FACTS: Canada’s manufacturing sales slumped 3.1% in December, after a 1.9% increase in the prior month. Sales declined in 16 of the 21 industries, representing 82% of the manufacturing sector. But half of December’s decrease took place in motor vehicles & parts (-11.4%). To a much lesser extent, chemicals (- 4.2%) and petroleum & coal products (-2.2%) were also important contributors to the drop. On a regional basis, sales fell in 6 provinces out of 10, the largest drops occurring in Manitoba (-7.5%), New Brunswick (-6.7%) and Ontario (-4.6%). New orders fell 4.4% in December, with almost half of the drop in transportation equipment (-9.8%). Unfilled orders rose 2.6%, fuelled by aerospace products (+5.0%). Inventories decreased 1.0%. The inventory-to-sale ratio was up 0.02 to 1.34. In real terms, manufacturing sales fell 3.8% in December, after a 1.7% increase in the prior month.

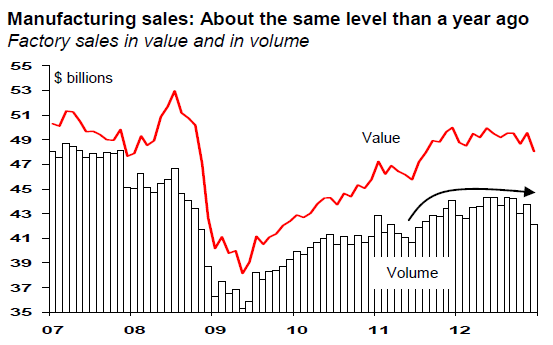

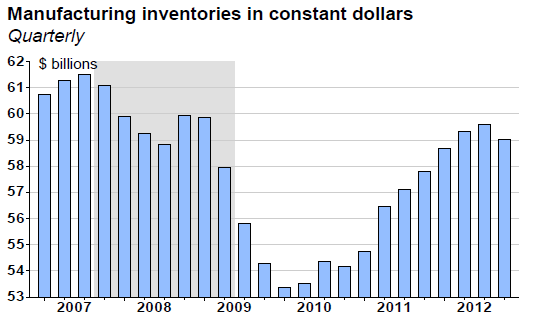

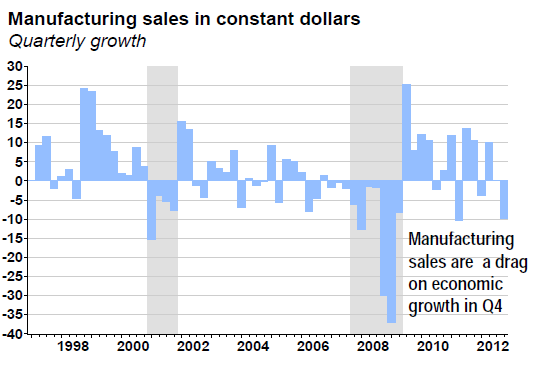

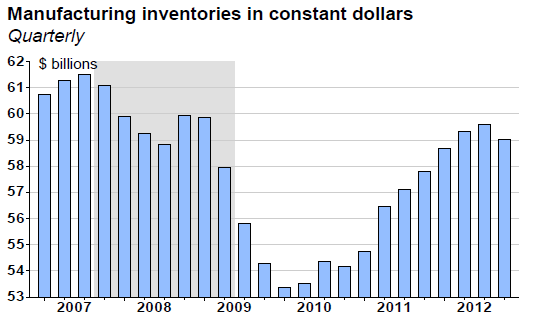

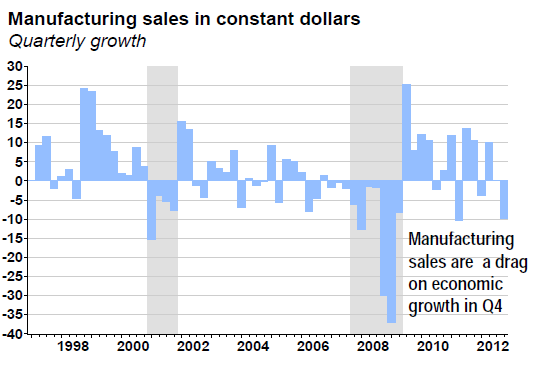

OPINION: In real terms, manufacturing sales have increased 3% in 2012, but the top chart shows that all the progress was indeed made in the second half of 2011. Looking ahead, December’s sales slump is not necessarily the start of a trend, as the dive in motor vehicles manufacturing is not a reflection of the rather strong demand for new cars in the U.S. Also, manufacturing production could get a boost from inventory rebuilding, as there was an inventory drawdown in Q4 (middle chart). But in the meantime, Q4 saw the worst performance of manufacturing sales in real terms since Q2 2011 (bottom chart). Of course, this will weigh on real GDP growth, especially for December. Real GDP figures for Q4 are scheduled to be released on March 1st.

OPINION: In real terms, manufacturing sales have increased 3% in 2012, but the top chart shows that all the progress was indeed made in the second half of 2011. Looking ahead, December’s sales slump is not necessarily the start of a trend, as the dive in motor vehicles manufacturing is not a reflection of the rather strong demand for new cars in the U.S. Also, manufacturing production could get a boost from inventory rebuilding, as there was an inventory drawdown in Q4 (middle chart). But in the meantime, Q4 saw the worst performance of manufacturing sales in real terms since Q2 2011 (bottom chart). Of course, this will weigh on real GDP growth, especially for December. Real GDP figures for Q4 are scheduled to be released on March 1st.