Yesterday, the U.S. dollar rose against its Canadian counterpart, which pushed USD/CAD above the upper border of the declining wedge, but can we trust this breakout?

EUR/USD

From today’s point of view, we see that the overall situation hasn’t changed much as EUR/USD is still trading around yesterday’s levels. Therefore, our previous commentary remains up-to-date:

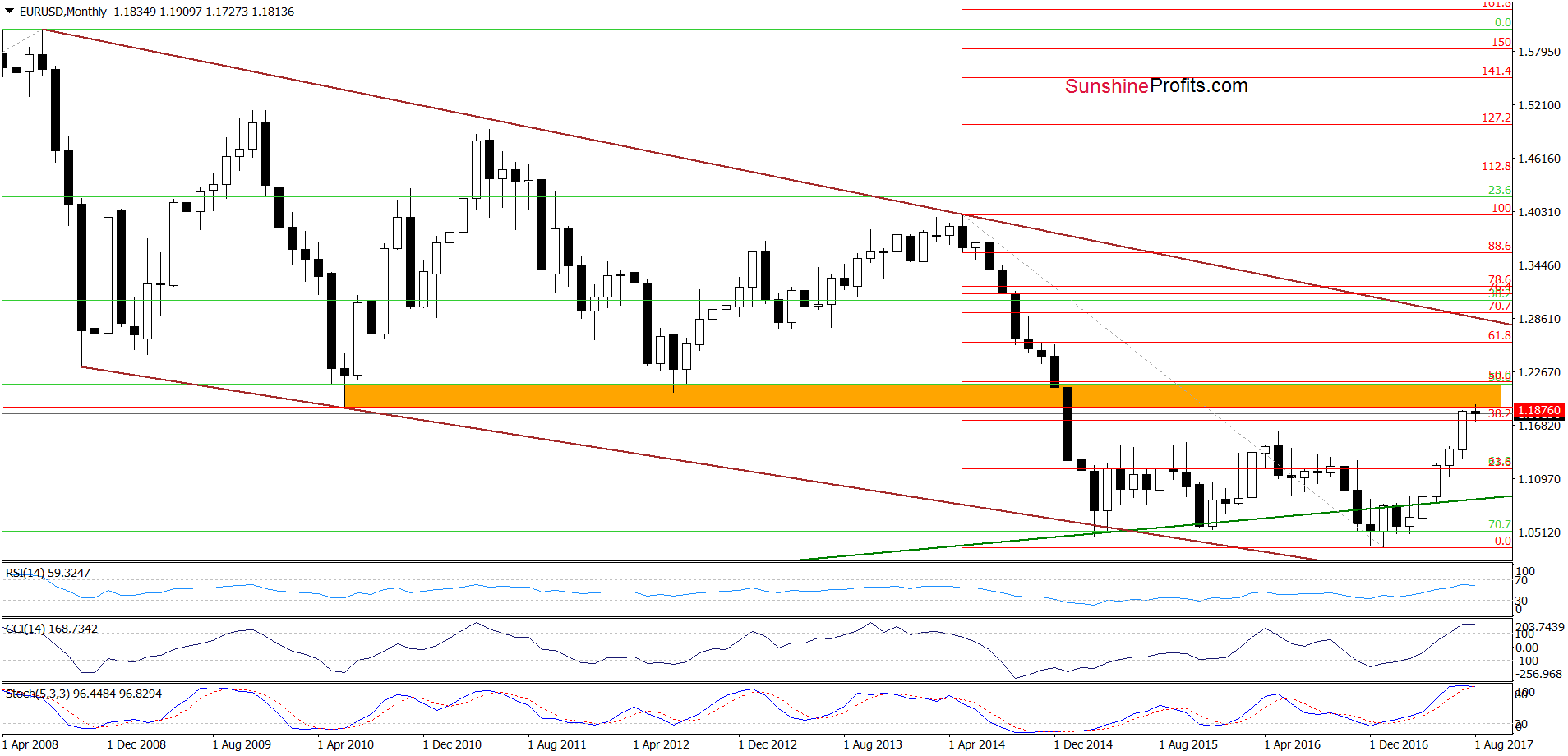

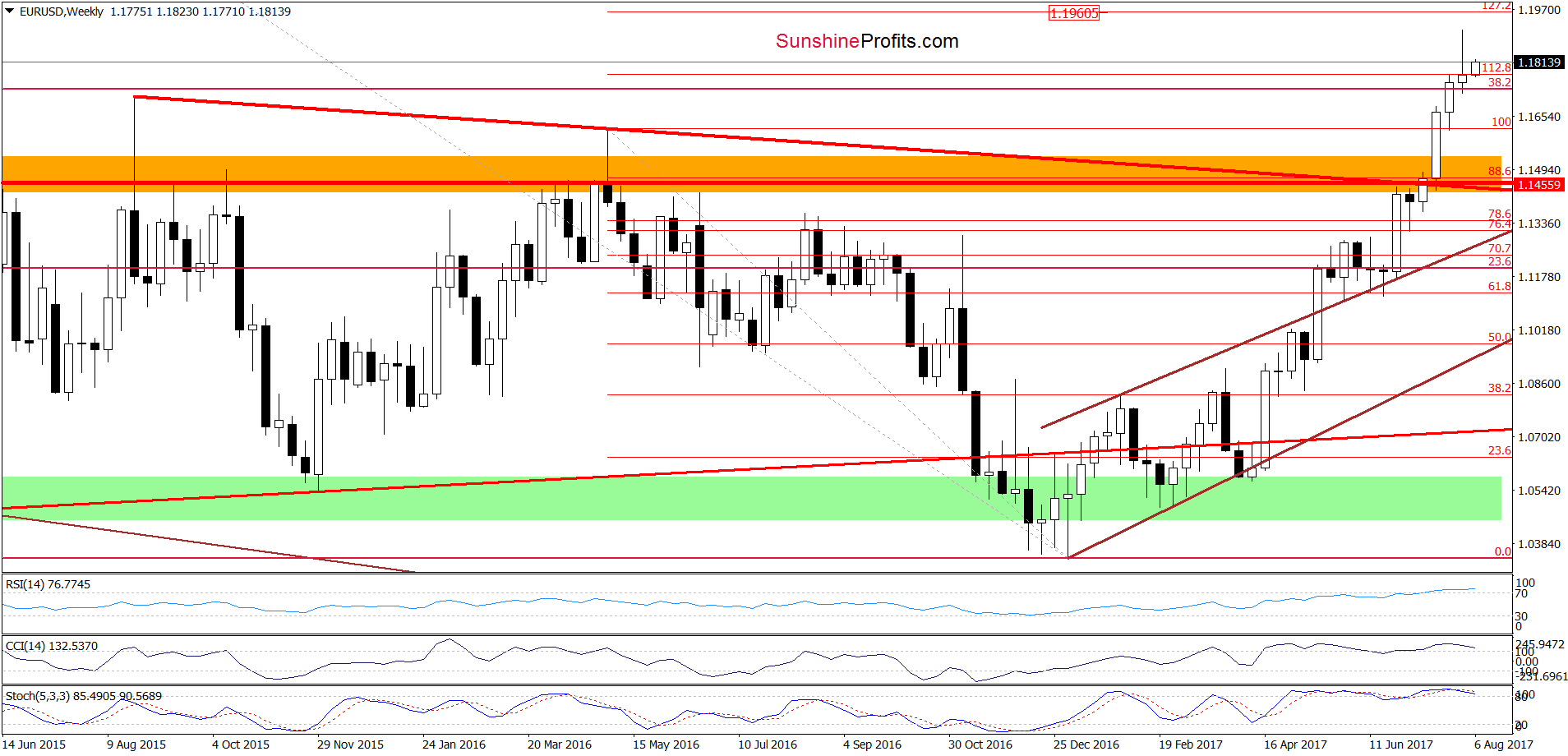

(…) Although monthly and weekly indicators are overbought, currency bulls pushed EUR/USD higher in the previous week, which resulted in a breakout above the 38.2% Fibonacci retracement based on the entire May 2014-January 2017 downward move (the retracement is more visible on the long-term chart) and the 112.8% Fibonacci extension (based on the May 2016- January 2017 downward move).

What does it mean for the exchange rate? In our opinion, such price action suggests that as long as there are no sell signals generated by the indicators, another attempt to move higher can’t be ruled out. Therefore, if the pair moves higher from current levels, the initial upside target will be around 1.1960, where the 127.2% Fibonacci extension is.

