Masco Corporation (NYSE:MAS) is slated to release second-quarter 2017 numbers on Jul 27.

In the last reported quarter, the company delivered a positive surprise of 14.14%. Notably, the company surpassed the Zacks Consensus Estimate in two of the last four quarters, with an average earnings beat of 3.53%.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

Cost-saving initiatives have been driving the company’s margins over the past few quarters and are expected to drive results in the quarter under review as well. The initiatives include business consolidation, system implementation, plant and branch closures, improvement in the global supply chain and headcount reduction to generate annual savings through reduction of corporate expenses and simplification of organizational structure.

Increasing demand for repair and remodeling is driving strong sales growth. With the gradual improvement in the housing end market, there has been an increase in demand for new home construction and repair, remodeling products in all channels of distribution. This encouraging momentum is expected to continue.

However, adverse currency translations remain a headwind as about 21% of Masco’s sales are generated outside the U.S. As such, the company is subjected to adverse currency translation across the globe which may hurt Masco’s international sales in the soon-to-be reported quarter.

Notably, the company is expected to have exited certain low-margin builder direct businesses in the U.S. and select low-margin accounts in the U.K. Cabinet business in the second quarter, which will likely impact revenues by approximately $5 million.

Meanwhile, for the second quarter, the Zacks Consensus Estimate for earnings is pegged at 60 cents a share, reflecting an increase of 29.8% year over year, while the consensus for revenues is at $2.07 billion, implying 3.4% year-over-year growth.

Earnings Whispers

Our proven model does not conclusively show that Masco is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Masco has an Earnings ESP of 0.00%. That is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 60 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

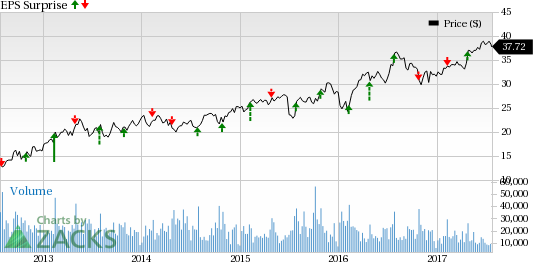

Masco Corporation Price and EPS Surprise

Zacks Rank: Masco has a Zacks Rank #2, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Please note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the broader construction sector that can be considered as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Owens Corning (NYSE:OC) has an Earnings ESP of +4.72% and a Zacks Rank #2. The company is slated to release its quarterly results on Jul 26.

Louisiana-Pacific Corporation (NYSE:LPX) has an Earnings ESP of +3.28% and a Zacks Rank #3. The company is scheduled to release its quarterly results on Aug 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

KBR, Inc. (NYSE:KBR) has an Earnings ESP of +2.04% and a Zacks Rank #3. The company is slated to release its quarterly results on Aug 2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Masco Corporation (MAS): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Original post