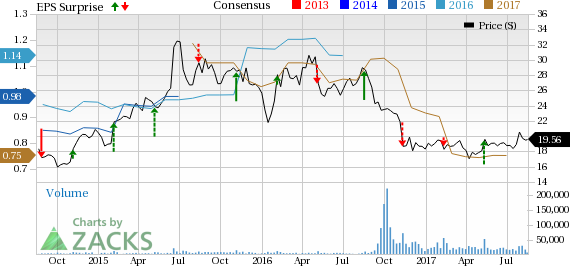

Coty Inc. (NYSE:COTY) is slated to report its fourth-quarter fiscal 2017 results on Aug 22, before the opening bell. This leading distributer, manufacturer and marketer of beauty products surpassed the Zacks Consensus Estimate in two out of the trailing four quarters, with an average beat of 27.1%.

With this in mind, let’s look into some factors that are likely to impact the company’s fourth-quarter results.

Which Way are Estimates Treading?

A look into estimate revisions give us an idea of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the fourth quarter declined by a penny to 9 cents in the past 30 days, while the same for fiscal 2017 has remained stable at 75 cents. We note that the estimated earnings for the fourth quarter and for fiscal 2017 depict a year-over-year decline of 27.8% and 45.4%, respectively.

Further, analysts polled by Zacks expect revenues of $2.17 billion for the fourth quarter. Revenues for the fiscal year are anticipated to be $7.58 billion.

What Does the Zacks Model Unveil?

Our proven model does not show that Coty is likely to beat estimates this quarter. This is because a stock needs to have a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) as well as a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Coty has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 9 cents. The company carries a Zacks Rank #3, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

Coty Inc. Price, Consensus and EPS Surprise

Factors Impacting the Quarter

Coty has been undertaking acquisitions to boost sales and enhance its brand portfolio. This is evident from the positive contributions during the third quarter, from the acquisitions of ghd and Younique, carried out in Nov 2016 and Feb 2017, respectively. In Apr 2017, Coty agreed to acquire the exclusive long-term global license rights for Burberry Beauty luxury fragrances, cosmetics and skincare. The deal is expected to enhance the company’s premium offering in the prestige fragrances and cosmetics categories within the Luxury portfolio.

Coty is also trying to boost its end-to-end digital transformation efforts including e-Commerce, across its divisions and regions. The company has been making great strides in China, when it comes to e-Commerce, which accounted for over 20% of Consumer Beauty revenues during the third quarter of fiscal 2017. In its direct-to-consumer efforts, the company through its Custom Blend app, is making progress with COVERGIRL brand. Additionally, it also seeks to divest its non-performing brands in order to focus and utilize its resources in other attractive opportunities.

Though strategic acquisitions have benefited sales in the Consumer Beauty segment by more than a 100% during the third quarter, sales declined 6% organically. This was primarily reflecting a negative price and mix impact. We note that the Consumer Beauty segment has been consistently witnessing underlying challenges, especially in North America. Moreover, excluding Younique and ghd, the company expects the constant currency net revenue trends in the fourth quarter to weaken sequentially.

Increasing competitive pressure and changing consumer preferences are also hurting the industry. In particular, declines in the retail nail, color cosmetics and hair color categories in the United States and mass fragrance in Western Europe and the domestic market are expected to negatively impact business, where recovery might take some time. Such headwinds are well reflected in the company’s share price performance. The stock has declined 29.4% in the past one year, wider than the industry's loss of 15.1%.

Other Favorable Picks

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +4.00% and carries a Zacks Rank #2.

Churchill Downs Incorporated (NASDAQ:CHDN) has an Earnings ESP of +3.23% and carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Churchill Downs, Incorporated (CHDN): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post