To say that weather-related news hasn’t dominated the landscape for much of 2014 would be an understatement. Most people had never heard of the polar vortex until this year as is clear when looking at a news trend search for the word “polar vortex.”

We’ve been dealing with an abnormally cold winter for most of 2014 with the weather being blamed for the recent poor economic data we’ve had over the last two months. That seems like a logical conclusion when Central Park in New York received 56.6 inches of snow by the middle of February, the 7th highest snowfall total going back to 1868.

However, there are plenty of naysayers who dismiss the effects of old man winter and claim the economy is beginning to cool on its own account. So, who's right? Personally, I think it is a huge mistake to minimize 141-year-old records being broken as having little to no effect on the economy. Perhaps the weather-deniers live in sunny San Diego and don't read the news?

Because economists can’t accurately predict the weather nor how it could impact their forecasts, it's not surprising that recent economic data has been below consensus estimates. The Citigroup Economic Surprise Index, which measures the outcome of economic data relative to estimates, fell from a peak 72.7 on January 15th to a recent low of -34.10 today. Due to the weaker than expected economic reports seen over the last few months, investors have ratcheted down their economic growth estimates for the first quarter and the bond market has responded as longer-term interest rates have fallen this year. Consequently, the yield curve has flattened as short-term yields remain steady while longer-term yields have fallen. The link between negative economic surprises and the yield curve is shown below:

If in fact much of the recent economic weakness can be attributed to the weather, than it is likely we should see a pickup in growth in the second quarter that was pushed out from Q1 and incoming data should begin to surprise on the upside. If we begin to see positive economic surprises we should also see a steepening of the yield curve as bond investors begin to sell their longer-dated holdings. One of the prime beneficiaries of a rising yield curve is the financial sector and the bottoming action in the yield curve was associated with a recent bottom in the financial sector’s relative strength (XLF) to the S&P 500 (SPY). While the financial sector has been largely underperforming the market since the middle of 2013, they may move to a market leader should the yield curve begin to increase again.

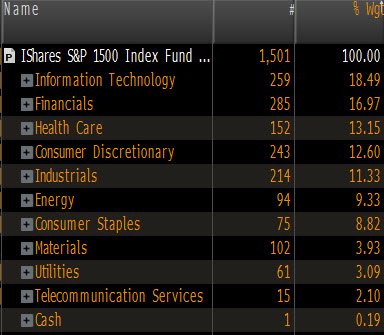

This would be significant for the market as the financial sector is the second largest sector in the S&P 1500 at a 17% weighting. The technology sector represents 18.5% of the S&P 1500 and after financials the next largest sector is the health care sector at 13.15%. With both the technology and health care sectors acting as market leadership, if the financial sector were to begin outperforming the market with a rising yield curve as the catalyst, we could see a strong rally ahead as these three sectors at a combined 48.5% weight make up nearly half of the entire U.S. market.

In the Word’s of Chauncey Gardner,

“There will be growth in the spring”

As our record-breaking winter begins to fade we should see growth in the spring. Hopefully, warmer temperatures will return alongside a rising yield curve and allow the financial sector to lead the way.