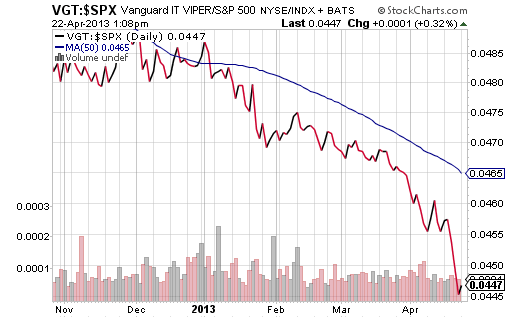

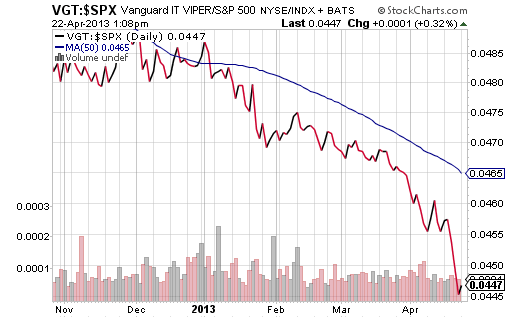

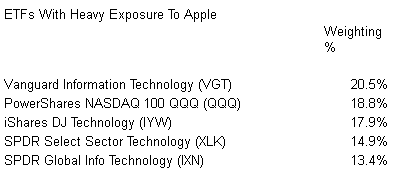

After the market closes on Tuesday, April 23, the world will turn its attention to the previously untarnished Apple (APPL). Its epic downward spiral from $700 per share to a sub-$400 price is largely responsible for the relative under-performance of Technology ETFs. Below, the Vanguard Information Technology (VGT):S&P 500 price ratio demonstrates the trend:

Over the last week, however, a different tech bellwether deserves the lion’s share of the blame. IBM’s (IBM) share price eroded 11% due in large part to a high profile “miss” on revenue and earnings. Unfortunately for exchange-traded enthusiasts, the company has an over-sized weighting in a number of Technology ETFs as well as the Dow.

What is particularly troubling about the IBM weighting is the history of the corporation’s share price with the broader market. According to Bespoke Investment Group, IBM earnings reports tell investors where the market is heading over the next 5 weeks with a 75% success rate. Over the last 5 quarters, the success rate is actually 100%. On the three occasions that IBM’s stock price rose after reporting, the S&P 500 gained ground; on the two occasions that IBM’s stock price fell after reporting, the S&P 500 lost value over the following 5-week period.

In other words, the broader market may already be set up for failure in the last week of April and the month of May. It follows that Technology ETFs with heavy IBM exposure may be particularly vulnerable.

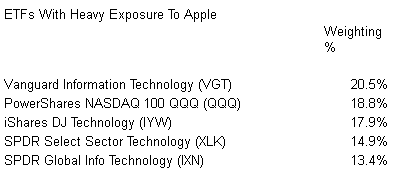

There is a wild card, however. What if Apple (APPL) defies critics as well as months of extraordinary selling pressure? What if iPhone, iPad as well as Mac desktops and laptops blow past sales expectations? What if revenue-based margins at the heart of profitability improved dramatically from Q1 to Q2?

If it happens, Apple might be able to reclaim some of its former glory. Moreover, with Apple’s prominent weighting in Tech ETFs, one may see the sector demonstrate resilience in spite of IBM’s recent woes.

Of course, for the market to respond favorably to upcoming earnings, a large number of “what ifs” need to occur. Do I believe that Apple will impress? No, I do not.

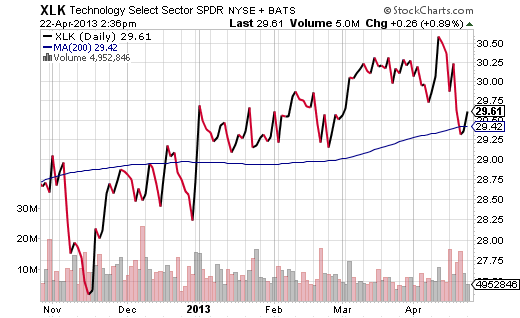

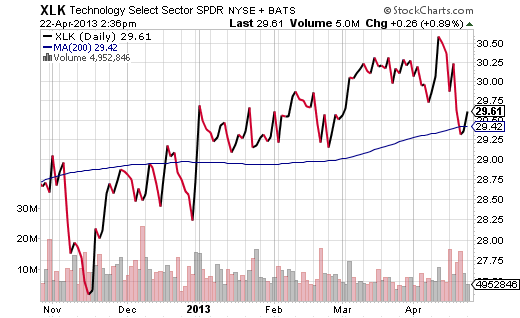

Nevertheless, it’s vital to recognize that the perception of Apple’s numbers will likely set the tone for Tech ETFs in the months ahead. As it stands, SPDR Select Technology (XLK) is already flirting with a long-term downtrend; the current price for XLK is struggling to stay above a 200-day moving average. If the i-Everything maker fails its upcoming exam, Technology ETF aficionados would likely need to utilize their exit strategy.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Over the last week, however, a different tech bellwether deserves the lion’s share of the blame. IBM’s (IBM) share price eroded 11% due in large part to a high profile “miss” on revenue and earnings. Unfortunately for exchange-traded enthusiasts, the company has an over-sized weighting in a number of Technology ETFs as well as the Dow.

What is particularly troubling about the IBM weighting is the history of the corporation’s share price with the broader market. According to Bespoke Investment Group, IBM earnings reports tell investors where the market is heading over the next 5 weeks with a 75% success rate. Over the last 5 quarters, the success rate is actually 100%. On the three occasions that IBM’s stock price rose after reporting, the S&P 500 gained ground; on the two occasions that IBM’s stock price fell after reporting, the S&P 500 lost value over the following 5-week period.

In other words, the broader market may already be set up for failure in the last week of April and the month of May. It follows that Technology ETFs with heavy IBM exposure may be particularly vulnerable.

There is a wild card, however. What if Apple (APPL) defies critics as well as months of extraordinary selling pressure? What if iPhone, iPad as well as Mac desktops and laptops blow past sales expectations? What if revenue-based margins at the heart of profitability improved dramatically from Q1 to Q2?

If it happens, Apple might be able to reclaim some of its former glory. Moreover, with Apple’s prominent weighting in Tech ETFs, one may see the sector demonstrate resilience in spite of IBM’s recent woes.

Of course, for the market to respond favorably to upcoming earnings, a large number of “what ifs” need to occur. Do I believe that Apple will impress? No, I do not.

Nevertheless, it’s vital to recognize that the perception of Apple’s numbers will likely set the tone for Tech ETFs in the months ahead. As it stands, SPDR Select Technology (XLK) is already flirting with a long-term downtrend; the current price for XLK is struggling to stay above a 200-day moving average. If the i-Everything maker fails its upcoming exam, Technology ETF aficionados would likely need to utilize their exit strategy.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.