Intuitive Surgical (NASDAQ:ISRG) Health Care - Health Care Equipment & Supplies | Reports April 19, After Market Closes

Key Takeaways

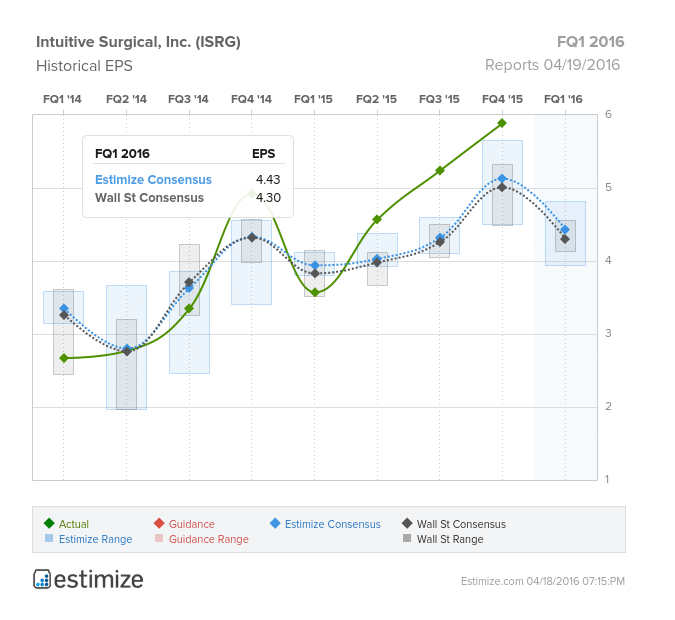

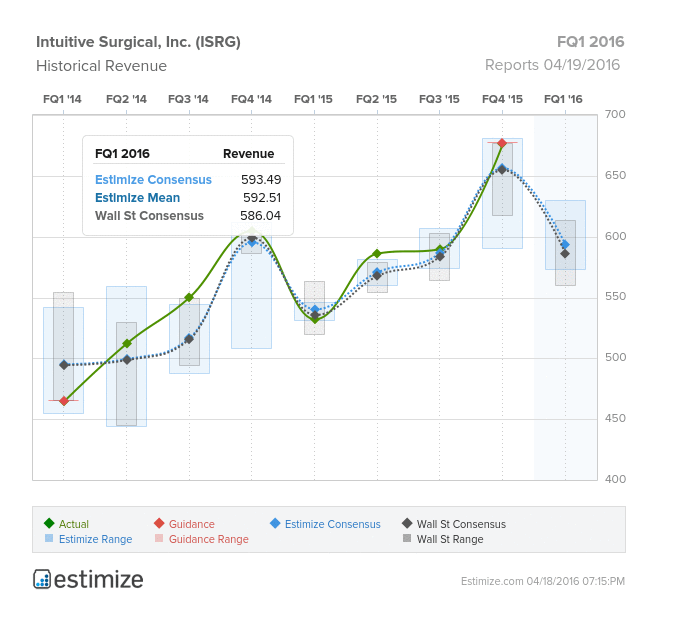

- The Estimize community is calling for EPS of $4.41 on revenue expectations of 592.51, 11 cents higher than Wall Street on the bottom line and $6.5 million higher on the top

- Intuitive Surgical’s robust growth the past year comes from the success of its surgical systems, particularly the da Vinci

- The surgical robotics company makes its biggest margins on accessories for its systems

- What are you expecting for ISRG?

The past year has been extremely volatile for healthcare and biotech companies. In fact, the Vanguard Health Care (NYSE:VHT) ETF, which tracks many of these stocks, is down 7.49% in the past 12 months. This hasn’t been the case for Intuitive Surgical, which has moved in the exact opposite direction. Over the same period, the stock is up 15.72% primarily due to the success of its flagship product, the da Vinci surgical system. Earnings have followed suit and have topped expectations in each of the past 3 quarters.

This quarter, the Estimize community is calling for EPS of $4.41 on revenue expectations of 592.51 million, 11 cents higher than Wall Street on the bottom line and $6.5 million higher on the top. However our Select Consensus, a weighted average of our most accurate analysts and recent estimates, is calling for a larger beat of 13 cents and $7.5 million. This margin has expanded in past three months with EPS revisions increasing 4%. If all goes as expected, profitability will grow 23% on a 12% increase in revenue, year over year.

Intuitive Surgical’s robust growth the past year comes from the success of its surgical systems , particularly the da Vinci. In Q4 2015, the number of procedures performed with a da VInci system increased 15%. Procedures volume should continue to see these gains with expectations of increasing by 10% this year. The biggest slight against these systems have been their astronomical price tag, which could hamper sales in the near future. However, Intuitive makes its biggest margins from new accessories such as the Xi Vessel Sealer, Xi Firefly and Xi Stapler. System wide sales are expected to be carried by new accessories and have been forecasted to rise 9.6%. If Intuitive Surgical is able to successfully capitalize on widespread adoption, and global expansion, then sky’s the limit for earnings potential.

Do you think ISRG can beat estimates?