The producer of agricultural and forestry equipment, construction equipment and engines, Deere & Company (NYSE:DE) , is set to release third-quarter fiscal 2017 results on Aug 18, before the market opens.

The company’s financial performance for the last four quarters has been impressive, recording better-than-expected results in each. Average earnings surprise was a positive 70.41%.

Notably, in the last quarter, the company’s earnings of $2.49 per share significantly beat the Zacks Consensus Estimate by a whopping 46.47%.

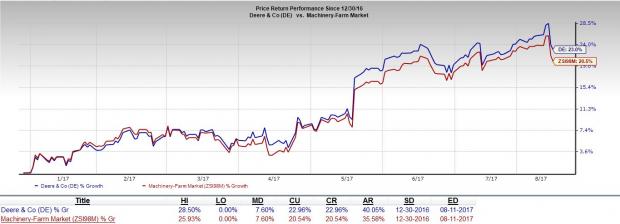

We believe that constant focus on strategic acquisitions, infrastructure improvements and growth opportunities have lifted investors’ sentiments for Deere. Year to date, the company’s shares have yielded 22.96% return, outperforming 20.54% growth recorded by the industry it belongs to.

Let us see whether Deere will be able to maintain its earnings streak this quarter.

Why a Likely Positive Surprise?

Our proven model shows that Deere is likely to beat estimates in the fiscal third quarter. This is because the company has the combination of two key ingredients for a possible earnings beat – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Deere has an ESP of +3.18%, with the Most Accurate estimate of $1.95 exceeding the Zacks Consensus Estimate of $1.89.

Zacks Rank: The company’s favorable Zacks Rank #2 increases the predictive power of ESP. Moreover, its positive ESP makes us reasonably confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

What’s Driving the Better-than-Expected Earnings?

Deere projects equipment sales to rise about 18% in the fiscal third quarter compared with the year-ago period. Foreign-currency rates are not expected to have a material translation impact on equipment sales for this fiscal or the third quarter. Net sales for the fiscal third quarter are estimated to be up about 18% compared with fiscal 2016.

Additionally, Deere is anticipated to gain from the recovering dairy market and improvement in Brazil. Its disciplined cost management and a broad product portfolio also remain tailwinds.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as according to our model they have the right combination of elements to post an earnings beat this quarter.

Altra Industrial Motion Corp. (NASDAQ:AIMC) , with an Earnings ESP of +2.17% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks, Inc. (NYSE:ANET) , with an Earnings ESP of +3.03% and a Zacks Rank #1.

Aspen Aerogels, Inc. (NYSE:ASPN) , with an Earnings ESP of +6.67% and a Zacks Rank #2.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Aspen Aerogels, Inc. (ASPN): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research