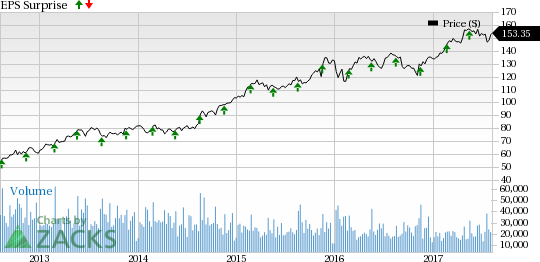

The Home Depot, Inc. (NYSE:HD) is slated to release second-quarter fiscal 2017 results on Aug 15. The question lingering in investors’ minds is whether this home improvement retailer will be able to deliver a positive earnings surprise in the quarter to be reported. The company has a spectacular positive earnings surprise record of over four years now. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the quarter under review is pegged at $2.21, reflecting year-over-year growth of over 12%. We noted that our earnings estimate has remained stable over the last 30 days. Further, analysts polled by Zacks expect revenues of $27.8 billion, up about 4.9% from the year-ago quarter.

Factors at Play

Home Depot’s splendid past performance reflects its focus on solid strategic initiatives. The company remains keen on building its interconnected capabilities, in response to the evolving retail environment – where digital and physical stores go hand in hand. In this direction, the company has made great strides in the past, by redesigning its website with enhanced features. Further, Home Depot’s interconnected strategy goes beyond the dot.com as it continues to invest in fulfillment options to meet customers demand through launches like customer order management system (COM) and the Buy Online Deliver From Store (BODFS) capability. Well, Home Depot continues to reap benefits from these initiatives, as evident from online sales growth of nearly 23% in first-quarter fiscal 2017. Also, we believe that these efforts are likely to drive the company’s top and bottom lines in future. Apart from this, Home Depot is also gaining from housing market recovery and favorable customer demand.

All these factors, which had encouraged management to raise its earnings view for fiscal 2017, also usher in confidence about the company’s upcoming release. However, intense competition remains a threat. Also, significant exposure to international markets makes Home Depot vulnerable to currency headwinds. Nonetheless, we note that shares of Home Depot have gained about 2.5% over the last six trading sessions, which clearly underscores investors’ positive sentiment in the company. Moreover, Home Depot’s shares have jumped 14.3% so far this year outperforming the industry’s 11.3% growth. Well, it looks like Home Depot is most likely to maintain its robust trend this time too.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Home Depot is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Home Depot currently carries a Zacks Rank #2, which increases the predictive power of ESP. However, the company has an Earnings ESP of 0.00% as both, the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $2.21. The combination of Home Depot’s Zacks Rank #2 and ESP of 0.00% makes surprise prediction difficult.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Gap Inc. (NYSE:GPS) has an Earnings ESP of +3.85% and a Zacks Rank #2.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Original post

Zacks Investment Research