Campbell Soup Company (NYSE:CPB) is scheduled to report second-quarter fiscal 2018 results on Feb 16, before the market opens.

Last quarter, the company delivered a positive earnings surprise of 3.4%. However, it pulled off a negative earnings surprise in three of the four trailing quarters, with an average miss of 3.7%.

What to Expect?

The question lingering in investors minds’ is that whether this consumer products company will be able to deliver a positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the quarter under review is pegged at 81 cents, reflecting a decline of 11% year over year. Earnings estimate for the current quarter has been stable in the last 30 days. Moreover, analysts polled by Zacks expect revenues of $2.17 billion, up about 0.14% from the year-ago quarter.

Campbell Soup has outperformed the industry in the past month, reflecting increased optimism on the stock ahead of the earnings release. The company’s shares have improved 0.4% against the industry’s decline of 4.6%. However, the stock has been showing a declining trend , 27.9% in the past year mainly due to a volatile operating environment and continued dismal performance at the company’s Campbell Fresh (C-Fresh) division.

Factors at Play

Campbell Soup is striving to revive its top line, which has not witnessed year-over-year growth for quite some time. Also, revenues have missed the consensus mark for four straight quarters now. The underperformance was due to a volatile operating environment along with intense competition and fast evolving retail landscape.

The volatile operating environment is characterized by a rapidly evolving retail sector and increased competition that has significantly weighed on the top line. Further, the bottom line remains strained by rise in cost inflation and higher carrot costs that have hurt the company’s Campbell Fresh (C-Fresh) division. Additionally, the increase in transportation and logistics costs owing to the recent hurricanes impacted earnings in the first quarter.

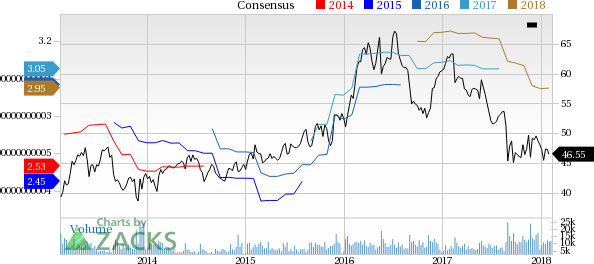

Given a tough operating environment, the company trimmed its earnings guidance for fiscal 2018 while sales growth forecast remains intact to range from negative 2% to flat. Adjusted earnings per share are now envisioned in the $2.95-$3.02 range, representing a decline of 1-3%. Earlier, the metric was expected to be $3.04-$3.11, reflecting growth range of flat to increase of 2%.

However, Campbell remains focused on getting its C-Fresh division back on growth track. Moreover, its focus on cost savings and core strategic imperatives are likely to drive growth in the long term.

What the Zacks Model Unveils?

Our proven model does not show that Campbell Soup Company is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Campbell Soup has an Earnings ESP of -0.41%. While the company’s Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings surprise.

Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat.

Service Corporation International (NYSE:SCI) has an Earnings ESP of +1.11% and a Zacks Rank #1.You can see the complete list of today’s Zacks #1 Rank stocks here.

Lamb Weston Holdings Inc. (NYSE:LW) has an Earnings ESP of +1.91% and a Zacks Rank #2.

US Foods Holding Corp. (NYSE:USFD) has an Earnings ESP of +1.18% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Campbell Soup Company (CPB): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

Service Corporation International (SCI): Free Stock Analysis Report

Original post

Zacks Investment Research