Fossil Group, Inc. (NASDAQ:FOSL) is slated to report second-quarter 2017 results on Aug 8, after market closes. The question lingering in investors’ minds is whether this designer and manufacturer of clothing and accessories will be able to deliver a positive earnings surprise in the to-be-reported quarter. The company has an average earnings surprise of 4.8% over the trailing four quarters. However, it reported a negative surprise of 66.7% in its first-quarter results this year.

Let’s delve deeper how things are shaping up for this announcement.

What Does the Zacks Model Unveil?

Our proven model does not show that Fossil is likely to beat estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Fossil has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 28 cents. The company carries a Zacks Rank #2, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

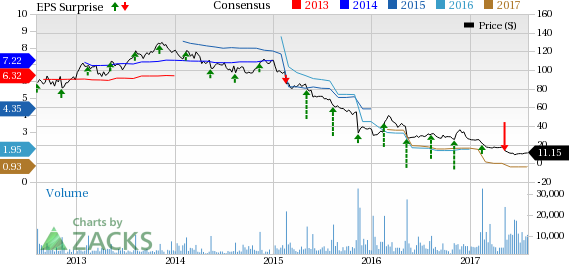

Fossil Group, Inc. Price, Consensus and EPS Surprise

Which Way are Estimates Treading?

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the second quarter has been stable over the last 30 days while the same for 2017 has increased by 3 cents.

We note that the current Zacks Consensus Estimate of a loss of 28 cents depicts a massive decline from the earnings of 12 cents reported in the prior-year quarter. The company projects adjusted loss in the band of 23–40 cents per share for the to-be-reported quarter. Further estimated earnings of 93 cents for fiscal 2017 depict a decline of 11 cents from the year-ago period.

Analysts polled by Zacks expect revenues of $619.5 million for the said quarter, down 9.6% from the year-ago quarter. Also, revenues for 2017 are projected to decline 4.6% to $2.9 billion.

Factors Influencing the Quarter

Fossil has been witnessing decline in its multi-brand licensed watch portfolio, majorly due to two factors. First, tech-enabled watches are significantly impacting the sales of traditional watches. Second, the success of the Michael Kors brand is overshadowing other brands’ performance. Moreover, in Jan 2016, Burberry announced that it is exiting the watch business and does not intend to renew its license agreement upon its expiration at the end of 2017. Further, sales of leathers have persistently been weak as customer response to the assortment continues to put pressure on results. Decline in traditional watches and weak leather business also hurt sales in the Americas, Europe and Asia regions during the first quarter of fiscal 2017.

In the U.S., the company is witnessing sluggish comps since the past few quarters due to weak traffic. In addition, Fossil has been witnessing lower margins in the retail channel, primarily due to increased promotions to drive sales and unfavorable currency fluctuations. As a result of such headwinds, sales have missed the Zacks Consensus Estimate in eight out of the last 10 straight quarters.

The headwinds are also well reflected in the share price performance of the company. While the stock has plunged 56.5% over the past six months, the industry declined 19.5%.

Nevertheless, Fossil has been exploring the potentials of wearable technology, owing to its rising demand. In fact, wearable represented 7% of the first-quarter 2017 sales across product categories amongst which over 75% of the sales came from smart watches. In this context, innovations and product launches undertaken by Fossil for the Skagen brand is expected to provide an increased digital presence along with solid returns on investment. The company also continues to focus on a restructuring program named New World Fossil, which aims at improving the financial performance of the Fossil brand and build an improved operating platform to drive long-term shareholder value.

Though Fossil’s connected wearables and smart watches are expected to gain momentum, the Watches category is likely to remain sluggish due to general weakness therein.

Do Retail Stocks Catch your Attention? Check These

Investors may also consider other stocks from the same segment such as Build-A-Bear Workshop, Inc. (NYSE:BBW) , Big Lots, Inc. (NYSE:BIG) and Burlington Stores, Inc. (NYSE:BURL) , all carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop has an average positive earnings surprise of 73.7% over the past four quarters. It has a long-term earnings growth rate of 22.5%.

Big Lots has an average positive earnings surprise of 83.1% over the past four quarters. It has a long-term earnings growth rate of 13.5%.

Burlington Stores has an average positive earnings surprise of 22.6% over the past four quarters. It has a long-term earnings growth rate of 15.9%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Fossil Group, Inc. (FOSL): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Original post

Zacks Investment Research