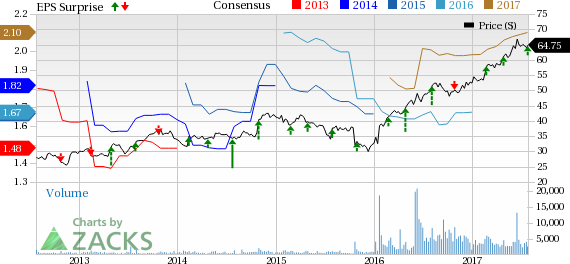

Mohawk Industries, Inc. (NYSE:MHK) is set to report second-quarter 2017 results on Jul 27.

Last quarter, the company delivered a positive earnings surprise of 0.4%. Meanwhile, it reported positive earnings surprises in all of the past four quarters, the average being 1.51%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Acquisitions are an important part of Mohawk Industries’ growth strategy which helps broaden its product portfolio and expand its geographic footprint and market share. The company had plans to finalize four acquisitions in the second quarter in order to expand its product offerings, geographic penetration and competitive position. The EPS guidance for the second quarter is at $3.53 to $3.62 (including acquisitions), which represents a 1.7% to 4.3% increase year over year. The Zacks Consensus Estimate for earnings is pegged at $3.61, reflecting a 3.9% year-over-year increase.

Apart from its inorganic drive, Mohawk Industries is introducing distinctive collections to boost sales. It is aggressively implementing productivity improvements and bringing new capacity online to support sales growth. Notably, for the second quarter, the Zacks Consensus Estimate for revenues is $2.46 billion, implying a 6.6% increase.

Moreover, Mohawk Industries is well poised to gain traction on the current positive housing scenario, as it has heavy exposure to the U.S. residential sector. Steady job and wage growth, a recovering economy, affordable interest/mortgage rates and rapidly increasing household formation hint at strong demand in 2017.

However, we are apprehensive about the persistent pressure from adverse foreign currency movement, since Mohawk Industries generates a significant amount of its revenues from outside the U.S.

Also, the rise in raw material costs has led Mohawk Industries to raise prices across its business, including a second increase for carpets (effective late May 2017), an increase for Ceramic (effective by the end of the second quarter), and a series of increases across Europe. The company expects raw materials cost to outweigh pricing in the second quarter.

Earnings Whispers

Our proven model does not conclusively show that Mohawk Industries will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP is 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $3.61. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hershey Company (NYSE:HSY) (The) Price and EPS Surprise

Zacks Rank: Mohawk Industries carries a Zacks Rank #2, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the Consumer Discretionary sector that can be considered as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Live Nation Entertainment, Inc. (NYSE:LYV) has an Earnings ESP of +31.25% and a Zacks Rank #3.

SeaWorld Entertainment, Inc. (NYSE:SEAS) has an Earnings ESP of +5.88% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wyndham Worldwide Corporation (NYSE:WYN) has an Earnings ESP of +1.33% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Wyndham Worldwide Corp (WYN): Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV): Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS): Free Stock Analysis Report

Mohawk Industries, Inc. (MHK): Free Stock Analysis Report

Original post

Zacks Investment Research