Surely one of the most incredible, and oftentimes frustrating tendency in the stock market is for the major indices to rally in the face of so much adversity. Just when it appears that the world is falling apart through a combination of fundamental, technical, and cyclical factors, some unseen force comes through to unwind the negativity.

This is also why it's so difficult to forecast where stocks are headed with a high degree of conviction. Last month all of the experts on TV told us we were headed for (or already in) a bear market. Now those exact same talking heads are waving the all clear flag and talking about how the coast is clear. What changed in so short a time frame?

There is a great saying on Wall Street that I will paraphrase as: nothing changes sentiment like price. Meaning you are apt to get more bearish on the way down and more bullish on the way up. It’s natural to become risk averse when you are losing money and want to get back in when it appears everyone else is riding prices higher. Fighting those impulses, or adopting a counterintuitive mindset, can be one of your greatest allies throughout your investing career.

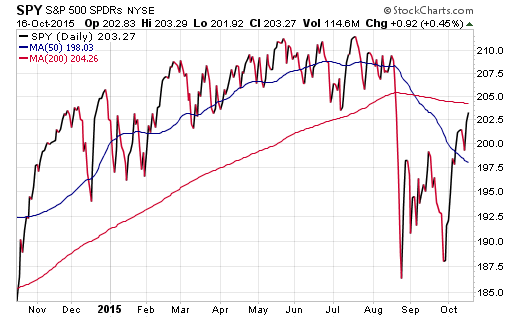

Examining where we are at in the current market, there is no doubt that the recent jump in the SPDR S&P 500 ETF (N:SPY) has been forceful. I believe that many were positioned for more volatility ahead and were caught off sides when stocks all of a sudden adopted a resilient tone.

This most recent leg higher appears different than the September fake-out. Even modest dips have been bought throughout the rally and stocks have managed to keep down days to minimal blips on the radar. This ultimately creates a “fear of missing out” (FOMO) that propels more and more investors back into the market as they try to recoup their losses or finish the year on a positive note.

No one wants to be the guy who sold and went to cash when their account was down 5%, only to see the market rally and finish the year with a 5% gain. However, there is the potential for just that type of scenario to play out.

I’m not here to wave the green flag and tell you that you are going to miss a huge opportunity over the next two months. By contrast, I am hesitant to put new money to work in stocks after such a big move to the upside. I think that a more conservative approach of laddering back into new positions over time or looking to buy on weakness would serve you much better at this stage of the game. Jumping in with both feet and whole lot of hope isn’t a sustainable investment approach.

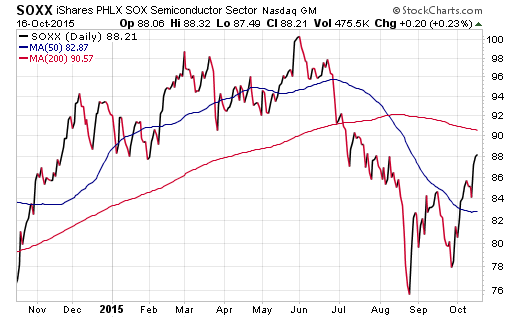

One area of the market I have my eye on right now are semiconductor stocks. There has been a great deal of M&A activity in this industry over the last several weeks in addition to a change in overall trend. The iShares PHLX Semiconductor ETF (O:SOXX) is a market-cap weighted index of 30 companies in this sector.

After falling steeply in the third quarter and leading on the downside, SOXX has experienced an enviable snap back in recent weeks. From a technical perspective, I think its worth noting that SOXX put in a higher low in September that was a positive sign of divergence from the broader market. This has likely created a new momentum category that both growth and income investors should be mindful of through the remainder of the year.

The Bottom Line

The stock market loves to head fake us into uncomfortable decisions at the worst possible times. That is why it is imperative that you make changes to your portfolio with a well-defined risk profile and sound investing principles. My preferred tactic right now is to use a balanced asset allocation structure to survive market volatility and still participate in any additional upside momentum that carries us into year-end.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.