The Aussie dollar has been staging a fairly substantive rally over the past few weeks, even with the setbacks resulting from the UK European Union Membership Referendum. The resumption of the pair’s bullishness has now been met with some stiff resistance but, ultimately, the AUD could be set to climb back to the April high if a corrective ABC pattern completes.

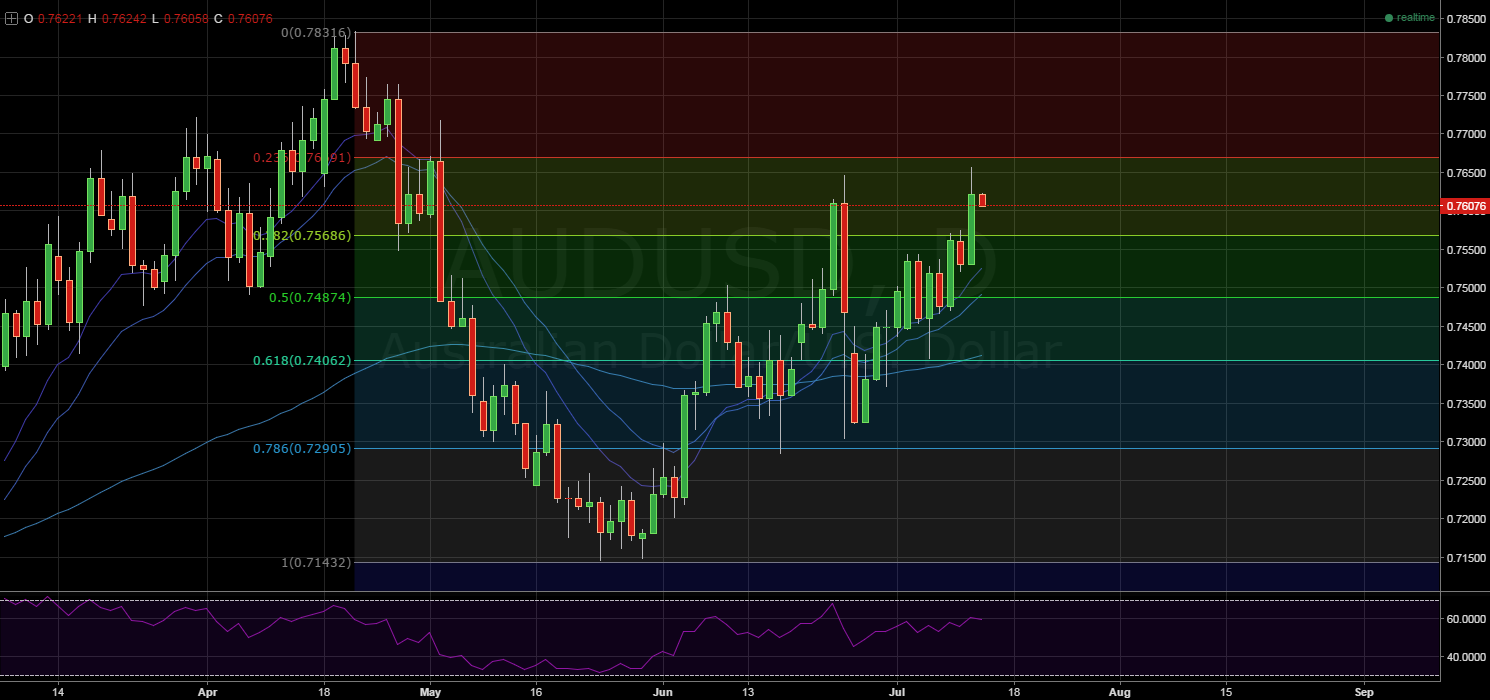

Firstly, Fibonacci retracements on the daily chart show that the pair is having some difficulty breaking back through the 23.6% retracement level. The zone of resistance that exists here has been tested on multiple occasions but April did see the 0.77 handle broken, if only for a matter of days.

However, despite the recent failure to push higher, a neutral RSI reading and some highly bullish EMA activity could see the level crumble in subsequent sessions.

Whilst not shown on the charts, the Parabolic SAR is also signalling that the AUD might be only beginning its bullish trend. Specifically, during the previous session, the indicator switched from a bearish to a bullish reading.

Consequently, the pair might now be poised to have another attempt at an upside breakout. This being said, the Aussie dollar might retreat back to support around the 50.0% Fibonacci level before attempting to surge higher once again.

