Key Points:

- Bearish Pennant is nearing completion.

- H4 stochastics are overbought.

- BOE expected to cut interest 25bps this week.

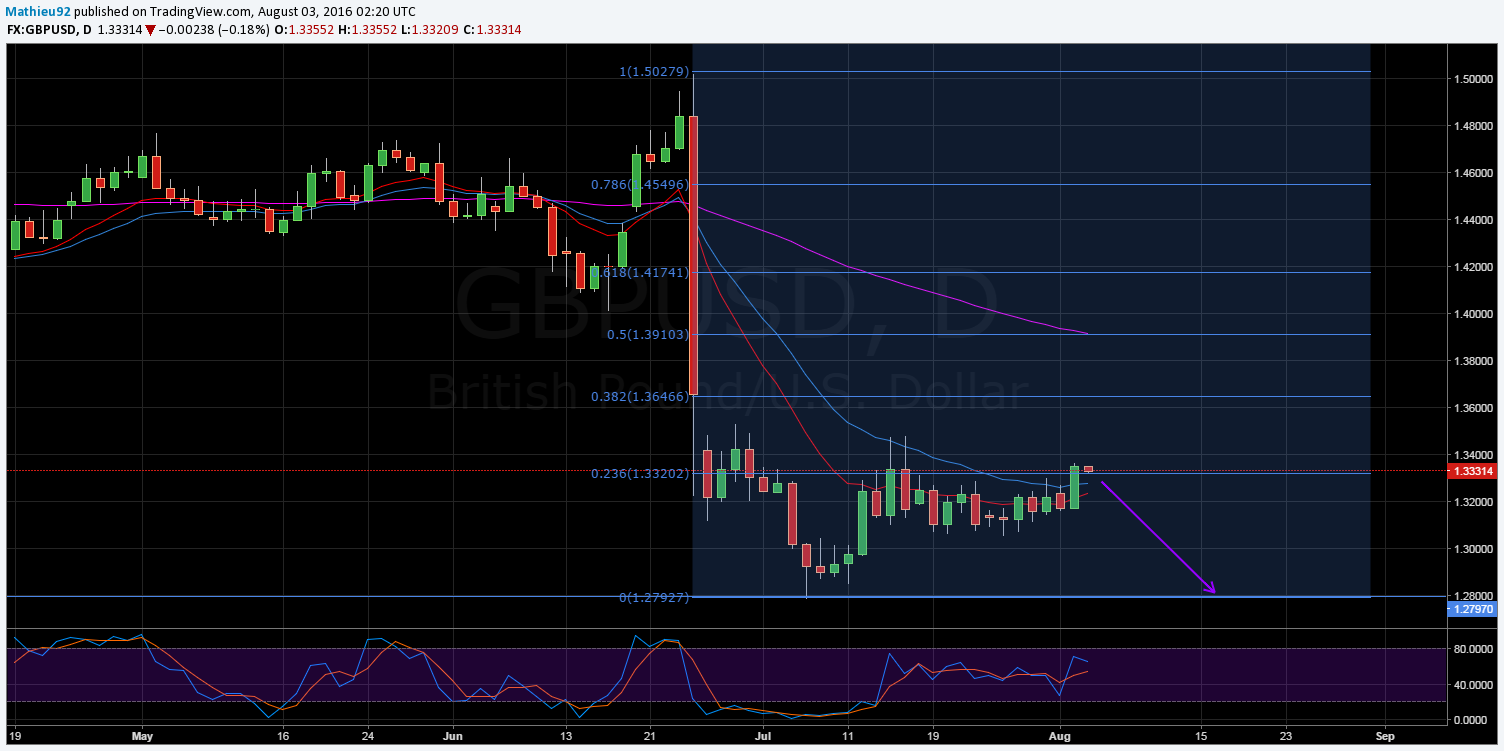

A recent move to the upside constraint of an emerging pennant formation has set the cable up for a potential breakout. Following the previous session’s rally, the GBPUSD has begun to decline and now challenges a pivotal support level. Eyes will now be on the pair as, if support is broken here, the Cable could move back to the lower constraint of the pennant or even stage a large rout and break free of the structure.

Taking a look at the H4 chart, it is now apparent that the cable is making a move away from the upside constraint after so recently failing to breach resistance. Furthermore, we can expect to see the pair remain in decline as it completes the consolidating pattern in full. This is mainly by virtue of an overbought stochastic reading which makes the chances of another surge in buying somewhat slim. Of course, this means the pound has little place to go but down in the near to medium term.

However, there is also building evidence that the pair’s decline may extend well beyond the downside constraint of the pennant formation. Specifically, the daily EMA activity still has a bearish bias which will continue to negatively impact the pair. Additionally, pennant structures such as this one typically result in a downside breakout upon completion. Also, a recent narrowing of the pair’s Bollinger bands could be a harbinger of an impending rout.

Much of this is all predicated on the Cable breaking its current support which is in place around the 1.3320 level. This level represents a convergence of multiple Fibonacci retracements, most notably, the 23.6% retracement shown on the above daily chart. As a result of the overlap in the Fibonacci levels, support at this level is likely to be highly robust. However, if it is broken, it could see a significant tumble eventuate.

Ultimately, after breaching support, the Cable should at least move back to the lower constraint before reversing at around the 1.3221 level. However, as discussed above, there could be much greater downside potential available in the event that the pennant finally breaks. This being said, keep an eye on this week’s US Non-Farm Employment Change results as they have the ability to delay the pattern’s completion or even upset it entirely. Likewise, watch out for any surprises from the BOE as they are announcing the Official Bank rate this week and, if they don’t follow through with a 25bp cut, it could send the pound soaring.