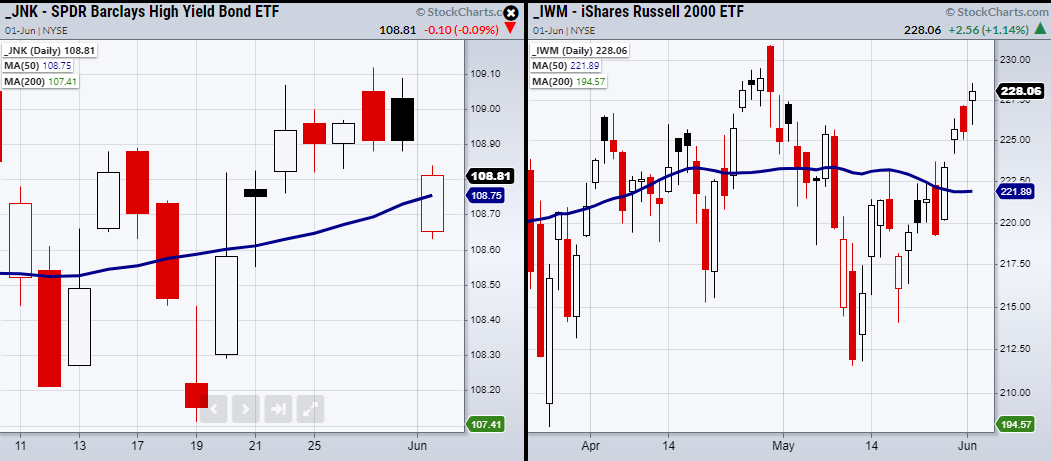

On Tuesday, the Russell 2000 (IWM) closed over its pivotal price area of $226.69 from Apr. 6.

Now it needs to hold over this price level as new support.

However, the other major indices including the S&P 500 (SPY), Dow Jones (DIA), closed almost unchanged from last Friday, while the NASDAQ 100 ({651|QQQ}}) ended down 0.31%.

Although they sold off from their morning gap-up, their ability to hold the current price area shows that the market has not given up its attempt to break to new highs.

Wednesday will be key as many outliers for instance the high yield bond ETF ({40651|JNK}}), 20+ Year treasury bonds (TLT), and the dollar (UUP) attempt to stabilize at their current levels.

Specifically, JNK which helps us determine investors’ appetite for risk, is sitting on the fence created by its 50-Day moving average at $108.76.

A sustained move under its MA would show market weakness and give caution as it will be a struggle for the market to reach new highs with JNK breaking lower.

Additionally, if the dollar breaks down, it will spark more inflation worries as this will only speed up an increase in food and energy prices throughout the year.

ETF Summary

S&P 500 (SPY) Resistance 422.82

Russell 2000 (IWM) 226.69 needs to hold as new support.

Dow (DIA) 351 highs to clear with 345 support area.

NASDAQ (QQQ) Next resistance 336.65 with 329.59 support.

KRE (Regional Banks) 68.23 support. 71.82 resistance.

SMH (Semiconductors) 242.50 support.

IYT (Transportation) 278.85 next resistance.

IBB (Biotechnology) 151 pivotal area.

XRT (Retail) 96.16 resistance.

Volatility Index ({{1061957|VXX})) Cleared over Fridays highs and held.

Junk Bonds (JNK) 108.76 support area from the 50-DMA.

XLU (Utilities) Failed the 50-DMA at 65.35.

SLV (Silver) 26.43 new resistance.

VBK (Small Cap Growth ETF) Flirting with the 50-DMA at 276.65.

UGA (US Gas Fund) Needs to hold over 34.75 area.

TLT (iShares 20+ Year Treasuries) Watching to hold over 138.01

USD (Dollar) 89.54 support.

MJ (Alternative Harvest ETF) Failed to confirm a bullish phase with second close over the 50-DMA at 21.24.

LIT (Lithium) 69.75 next level to clear.

XOP (Oil and Gas Exploration) 92.24 now support.

DBA (Agriculture) doji day.

GLD (Gold Trust) Minor support the 10-DMA at 176.81