Nokia (HE:NOKIA) Corporation is nearing completion of its proposed tie-up with Alcatel Lucent SA (N:ALU). For the most part, the union between Nokia and Alcatel-Lucent (PA:ALUA) is as offensive as it is defensive.

Nokia is seeking to acquire Alcatel-Lucent to boost its telecom equipment business. As such, the company is both interested in defending its share in the telecom equipment market and taking share from the competition – primarily Huawei and Ericsson (ST:ERICAs) .

The combination of Nokia and Alcatel-Lucent is expected to result in a communications technology powerhouse with strengths in segments such as fixed networks, wireless networks, applications and analytics among others.

However, a recent development is threatening to complicate the picture for the combined Nokia. In what appears like a reaction to Nokia’s pending transformation, Cisco Systems, Inc. (NASDAQ:O:CSCO) recently announced collaboration with rival Ericsson. The two companies intend to work together in areas that include technology sharing and sales. The collaboration between Cisco and Ericsson is expected to yield $1 billion in additional revenues on both sides by 2018.

At the same time, Cisco seemed to predict chaos for the combined Nokia. Cisco’s executive chairman, John Chambers, appears to suggest that Nokia’s transformation through Alcatel-Lucent buyout will be a long and disruptive process devoid of value. Therefore, as Nokia tackles complex integration issues, Cisco and Ericsson are plotting to take its market share.

How can Nokia be promising positive transformation with the acquisition of Alcatel-Lucent when competitors have already taken notice of its weakness? Does it look like Nokia’s management is equal to the challenge ahead? Can the deal with Alcatel-Lucent tilt market equation in Nokia’s favor?

Nothing like chaos

First, it is important to note that Nokia Corporation (ADR) (NYSE:NOK) officials have already dismissed the notion that Nokia-Alcatel-Lucent is a recipe for chaos. Instead, Nokia sees its combined sales force driving displacement of Ericsson and diluting the value in its joint venture with Cisco. But there is more to the integrated Nokia.

Strong execution

Nokia Corporation (ADR) (NYSE:NOK)’s management has in the recent times demonstrated excellent strategy execution, especially on the operating efficiency front. That explains the steady improvements in the company’s margins. In the last quarter (3Q2015), Nokia Networks operating margins rose to 13.6%, exceeding the consensus estimate of 10.2%. Operating margins in the quarter improved 10bps YoY and 2% sequentially.

The management of Nokia remains confident that the ambitious annual operating margins target of 8% to 11% is attainable.

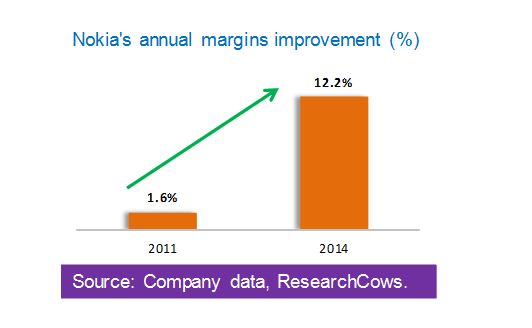

Impressive margins expansion in the last two quarters is only part of the story in Nokia’s efficiency drive. In the period between 2011 and 2014, the current management team was drove margins improvement at Nokia Networks to 12.2% from just about 1.6%.

The impressive turnaround happened at a time when the small Nokia Networks appeared to be disadvantageously positioned against larger rivals Ericsson and Huawei.

Not only did Nokia Networks defy tough conditions to expand margins, but the business also took share from rivals in key markets, a trend that should accelerated in the new dispensation.

Spreading efficiency gospel

Nokia Networks amazing margins improvement over a short period came on the back of incredibly lean R&D budget compared to rivals.

Given that Nokia has proven to be a master in cost cutting, it is only sensible to assume that the company will work to introduce the efficiency culture in Alcatel-Lucent.

It is interesting also that Nokia’s efficiency drive is set to meet Alcatel-Lucent’s SHIFT plan, which is also about cost cutting. Through its SHIFT plan, Alcatel-Lucent has been able to register impressive margins improvements in the last few years. For example, margins are estimated to 6.6% this year from negative -1.8% in 2012. Further margin expansion is expected under the SHIFT plan with the possibility of margin ascending to 15% in the next few years.

Therefore, Alcatel-Lucent is coming to improve profitability in the integrated Nokia. If the deal with Alcatel-Lucent closes in 1Q2016 as anticipated, Nokia targets to register €900 million cost synergies by 2018, amount that looks conservative given the cost benefit potential of the combined company.

Sales growth

Combining Nokia and Alcatel-Lucent is not only going to result in improvement in cost structure, but also drive sales growth as the combined entity takes market share from the competition. Ericsson is expected to take the heat as the new Nokia goes after its customers with more integrated solutions.

Besides the opportunity of pitching its own products and solutions alongside those of Alcatel-Lucent, Nokia is also set to benefit from a more vibrant R&D division. A more aggressive R&D department should contribute more innovation to drive product differentiation and accelerate market share gain and revenue growth.

Additionally a vibrant R&D should also drive more efficiency in the combined company, thus providing boost to the bottom-line as well as the topline.

Cash flow narrative

Continued cost curtailment and margins improvements should result in cash flow improvement in the integrated company. Nokia has been more aggressive than Alcatel-Lucent in driving strong cash flow growth, but Alcatel-Lucent’s SHIFT plan should ultimately give lift to cash flow figures.

Shareholder value

Nokia Corporation (ADR) (NYSE:NOK) has shown interest in returning cash to shareholders. It is not currently know what fraction of free cash flow the company intends to return to shareholders in its integrated format, but it is likely to be more than rival Ericsson returns to its shareholders.

Customers and markets

Nokia Corporation (ADR) (NYSE:NOK) sells its telecommunications equipment to China Mobile Ltd (N:CHL), Deutsche Telekom (DE:DTEGn) and other global carriers. Acquisition of Alcatel-Lucent should enhance the company’s penetration in the U.S., Chinese and Indian telecom markets to take advantage of carrier network upgrades. In the recent times, though, unfavorable economic conditions have seemed to soften spending on telecom equipment.

Conclusion

Nokia Corporation (ADR) (NYSE:NOK) has taken lessons from its past M&A transactions to ensure that integrating Alcatel-Lucent into its system becomes a smooth process. In that regard, Nokia has structure its marriage with Alcatel-Lucent as a takeover rather than a joint venture, a format that is expected to eliminate any potential integration hurdles or execution conflicts.

Disclaimer: The opinions and data expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisory capacity, nor is this an investment research report. The author’s opinions expressed herein address only select aspects of potential investment in securities of the company or companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.