Prothena Corporation plc (NASDAQ:PRTA) is expected to report second-quarter 2017 results on Aug 1.

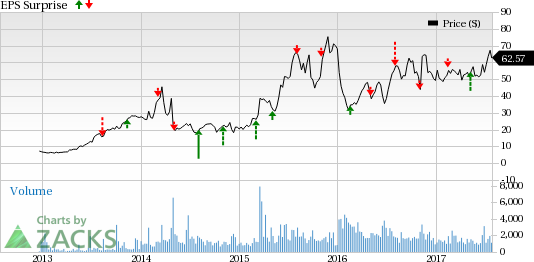

Last quarter, the company reported a narrower-than-expected loss resulting in a positive earnings surprise of 25.0%. Notably, Prothena’s track record has been dismal so far. The company reported a wider-than-expected loss in three of the trailing four quarters, with an average negative surprise of 5.93%.

Prothena’s share price increased 27.2% in the year so far, better than the industry’s gain of 12.0%.

Let's see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Prothena is likely to beat estimates this quarter because it has the right combination of two key ingredients.

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +37.26%. This is because the Most Accurate estimate is pegged at a loss of $0.64 while the Zacks Consensus Estimate is pegged at a loss of $1.02. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Prothena currently carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings estimates. The combination of Zacks Rank #3 and a positive ESP makes us confident of an earnings beat in the upcoming release.

Conversely, Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement especially when the company is seeing negative estimate revisions.

Pipeline Progress in Focus

Prothena’s top line primarily comprises collaboration revenues earned through its license, development and commercialization agreements. In fact, the company earns collaboration revenues mainly under its license agreement with Roche Holding (SIX:ROG) AG (OTC:RHHBY) for PRX002.

We believe, investor focus should remain on pipeline updates by the company as it has no approved product in its portfolio.

The company is evaluating its lead candidate NEOD001 in the phase III VITAL Amyloidosis study in newly diagnosed treatment-naïve patients with AL amyloidosis and cardiac dysfunction. Prothena is also evaluating the candidate in a phase IIb study, PRONTO, in previously treated patients with AL amyloidosis and persistent cardiac dysfunction. The company completed enrollment in this study and top-line results from the study are expected following the 12-month study period in second-quarter2018.

Moreover, Prothena is evaluating PRX002, in collaboration with Roche, for the treatment of Parkinson’s disease and other related synucleinopathies. The company initiated a phase II study, PASADENA, in patients suffering from Parkinson`s disease in second-quarter 2017.The initiation triggered a $30 million milestone from Roche to Prothena, which was earned in the quarter to be reported. Prothena had earlier obtained $45 million in upfront and development milestone payments.

Top-line data from a phase Ib multiple ascending dose, proof-of-biology study on PRX003 in patients with psoriasis is expected in third-quarter 2017.

Prothena is also working to advance PRX004 in a phase I study in patients with ATTR amyloidosis. The candidate is expected to enter clinic in 2018.

Concurrent with the first earnings call, Prothena updated its cash guidance to include the recent $150.3 million from the Mar 2017 public equity offering. The company expects net cash from operating and investing activities in the range of $160–$170 million. The company expects to end 2017 with approximately $375 million in cash, cash equivalents and restricted cash (midpoint).

Moving ahead, like any other development-stage biotechnology company, Prothena is likely to see an increase in research and development expenses due to higher spending on pipeline.

Stocks to Consider

Here are some other health care stocks that you may want to consider, as our model shows that they too have the right combination of elements to post an earnings beat this quarter.

Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) has an Earnings ESP of +9.39% and a Zacks Rank #3. The company is expected to release second-quarter results on Aug 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Impax Laboratories (NASDAQ:IPXL) has an Earnings ESP of 7.14% and a Zacks Rank #3. The company is expected to release second-quarter results on Aug 9.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Prothena Corporation PLC (PRTA): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Impax Laboratories, Inc. (IPXL): Free Stock Analysis Report

Original post

Zacks Investment Research