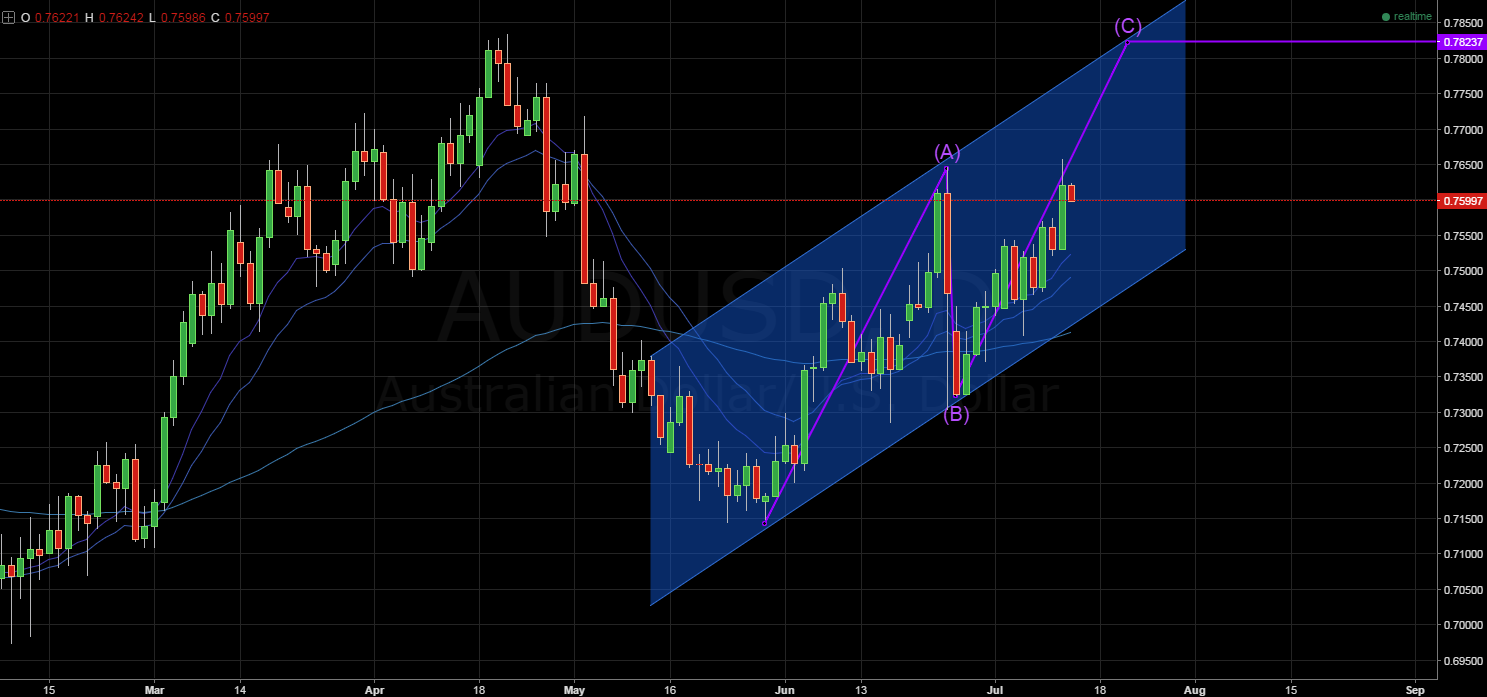

Any subsequent bullish manoeuvres will likely come in the form of a corrective ABC pattern, as shown in the above chart. Ending around the 0.7823 zone of resistance, the rally should remain constrained within the bullish channel which formed in mid-May. Consequently, resistance is likely to be unbroken at point C and a reversal will see the pair seek out support once more.

On the fundamental front, Australia has a number of influential indicator resultreleases due by week’s end. Notably, the Unemployment Rate is set to be posted on Thursday and is presently forecasted to have an uptick from 5.7% to 5.8%.

If the figure comes in on target, this could interrupt the ABC formation and prevent point C from being reached. However, if the rate shows no change, this could actually provide the requisite momentum to see the current zone of resistance broken.

Ultimately, the Aussie dollar has being making a solid effort to recover amid the ongoing market uncertainty in the wake of the UK referendum. Consequently, it comes as little surprise that a number of technical indicators are signalling that the pair could continue to reach towards the April high.

However, keep a close watch on the impending Australian Employment results as they could throw a spanner in the works and cap the AUD’s upside potential significantly.