Crude oil bulls are attempting a comeback early in the week. Can they pull a rabbit out of their hats? Carefully examining the situation, we have the answer to that question. It’s great to share the rich details. In the format you are used to – on time and highly actionable.

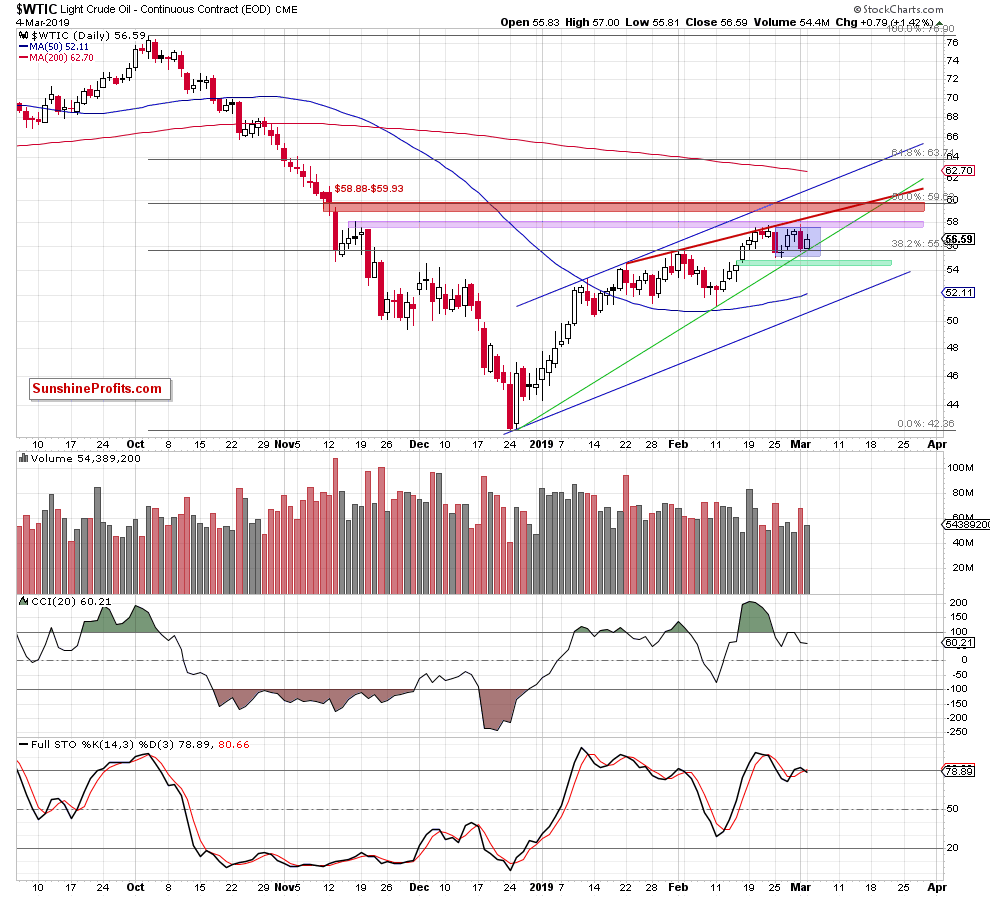

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, the rising green support line provided temporary relief to the bulls. Black gold moved higher but the lingering doubts as to the bulls’ strength remain. Namely, the price action left a sizable upper knot (which shows a kind of an intraday reversal) and also the volume of the upswing was lower than that of the decline (which has bearish implications).

Next, there is the discrepancy between the higher oil price and the action of the daily indicators. Just like we mentioned yesterday in the summary, Stochastics now fully issued its sell signal. Not to be left behind, CCI presents us with one, too. Let’s not forget the powerful combination of nearby resistances (the purple resistance zone and the red resistance line) that are likely to continue to keep any further gains in check.

All the above suggests that another attempt to break below the rising green support line is very likely in the coming days. This can happen perhaps even later today or tomorrow.

Before any decision to potentially increase the size of a short position, we want to see oil trading below this green support line and the closed gap (marked with a horizontal green rectangle) first. This would provide a powerful signal that the oil price is ripe for a further decline. It simply depends on the force, volume and other circumstances such a break is made with. If favorable to the bears, the prudential approach is to follow the risk-reward ratio and increase the position smartly.