- Very short-term outlook: mixed

- Short-term outlook: mixed with bearish bias

- MT outlook: mixed

- LT outlook: mixed

USD/CAD

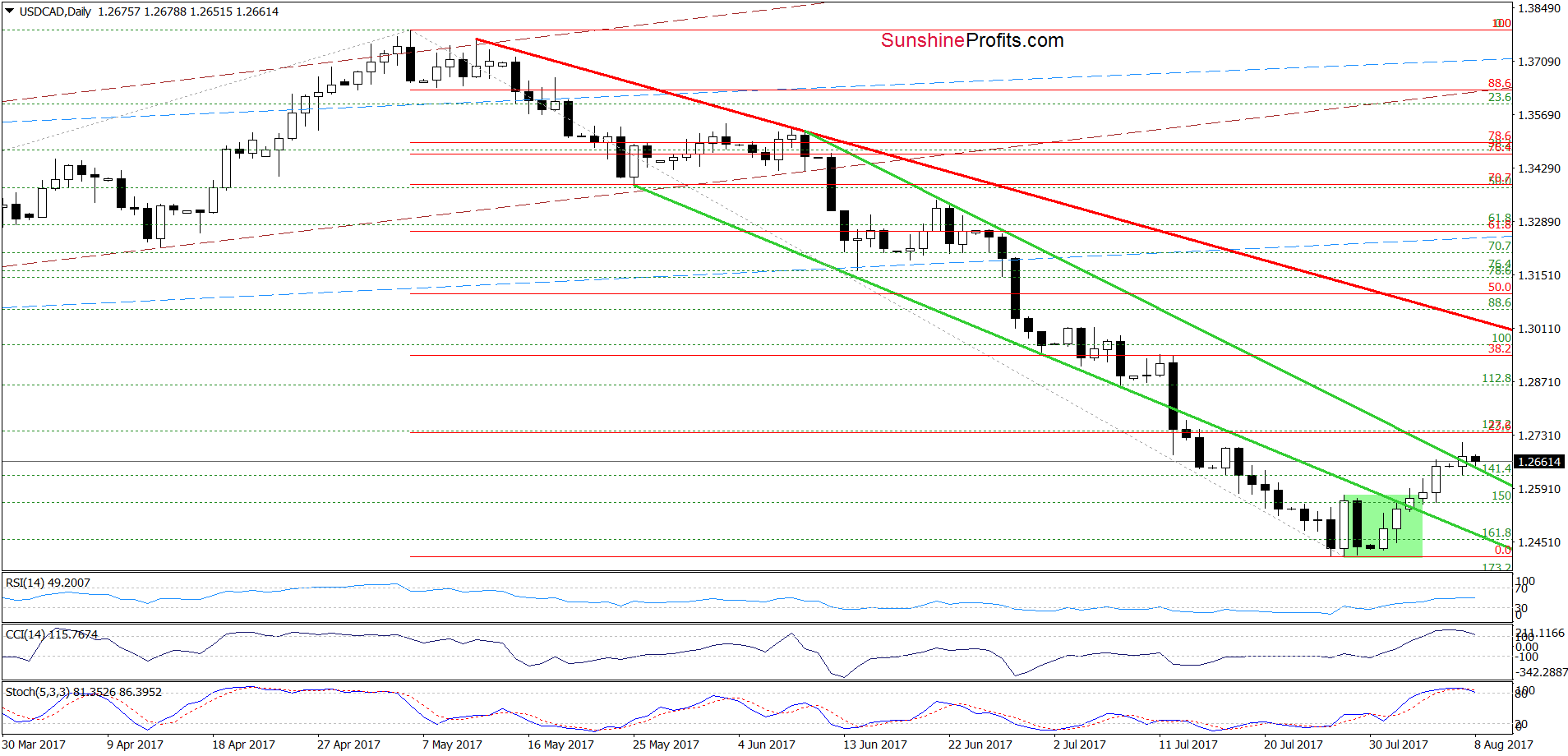

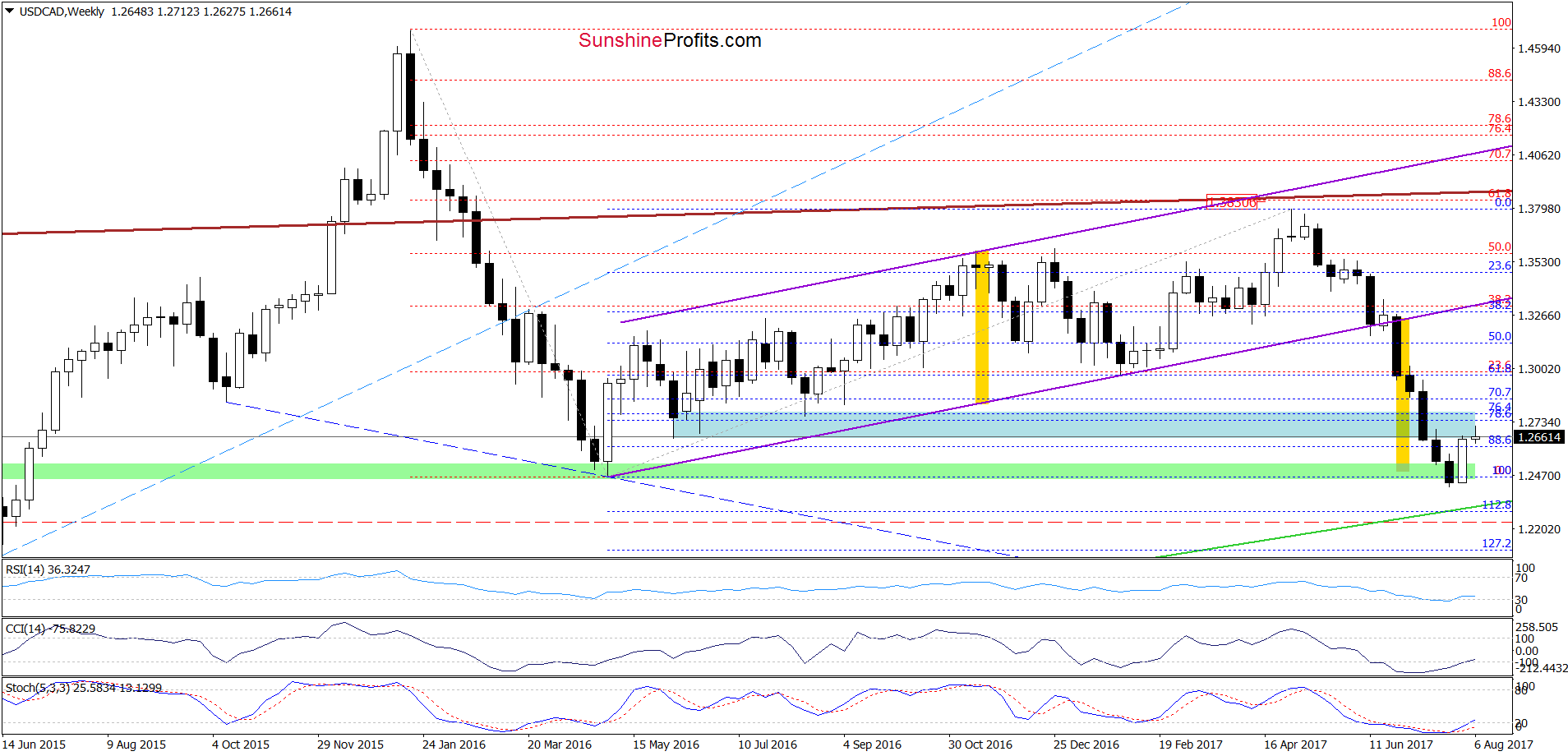

The first thing that catches the eye on the daily chart is a breakout above the upper border of the green declining trend channel. Although this is a positive development, the breakout is unconfirmed. Additionally, not far from current levels is also the 23.6% Fibonacci retracement based on the entire May-July downward move, which together with the position of the daily indicators (there are very close to generating sell signals) could encourage currency bulls to act – especially when we factor in the blue resistance zone created by the June 2016 lows (marked on the weekly chart below).

If this is the case and USD/CAD reverses and decline, we will likely see a test of the green support zone (seen on the above chart) and the lower border of the green declining wedge in the following days.

