- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can The Euro Fight Back?

The Euro has been looking on the back foot as of late, after Mario Draghi came to the party and smashed down the markets. Slashing interest rates and threatening exotic measures in his effort to fight the Euro.

What’s next for the Euro might be of little concern for a lot of people, but I personally believe it has a lot more room to fall further, despite the recent candles showing buying pressure still being there.

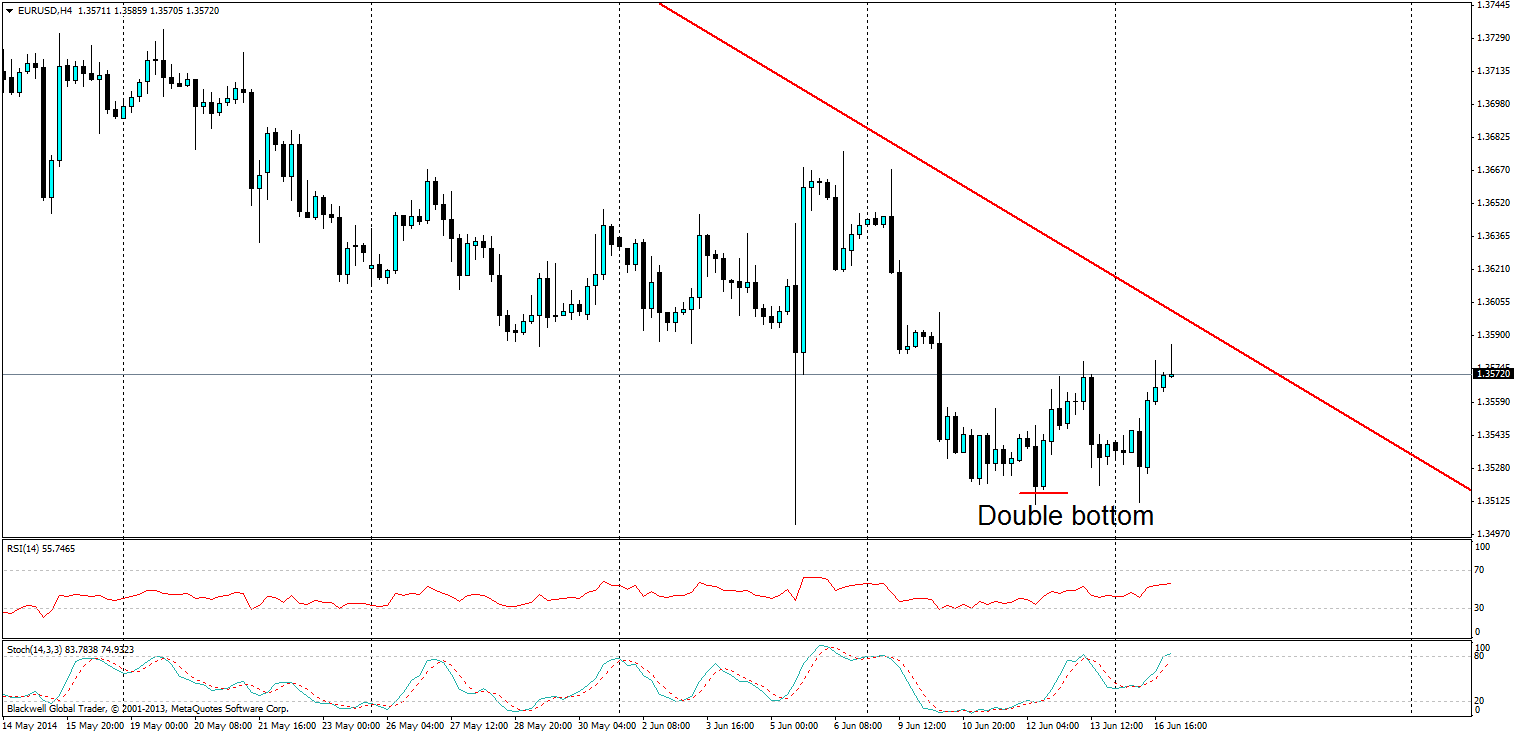

Source: Blackwell Trader (EUR/USD, H4)

On the 4H chart (see chart above), we have seen a double bottom candlestick formation, this is generally indicative of a bull run for the pair. So far so good it has run higher, but it's stopped short of the current daily trend line, and I believe the market is cautious for the upcoming economic survey (see chart below).

