Canadian GDP contracted in the first half of 2015, complying with the technical definition of a recession. In a January 13 speech, Deputy Governor Timothy Lane acknowledged this possibility. The presentation outlined the following events: oil's price drop causes a decline in capital investment, increasing unemployment and lowering confidence. Although lower oil prices increase consumer’s incomes and thereby consumer spending, he concluded the net impact was negative.

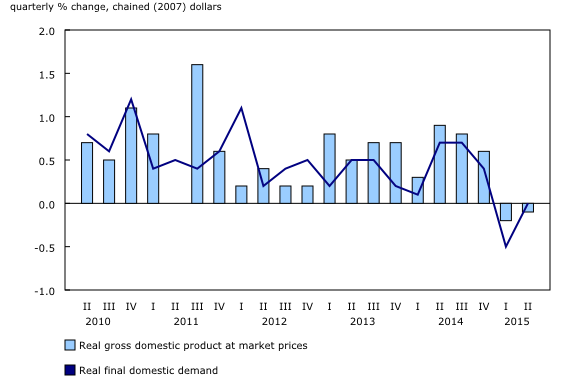

Today’s GDP report came fairly close to confirming Lane’s analysis, as this graph from the release shows:

The biggest problem is the contraction related to the oil and gas industry:

The mining, quarrying, oil and gas extraction sector (-4.5%) posted a notable decrease, down for a second consecutive quarter. The decrease was mostly a result of the decline in the non-conventional oil extraction industry (-5.7%), which experienced maintenance shutdowns and production difficulties in the second quarter. Support activities for mining, oil and gas extraction (-18%) declined for the second consecutive quarter. Manufacturing, construction and utilities also declined in the second quarter.

Although other industries such as real estate and wholesale trade are growing, the oil and gas contraction is larger and therefore, lowering growth.

And, as Lane predicted, consumer spending is increasing. While household’s final consumption expenditures increased .1% in the first quarter, they were up .6% in the second.

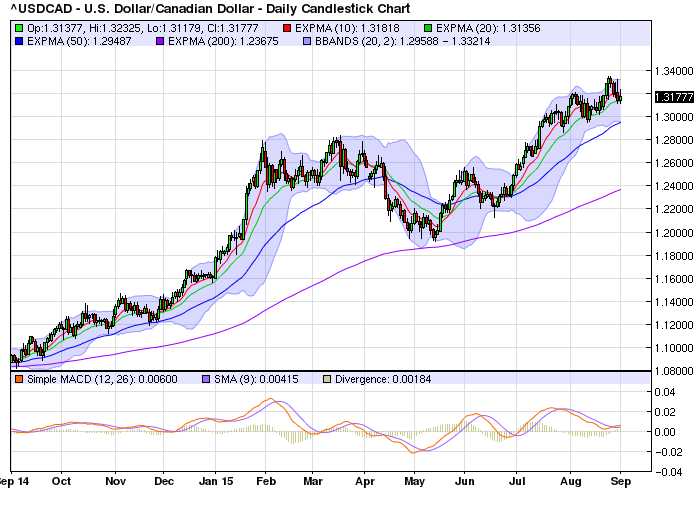

The impact on the Canadian dollar continues to be negative, starting with the USD/CAD pair:

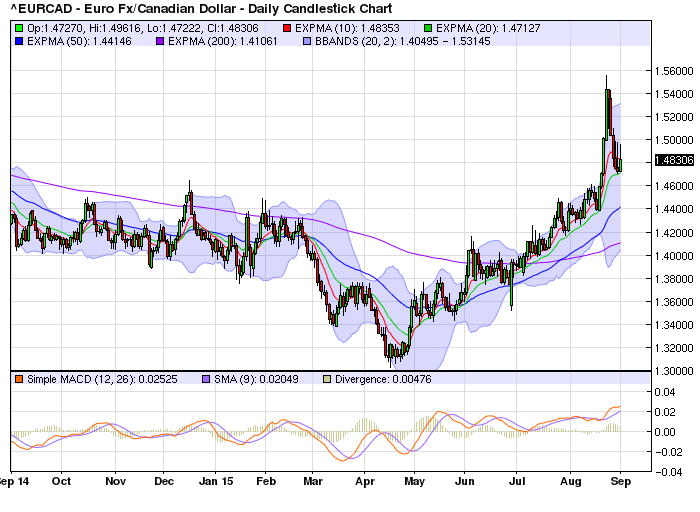

A year ago, a USD purchased ~1.09 CAD; now it’s 1.31, a ~20% drop. And the EUR/CAD has also rallied:

The CAD started to decline relative to the EUR in late April; it has lost ~13% versus the EUR.

When oil’s price drop started, many analysts (myself included) thought it would rebound quickly. That was nearly a year ago, and prices remain slightly above 2008-2009 Great Recession levels. With interest rates at .5% and no QE program in place, the Bank of Canada has some policy room to maneuver. But the longer oil’s price is weak, the longer the potential negative impact on the Canadian economy.