- Very short-term outlook: mixed

- Short-term outlook: mixed with bearish bias

- MT outlook: mixed

- LT outlook: mixed

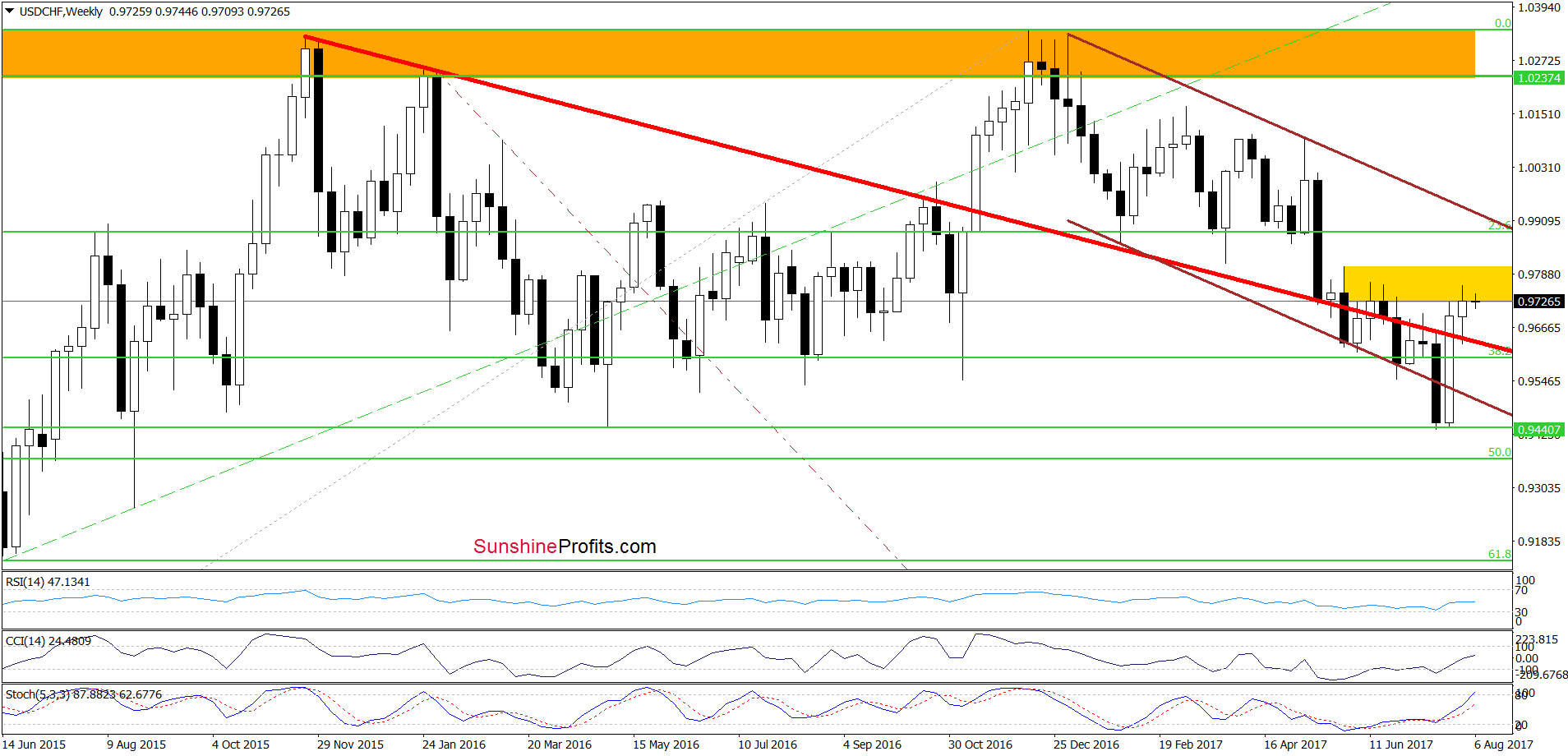

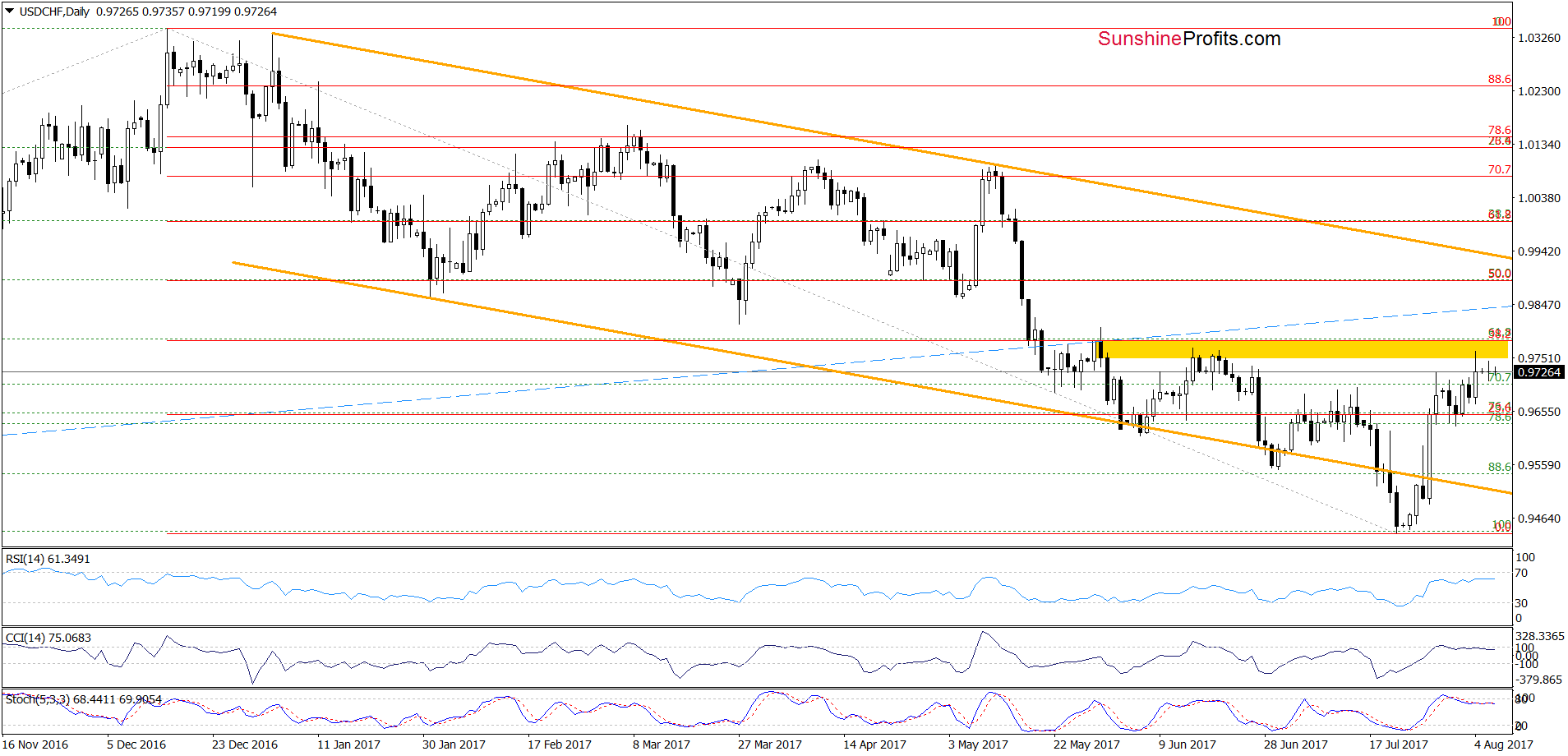

USD/CHF

Looking at the charts, we see that invalidation of the breakdown under the lower border of the orange declining trend channel encouraged currency bulls to act, which resulted in a climb to the yellow resistance zone. After Friday’s upswing the pair started consolidation, which suggests that one more upswing and a test of the 38.2% Fibonacci retracement can’t be ruled out. Nevertheless, the sell signals generated by the daily indicators indicate that the space for increases may be limited and reversal in the coming days is likely. If this is the case and the exchange rate moves lower from current levels, the first downside target will be around 0.9630, where the last week’s low is.

- Very short-term outlook: mixed

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Naturally, the above could change in the coming days and we’ll keep our subscribers informed, but that’s what appears likely based on the data that we have right now.

Thank you.