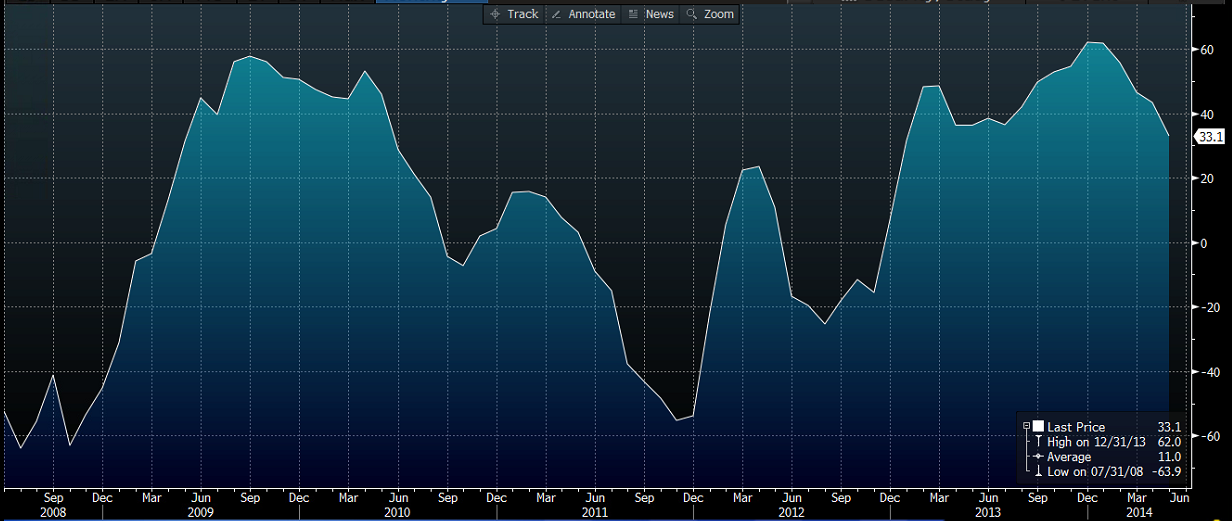

Source: Bloomberg (German Economic Sentiment [ZEW])

The forecast is currently for an improvement in economic sentiment, sure it’s possible. But the Germans are a very conservative people, and I strongly doubt they will be pushing for anything higher than the previous month; especially when the European Central Bank has just recently taken action to fight off deflation.

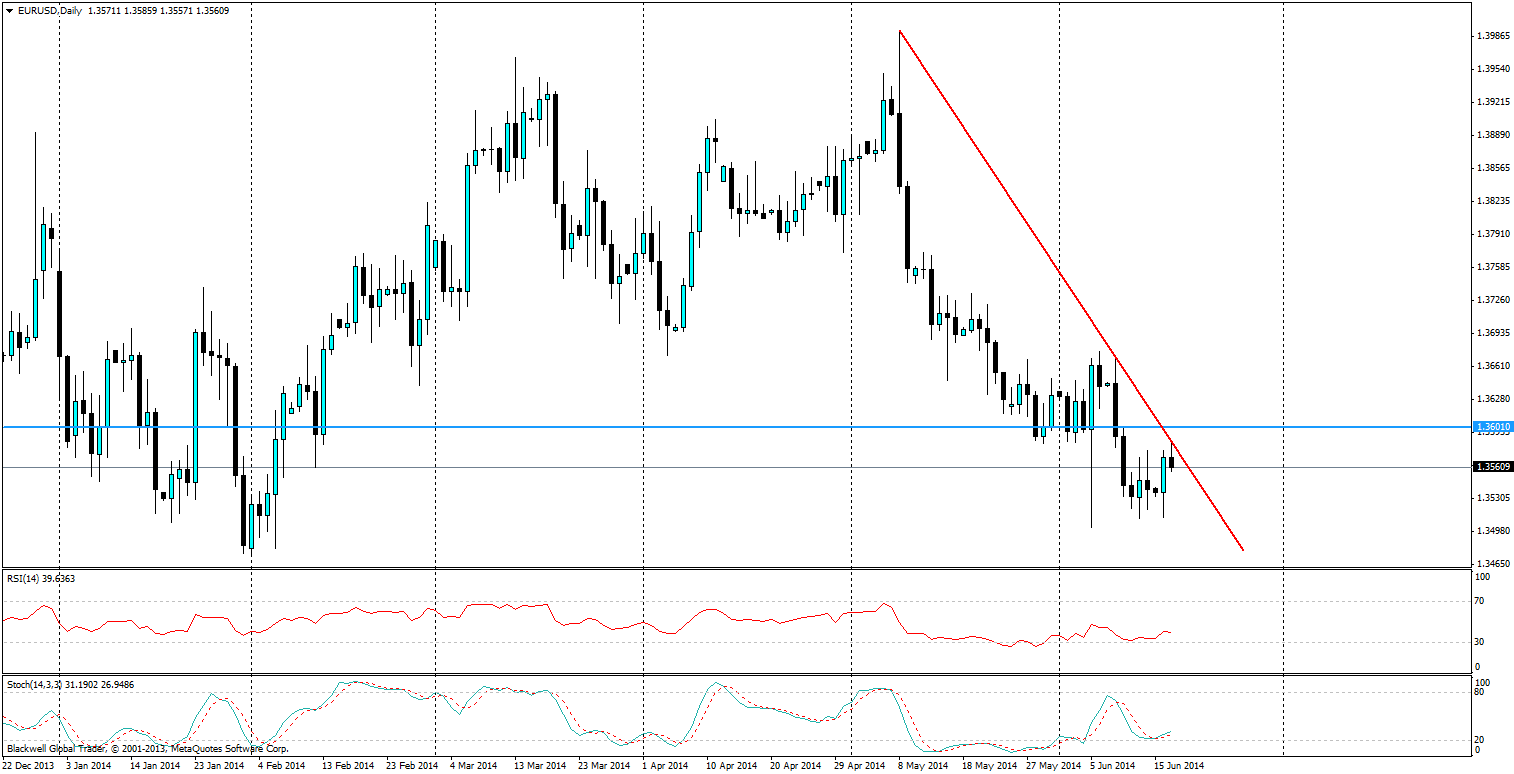

Source: Blackwell Trader (EUR/USD, D1)

The daily chart (see chart above) shows the bears at work though, and it's looking very strong -- especially after today’s touch and pull back. For the bears to be defeated and the bulls to take charge I would have to see a breakthrough on the current trend line and a push up to at least 1.3601. However, in the short term I am very much bearish on the EUR/USD cross.

It’s easy to see why, we have had a brief double bottom and now the market is starting to turn on the daily after a trend line touch, I expect to see further lows as the trend line looks to hold. Only a shockingly positive economic sentiment survey could sway the market, and the Germans are certainly not optimists.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.