Investing.com’s stocks of the week

Sometimes, when the chairman of the U.S. Federal Reserve speaks, my diaphragm pushes on my lungs hard enough to inhibit breathing. It’s not that I don’t admire Ben Bernanke on a variety of levels. It’s just hard to believe that a man of remarkable intelligence is serious when he says, In light of the current low interest-rate environment, we are watching particularly closely for instances of reaching for yield.

So members of the Fed are monitoring excessive risk taking, are they? How can anyone refrain from riotous laughter?

My 80-year old father in Florida never had a need for higher-yielding bonds. In the 20 years between 1988 and 2008, he and his wife were quite content to supplement their pension with an average of 5%-6% interest from CDs. Unfortunately for them, the last of the CDs matured in 2010 and the Fed’s seemingly endless quantitative easing effectively killed the collective yield on CDs, treasuries and investment-grade debt. Their only choice to avoid invading principal? Pops had to begin risking IRA dollars in higher-yielding bonds and preferred stock.

From Greed To Fear

Anecdotal evidence notwithstanding, Bernanke and colleagues can monitor yield reaching and superfluous risk taking until the cows come home. Unless they pull the proverbial punch bowl and/or begin slowing their billions in treasury purchases, savers will step up the risk ladder and investors will get even greedier. And let’s face it… someday, the fear of missing out on an “easy money rally” will eventually morph into the fear of losing one’s shirt, shoes and undergarments.

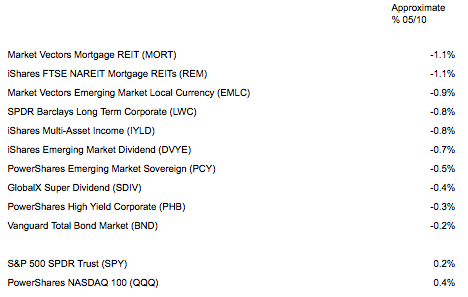

Perhaps Bernanke believes he can talk the markets into a cooling-off period. In that manner, much like his counterpart at the European Central Bank, he might not have to act or change course at all. Indeed, on Friday, 5/10/13, yield-oriented bonds and stocks struggled far more than the S&P 500 at large.

From Addiction To Recovery

Obviously, Bernanke hopes that an addiction to monetary stimulus will soon transition into a self-sustaining recovery. It follows that he will not will not overplay a hawkish hand. By the same token, his “talking points” need to remain sufficiently dovish to appease market participants; that is, interest rates better stay depressed enough for real estate demand and stock share demand to remain robust.

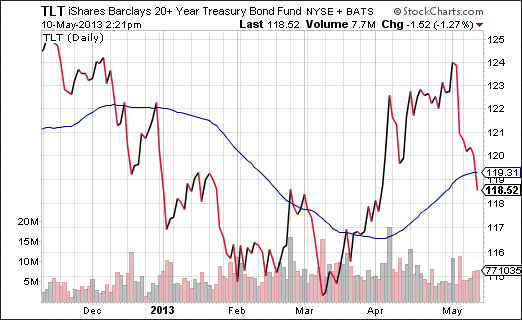

Keep in mind, iShares 20+ Year Treasury Bond (TLT) is falling and long-term bond yields are climbing again. On its surface, this may benefit “risk-on” stock share acquisition. Nevertheless, the activity is equally capable of causing early-to-the-party equity investors to rethink the impact of rising interest rates. Certainly, the “first-in” folks have a protection plan in place. What about those who came late to the stock market’s jamboree?