Microsoft Corporation (NASDAQ:MSFT) Information Technology - Software | Reports April 21, After Market Closes

Key Takeaways

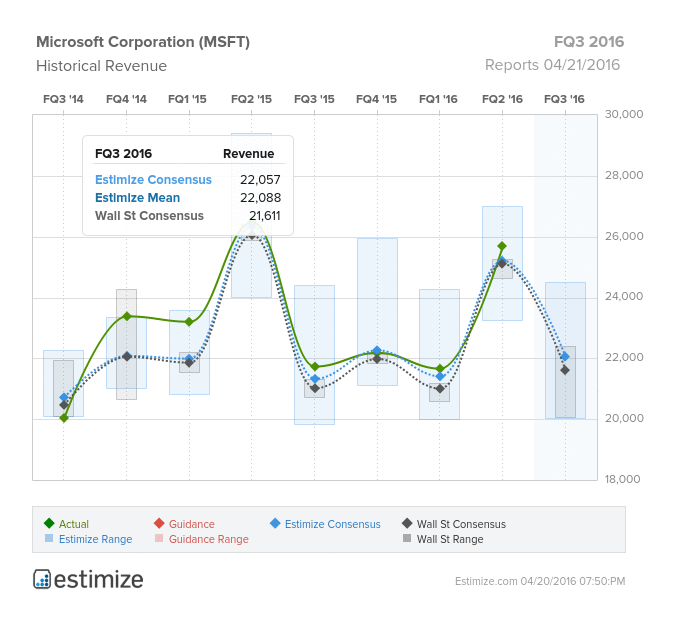

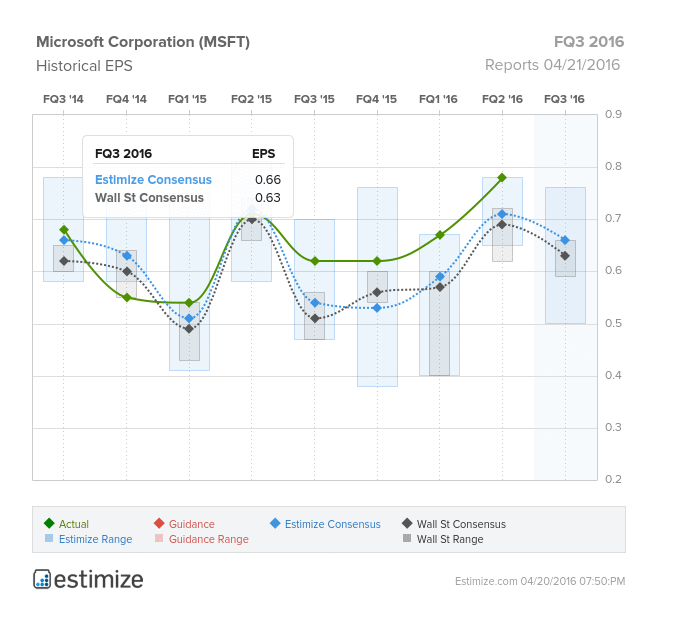

- The Estimize consensus is calling for EPS of $0.66 on revenue expectations of $22.06 billion, 3 cents higher than the Street on the bottom and $446 million on the top

- Cloud computing has been Microsoft’s strongest revenue driver as Azure competes for the top spot in the growing cloud space

- Unsurprisingly, PC revenue is expected to fall largely driven by lower demand for personal computers

Leading technology company, Microsoft is scheduled to report fiscal third quarter earnings Thursday, after the market closes. Microsoft is just one of the many mega cap stocks to report this week and shares a report date with one of its cloud competitors in Google (NASDAQ:GOOGL).

Like its peers, Microsoft is coming off a slew of favorable quarters. Last quarter, the company topped expectations by a wide margin, beating on the bottom line by 7 cents and $480 million on top. In fact, Microsoft has beat its EPS target in each of the past 4 quarters by just as wide of a margin. Despite sluggish PC and Xbox sales, expectations have been upbeat thanks to robust growth with its cloud products.

The Estimize consensus is calling for EPS of $0.66 on revenue expectations of $22.06 billion, 3 cents higher than the Street on the bottom and $446 million on the top. Since their last reports, per share estimates have been cut by 13% while revenue was slashed 3%.

Current estimates are still forecasting favorable 7% growth in profitability on a year over year basis. Given Microsoft’s track record, it’s not surprising that the stock is up 35.14% in the past 12 months.

Later today, Thursday, all eyes will be focused on Microsoft’s cloud division. Cloud computing has been Microsoft’s strongest revenue driver as Azure competes for the top spot in the growing cloud space. Azure is slowly emerging as a fan favorite against notable products from Google and Amazon (NASDAQ:AMZN). Currently, commercial cloud growth is expected to be as high as 70% year-over- year supported by 125% growth in its flagship Azure products. Apart from cloud computing, MS Office has been a bright spot in Microsoft’s financials. Commerical Office 365 revenue is forecasted to grow a resounding 63%

Unfortunately, the booming growth in cloud computing must offset waning demand in its legacy business. It’s no secret that PC sales have declined recently and Microsoft has suffered because of it. This quarter PC revenue is expected to decline 2.7% due in part PC weakness. Microsoft also didn’t do itself any favors when it upgraded all users to the newest versions of its operating system for free.

Meanwhile, Xbox One sales have come in far below comparable gaming systems. It’s estimated that cumulative Xbox sales have yet to reach 20 million units while PS4 sales just surpassed 35 million units sold.