced in 2016-17.

The Budget confirms last December’s announcement about transfers to provinces. This means that the 6% annual escalator for the Canada Health Transfer (CHT) will continue through 2015-2016. It will then reach $34 billion, or 13% of total program expenses (11% in 2011-12). Starting in 2017-18, the CHT will grow in line with a three-year moving average of nominal average GDP.

The announcement about OAS and GIS age eligibility means that people born before April 1958 (aged 54 or older as of March 31, 2012) will not be affected. People born in April or May 1958 will be eligible at the age of 65 years and one month. The eligibility age will increase by one month for those born in June or July 1958, and so on, so that those born in February 1962 or later will be eligible at 67. The age eligibility of support to low-income spouses, common-law partners of or survivors of GIS recipients (Allowance and Allowance for the Survivor) will increase from 60-64 today to 62-66.

Debt-Management Strategy

For 2012-13, the Government is expected to borrow $268 billion from financial markets. This includes $235 billion of refinancing needs, $23 billion of new requirements and net cash increase of $10 billion. The outstanding stock of treasury bills will shrink by roughly $4 billion while the amount of marketable bonds outstanding will increase by $36 billion and foreign debt by $2 billion. The Government plans to increase issuance of 10-year bonds and reduce those of short-term bonds. The regular buyback operations on a cash basis for the 10-year sector will be discontinued. The temporary increase in 10-year bond issuance will allow the Government to lock in historically low interest rates. Over the medium term, the average term to maturity of the marketable debt net of financial assets is projected to gradually increase from roughly 7.3 years to 8 years by 2016-17.

In 2012-13, the level of gross bond issuance is planned to be about $99 billion, taking into account $2 billion of buybacks and $67 billion of maturities (including the inflation adjustment of RRBs), consequently the net increase in bonds will be $30 billion.

In 2013-2014, non-budgetary transactions will more than offset budgetary balance requirements as assets under the Insured Mortgage Purchase Program will be maturing ($42 billion).

The federal debt-to-GDP ratio is expected to reach 34.4% in 2012-13 and is projected to fall to 28.5% in 2016-17. This would bring this ratio back to pre-recession level and 42% lower than at its peak of 68.4% in 1995-96.

Conclusion

Canada’s fiscal position prior to the 2007 crisis meant the federal government was in a position to bring significant measures in order to foster economic growth and Canada’s competitiveness on international markets. We have argued in the past (Weekly Economic Letter - March 5, 2012) that retention of older workers in the workforce should be seen as an economic growth strategy to limit the pressure of aging on all government social programs (notably health care), not just public pensions. Today’s budget announcement to change OAS/GIS age eligibility from 65 to 67 starting in 2023 will have a limited impact on the bulk of baby boomers. While it is a step in the right direction, it could have been implemented earlier.

We welcome the one-year extension of the Hiring Credit for Small Business as small businesses account for 37% of private employment in Canada but hardly contributed to net job creation coming out of the last recession.