We begin with DBC, which is doing a yeoman’s job of sinking. It is approaching the lower half of its long-time descending channel, and I think energy is speaking truthfully to us about what’s ahead for the economy.

The IEFA, global equities, is sinking away from its long-term broken uptrend.

Gold miners still have an absolutely solid chance of rallying, provided prices don’t’ sink back again into that green-tinted zone.

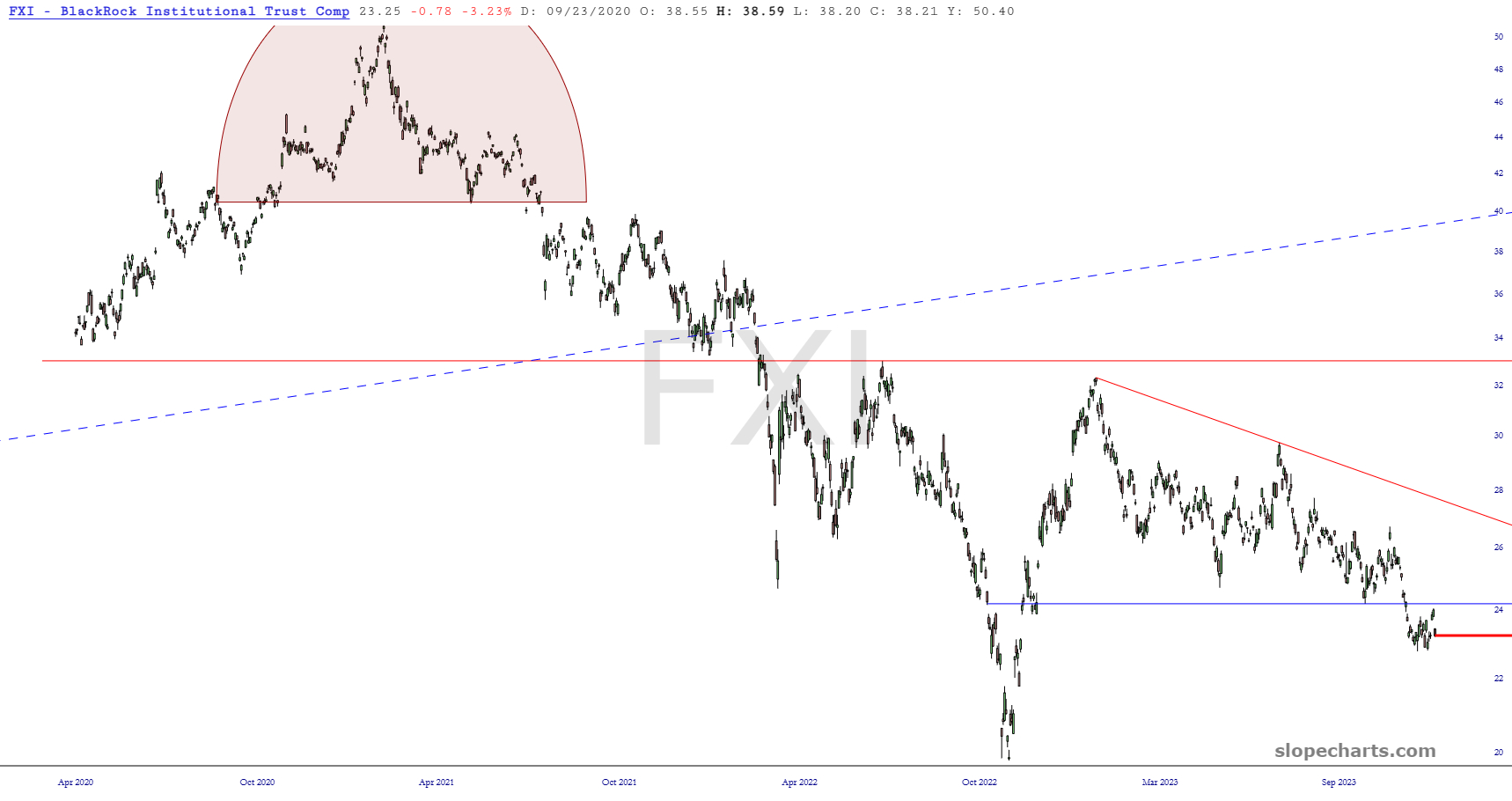

iShares China Large-Cap ETF (NYSE:FXI) continues to weaken beneath its right triangle.

One of my three sine-wave trades, the small caps iShares Russell 2000 ETF (NYSE:IWM), had a nice down day today and is behaving itself perfectly properly.

Tech stocks got kicked in the balls, thanks to both severe AAPL weakness (investment bank downgrade) as well as profit-taking on tech in general.

The same holds true for semiconductor, which is of course very dependent on a single stock, Nvidia (NASDAQ:NVDA).

Bonds, precisely as I hoped and predicted, as sinking away from that broken red uptrend.

My second “sine wave trade”, utilities, was annoyingly strong today, perhaps as a defensive play. I actually bought a few more puts as it strengthened, but it sure as hell better start to weaken again soon.

My third and final sine wave trade, retail, went down today, which is a good thing. I’ve got March puts on all of these (IWM, XRT, XLU) and am really needing these to work out before I get aggressive with my trading again.

It was an exceptionally long day (trip to the airport, miserable red-eye light, lots of driving, lots of packing, all the while trying to do my job more-or-less) so I’m going to turn in.