Herbalife Ltd. (NYSE:HLF) is scheduled to report second-quarter 2017 results on Aug 1, after the market closes.

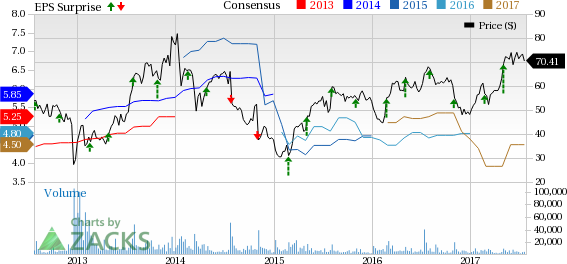

The question lingering in investors’ minds is, whether this leading nutrition company will be able to maintain its positive earnings streak in the to-be-reported quarter. Notably, its earnings have outpaced the Zacks Consensus Estimate in 10 straight quarters now, with a trailing four-quarter average of 18.4%.

Let’s see how things are shaping up for this announcement.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show earnings beat for Herbalife this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Herbalife has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.10. Although the company’s Zacks Rank #3 increases the predictive power of ESP but we need a positive Earnings ESP in order to be confident about an earnings surprise.

Estimate Revisions

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate of $1.10 and $4.50 for the second quarter and 2017 has remained stable in the last 30 days and this reflects a year-over-year decline of 14.7% and 7.2%, respectively.

Furthermore, analysts polled by Zacks expect revenues of $1.14 billion for the second quarter, down 5% from the year-ago period. However, revenues of $4.59 billion are anticipated for the full year, which is up 2.2% from 2016.

Factors at Play

Herbalife has recently come under the scanner after some law firms like Faruqi & Faruqi, LLP and Lundin Law PC declared investigation related to possible violations of federal securities laws against the company. It should also be noted that on Jun 4, this California-based company, slashed its sales guidance, which was raised during first-quarter 2017 conference call. This was due to the new tougher Federal Trade Commission rules in the U.S. that are expected to hurt company’s business more than anticipated. Also, softness in its Mexico operations and distributors adopting the latest protocols are expected to dent sales in the to-be-reported quarter.

The company now expects sales to decline in the range of 2–6% from 0.5–4.5%, guided earlier. Also, volumes are anticipated to decrease 4–8% compared with previous range of 1–5% for the second quarter. Management too expects the quarter to be a challenging one in 2017 compared with the year-ago quarter. Currency is also likely to hurt its results.

Notably, Herbalife has been battling with billionaire investor Bill Ackman since Dec 2012, when Ackman made a $1 billion bet against the nutrition company, accusing it of being a pyramid scheme i.e. it employs deceptive marketing practices for improving business. Also, it received a civil investigative demand in 2014 from the FTC related to its marketing practices.

Though the company resolved the probe with the FTC and paid $200 million through fines and settlements without being named a pyramid scheme, it was forced to prove that 80% of its annual sales come from documented consumer purchases. Interestingly, the company outpaced the key threshold of 80% under its agreement with the U.S. Federal Trade Commission. It announced that 90% of the U.S. sales in May were documented purchases, which consisted of over three million receipted retail transactions.

In fact, Herbalife has remained upbeat about its prospects, which is evitable in its impressive earnings history and stock price performance. Shares of Herbalife have surged 41.3% on a year-to-date basis against its industry’s decline of 5.9%. Also, the stock has outperformed the broader Retail-Wholesale sector that has gained 17.1%.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

Yum! Brands, Inc. (NYSE:YUM) has an Earnings ESP of +1.64% and a Zacks Rank #3.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Herbalife LTD. (HLF): Free Stock Analysis Report

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Original post