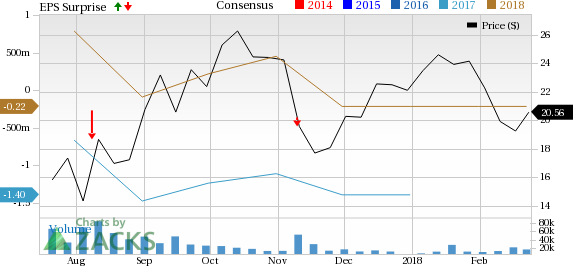

Hertz Global Holdings, Inc. (NYSE:HTZ) is scheduled to release fourth-quarter 2017 results on Feb 27. Last quarter, the company delivered a negative earnings surprise of 3.4%.

In fact, Hertz missed the Zacks Consensus Estimates in each of the trailing four quarters, with an average negative surprise of 130.2%. Let’s see how things are shaping up prior to this announcement.

What to Expect

The question lingering in investors’ minds now is whether Hertz will be able to post positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the quarter under review is a loss of 58 cents per share, which reflects an improvement from a loss of 71 cents per share in the year-ago quarter.

We note that the Zacks Consensus Estimate for the fourth quarter has been stable in the last 30 days. Analysts polled by Zacks expect revenues of $2.04 billion, up 1.4% from the year-ago quarter.

Furthermore, we note that the stock has outperformed the broader industry in the last three months. The company’s shares have surged 13.7% compared with the industry’s growth of 6.4%.

Factors at Play

While Hertz’s performance remained disappointing in the last few quarters, the company remains on track with the execution of its turnaround plan that is focused on growth through enhanced fleet, service, brands and technology. In the most recent quarter, the company gained from persistent enhancement of fleet offerings, expansion of the Ultimate Choice program and a strategic focus on optimizing revenue management. The company remains dedicated to positioning Hertz as a leader in the global rental car market by strengthening the business to drive predictable and sustainable long-term growth.

However, the company believes, there is a lot of work left before it fully turns around its results. Moreover, structural issues with the car rental model remain a concern. The company describes the fourth quarter as a period of seasonally lower demand. At the same time, the company remains keen on continuing its investments for long-term growth. This suggests that expenses will be higher throughout 2018. These factors make us slightly cautious about the upcoming results.

What the Zacks Model Unveils

Our proven model does not conclusively show that Hertz is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hertz has an Earnings ESP of 0.00% and a Zacks Rank #3. While the Zacks Rank increases the predictive power of ESP, an Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Air Lease Corp. (NYSE:AL) has an Earnings ESP of +0.46% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

FedEx Corp. (NYSE:FDX) currently has an Earnings ESP of +2.03% and a Zacks Rank #2.

Diana Shipping, Inc. (NYSE:DSX) currently has an Earnings ESP of +4.76% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Air Lease Corporation (AL): Free Stock Analysis Report

Diana Shipping inc. (DSX): Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ): Free Stock Analysis Report

FedEx Corporation (FDX): Free Stock Analysis Report

Original post

Zacks Investment Research