Emerson Electric Co. (NYSE:EMR) sweetened its earlier bid forautomation products manufacturer Rockwell Automation Inc. (NYSE:ROK) , in an effort to bring its hesitant rival to the negotiating table and form a new giant in industrial automation.

Yesterday, Emerson wrote to Rockwell Automation, proposing a takeover at $225 per share, with 60% in cash and 40% in stock, for a total consideration of about $29 billion. The price represents a premium of 19% to Rockwell Automation’s closing stock price of $188.73 on Wednesday.

The latest bid follows Rockwell Automation's repeated rejections of Emerson's overtures for much of this year. In late October, we came to know that Rockwell Automation had already rejected two offers from Emerson, including a $215 per share, $27.6 billion takeover offer made in the same month.

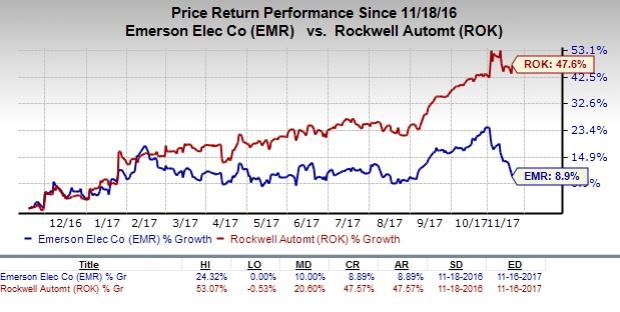

Rockwell Automation’s stock price has raced much ahead of Emerson in the past year. While Emerson has risen 8.9%, Rockwell Automation shares have soared a whopping 47.6% during the same time frame.

Responding to the offer, Rockwell Automation said it would review the unsolicited proposal with its financial and legal advisers, and then determine the course of action which is in the best interest of the company and its shareholders.

Emerson believes there is undeniable strategic, operational and financial merit to the merger, and it would benefit customers, employees and shareholders alike.

Emerson's strength lies in process automation — enabling power plants and factories in mining, cement and other such sectors operate more efficiently. Rockwell Automation is a prominent player in the so-called discrete automation — helping assemble component parts to manufacture products like household appliances, automobiles and computer systems.

Doubtlessly, an Emerson and Rockwell Automation merger would create a leader in the $200-billion global automation market.

Emerson believes the deal will create $6 billion in capitalized synergies, of which about a third would come from sales synergies. Sales synergies would include more comprehensive in-house product offering, an increased win rate in large projects and complementary products for cross-selling opportunities and channel pull through.

The rest would represent cost synergies, including corporate and public company costs, materials costs, administrative and channel efficiencies, manufacturing optimization, and more effective R&D and engineering costs spread across a broader base.

Emerson also stated that the deal would create $8 billion of total value ($62 per share) for Rockwell Automation shareholders.

Rockwell Automation had earlier insisted that it was better off alone, with its booming Logix product that offers customers a single software platform to build on, instead of learning multiple ones which Emerson offers. The company thinks that the common platform is vital to its commercial success and integrating it with Emerson's multiple offerings could be costly and create customer disruptions. Also, the company had great confidence in its strategic direction and ability to continue delivering superior levels of growth and value creation.

Some analysts see definite value in the deal, however, and the latest bid would surely be difficult for Rockwell Automation to reject outright.

Both Emerson and Rockwell Automation currently carry a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the broader space include Terex Corporation (NYSE:TEX) and Caterpillar, Inc. (NYSE:CAT) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Terex generated four outstanding beats over the trailing four quarters, for an outstanding average positive surprise of 135.9%.

Caterpillar has a striking earnings surprise history for the same time frame, having beaten estimates all through for an average beat of 53.1%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Emerson Electric Company (EMR): Free Stock Analysis Report

Original post

Zacks Investment Research