Yesterday’s wave of PMI data in the Eurozone further highlighted the divergence between the fiscally prudent countries in the region and the struggling members. German manufacturing PMI rose 2.6 points to 47.3 in September, while purchasing managers on average reported an expansion in services for the first time since June. This contrasts to France where PMI data showed manufacturing output fell sharply, with the index declining to 42.6 in September from 46 points, and well below the 46.4 forecast by analysts. PMI data for France’s service sector was equally poor. The readings play into the hands of skeptics of the European Central Bank’s bond-buying plan. While equity markets have rallied and bond yields eased in the recent weeks, the effects are unlikely to provide any real support to the southern economies, which continue to suffer from a deeper structural problems.

We have a slow day ahead on the data front. Canadian CPI data is due out this afternoon. There are also rumours that Xstrata and Glencore may finalise their merger today, while the American Petroleum Institute Monthly report will show whether domestic demand in the US is recovering.

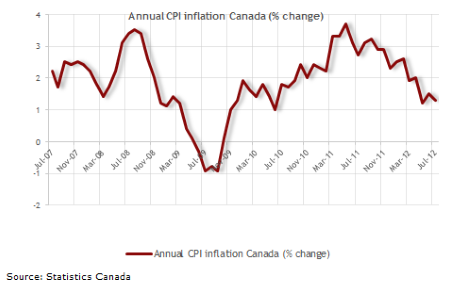

Canada CPI (12:30 GMT) The consumer price index in Canada is expected to remain unchanged at 1.3% in August, with the core measure forecast to fall slightly, according to analysts’ estimates. Data from Statistics Canada show consumer prices rose to 1.3% in the 12 months to July due to higher automobile, food and electricity prices. The Bank of Canada will welcome the stabilised inflation rate, which has dropped sharply since its peak of 3.7% in May last year and in the process allowed the central bank to delay any plans to cut rates. Industrial product prices have also moved lower in recent months. The IPP index fell 0.5% in July compared with June, with the decline linked to chemical products, motor vehicles and other transportation equipment.

Xstrata & Glencore merger (All day) Reports out yesterday indicate that the USD 80 billion planned merger between miners Xstrata and Glencore is set to conclude when the two companies' boards meet in London today. The UK Takeover Panel is said to have given the them until Monday morning to finalise the agreement, but an announcement is expected soon. The merger threatened to collapse earlier this month after Qatar Holding, a sovereign wealth fund with a 12 percent stake in Xstrata, failed to back the original deal, prompting Glencore’s chief executive, Ivan Glasenberg, to increase its offer from 2.8 shares to 3.05 shares. Xstrata’s stock price dipped 1.27 percent yesterday, while shares in Glencore also lost 1.38 percent. Failure to a agree a deal today will certainly make shareholders nervous about a sell-off going into the weekend.

American Petroleum Institute Report (14:00 GMT) Although investors will be focussed on reports that Saudi Arabia has agreed to increase oil supplies to combat the recent rise in crude prices, the American Petroleum Institute's report out today will outline the levels of demand for oil and natural gas in the US. In July, total US petroleum deliveries fell 2.7 percent to just above 18 million barrels per day, the lowest level since September 2008. Meanwhile, demand for gasoline also fell, down 3.8 percent from July a year ago to the lowest July level since 1997. A weak petroleum number would be a further indication the US economy is faltering.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

CAN CPI, Xstrata/Glencore Deal, US Oil Demand

Published 09/21/2012, 07:30 AM

Updated 03/19/2019, 04:00 AM

CAN CPI, Xstrata/Glencore Deal, US Oil Demand

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.