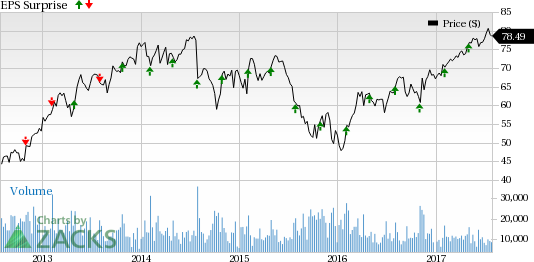

Eaton Corporation (NYSE:ETN) is slated to report second-quarter 2017 financial results before the market opens on Aug 1. The power management company reported a positive earnings surprise in three out of the last four quarters, resulting in an average surprise of 3.26%.

Why a Likely Positive Surprise?

Our proven model shows that Eaton Corporation is likely to beat estimates because it has the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) to be able to beat estimates and Eaton Corporation has the right mix.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The company’s Earnings ESP is +1.72%. This is because the Most Accurate estimate is pegged at $1.18, higher than the Zacks Consensus Estimate of $1.16. This is a meaningful and leading indicator of a likely positive surprise.

Zacks Rank: Eaton currently carries a Zacks Rank #2. The combination of Eaton’s favorable Zacks Rank and positive ESP makes us reasonably confident of a positive surprise this season.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Factors to Consider

Eaton expects its earnings per share to be between $1.05 and $1.15 in second-quarter 2017. Segment margins are expected in the range of 15.2–15.6%, including restructuring costs.

To cope with the challenging environment, the company had planned a restructuring program. Eaton will continue the program and reap its benefits in the second quarter and throughout 2017.

Eaton continues to invest in research and development (R&D) activities to churn out new products and upgrade the existing ones to facilitate effective and easy power management. In addition, the improvement in its end market will result in organic growth and boost earnings.

However, foreign exchange is expected to have a negative impact on earnings in the second quarter.

Other Stocks to Consider

Apart from Eaton Corporation, one can consider a few other companies from the Sector that have the right combination of elements to post an earnings beat this quarter.

Deere & Company (NYSE:DE) has an Earnings ESP of +5.32% and a Zacks Rank #1. It is expected to report third-quarter fiscal 2017 earnings on Aug 18. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ball Corporation (NYSE:BLL) has an Earnings ESP of +1.82% and a Zacks Rank #3. It is expected to report second-quarter earnings on Aug 3.

MRC Global Inc. (NYSE:MRC) has an Earnings ESP of +66.67% and a Zacks Rank #3. It is expected to report first-quarter earnings on Aug 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ball Corporation (BLL): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Eaton Corporation, PLC (ETN): Free Stock Analysis Report

MRC Global Inc. (MRC): Free Stock Analysis Report

Original post

Zacks Investment Research