Is it a fad slated to fade or a needed wakeup call?

For the past four to five years, Environmental, Social and Governance performance has dominated the investment conversation. Partly as a result of very real climate and socio-economic issues and partly due to generational shifts in values coupled with industry players embracing a "feel-good" marketing scheme to attract investor interest, ESG really found its footing over the past few years. But the narrative has begun to unravel a bit as the realities of actually determining what is and isn' t ESG are coming to light. Will ESG fade into a passing fad we all recall years down the road the way we do with the internet bubble in the late 90' s, or will it regain its footing and credibility?

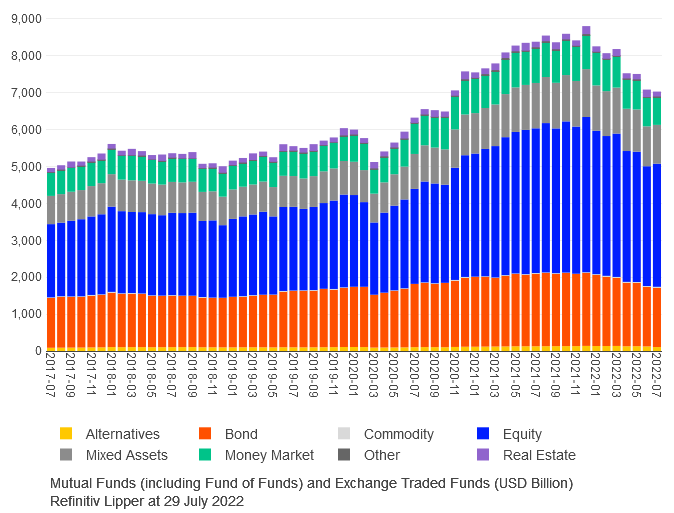

The momentum in ESG was already building as we entered into the global pandemic but seemed to ramp up even more as investors reflected on their world from the confines of their homes during lockdowns. Perhaps spending more time paying attention to the news and seeing the very real impacts of climate change as well as issues of social inequality took hold and the need to express their values in their investments became more prominent. Assets under management and fund flows in responsible investment themed funds rose to record levels by late 2021.

Global Asset Under Management in Responsible Investment Funds

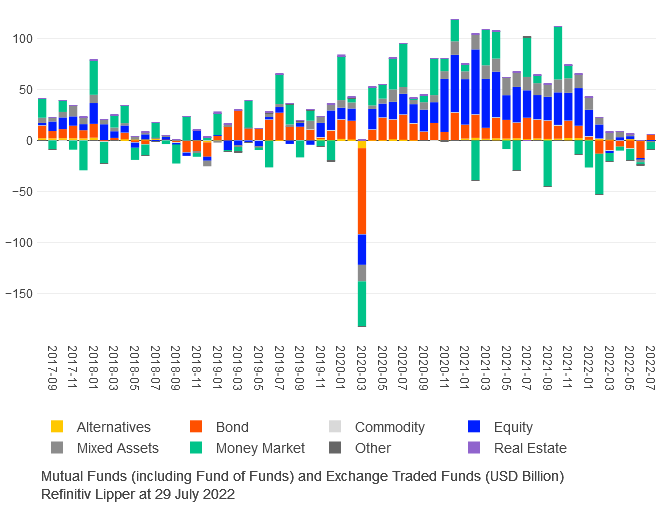

Public figures such as Elon Musk, CEO of Tesla (NASDAQ:TSLA), and former Vice President Mike Pence began making very public statements calling out the failings of ESG. Well respected research began to surface such as MIT' s "Aggregate Confusion Project" that applied data and science to the debate and highlighted just how immature the ESG movement still is and, by extension, how questionable ESG investing and investment products are in their current state. All these factors helped change the momentum of flows dramatically.

Global Fund Flows into Responsible Investment Funds

It' s important to note that the general market malaise that has taken place in the first half of 2022 also impacted flows and AUM, but it' s undeniable that ESG' s reputation has been tarnished. But will it rebound and regain its footing? There are several factors that point to ESG having staying power despite its current missteps and, in fact, it' s arguable that these public callouts are healthy in helping raise awareness to the needs for better and more standardized data disclosures and more thoughtful and forward-looking ratings and scores for companies.

First and foremost is the regulatory momentum taking place across the major developed investing markets. In the EU, substantial steps are being put in motion to put usable frameworks in place to categorize a company' s ESG footprint and to incorporate these designations into the investment advisory process via the SFDR (Sustainable Finance Disclosure Regulations) and EET (European ESG Template) directives. The UK and US are following suit with similarly detailed regulatory proposals in the works that collectively raise the bar for both disclosures by companies as well as assessments used in the investment advisory and fund selection processes. Companies will have no choice but to get onsides with these regulatory efforts which will inherently drive more transparency and standardization at the industry level. This will help solve perhaps the biggest complaint – that ESG company scores are inconsistent from provider to provider and serve to confuse the investing public. These same regulators are also calling companies out for nefarious claims and bringing about real consequences for obvious greenwashing.

Equally important and along the same lines of highly visible and coordinated efforts are the pledges that companies are making via initiatives such as the PRI (Principles for Responsible Investment) and GFANZ (Glasgow Financial Alliance for Net Zero) to lessen, neutralize and eventually eliminate their carbon footprints. Target setting among the major companies in carbon intensive industries such as energy, transportation and construction has stepped up dramatically over the past three years. Many of these companies have widely publicized their "net zero" targets which will make it incumbent upon them to figure out how to actually do it. Again, this will drive common best practices to start to emerge which will bring even more focus to the metrics and disclosures needed for investors and ratings providers to track.

It’s also worth noting that ESG is generally good for business. Products with true ESG oriented benefits tend to enjoy premium pricing (consider the cost of an electric vehicle compared to a traditional combustion engine). Its also the case that the cost of capital will inherently benefit companies with positive ESG profiles. As investors flock to invest in these companies, their ability to get preferred equity and debt financing for their businesses will become an enticing benefit to go green.

Finally, there is a generational shift in investor preferences taking place that will drive investment mandates and product offerings at both the institutional and retail levels. A recent study of the wealth industry by Refinitiv noted that 71% of investors are either more willing or much more willing to consider ESG investing just over the past 12 months. This includes both advisor-led investors as well as self-directed investors. Additionally, there is currently a shift taking place in some $30 trillion in asset ownership in the coming years as baby boomer wealth increasingly moves toward the longer living female spouse in the relationship as well as to the millennial and Gen Z children via inheritance. Both of these demographic groups have a higher propensity toward directing their investments in alignment with their values, so the demand will continue to grow. For all of these reasons, some 85% of asset managers polled in a recent Index Industry Association survey claim that ESG has become a priority in their investment strategies and product offerings.

So, one can reasonably argue that what we' re witnessing isn' t the beginning of the end but rather a calling out of ESG for very real shortcomings that will lead to a needed maturing and focusing on the material issues and underlying performance metrics. This can only be viewed as healthy and needed in order to help the ESG disclosure and investing analytics to align and standardize and effectively raise the transparency and accuracy of transition metrics and company ratings. It won' t happen overnight and indeed this is likely the beginning of a years-long journey, but it will result in a steady improvement in providing more clarity and better information for investors to make decisions about ESG that align with their personal values.