Rocket fuel

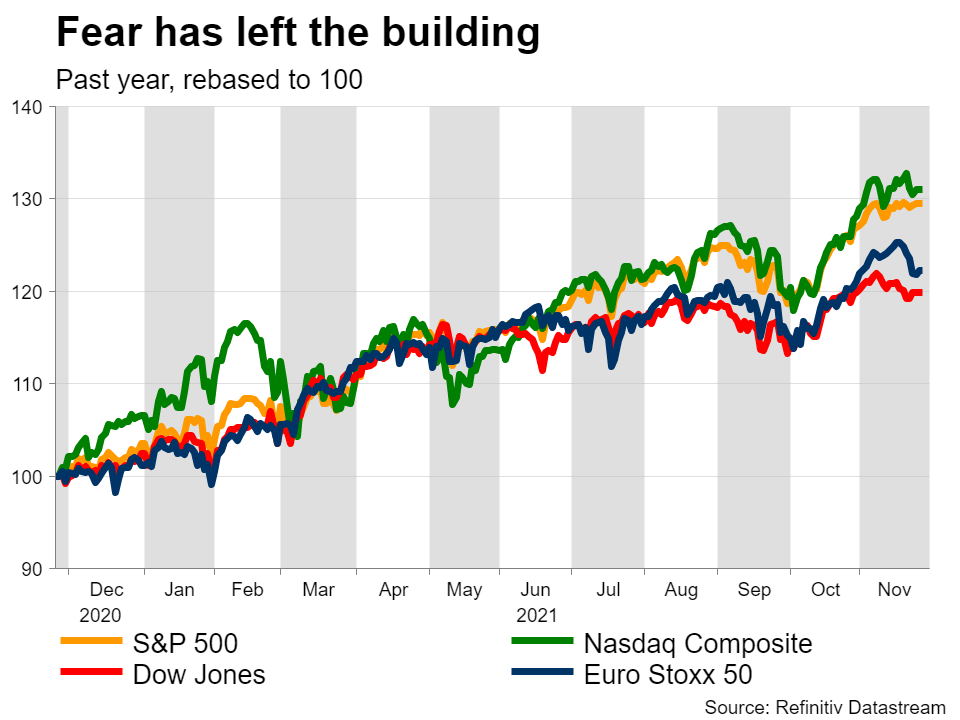

There’s a clear sense of euphoria driving this bull market. Asset prices seem almost immune to bad news, every dip is a new opportunity to buy, and momentum is king. Take covid news. Fears of a new vaccine-resistant variant dragged US markets lower today, but the losses were not dramatic.

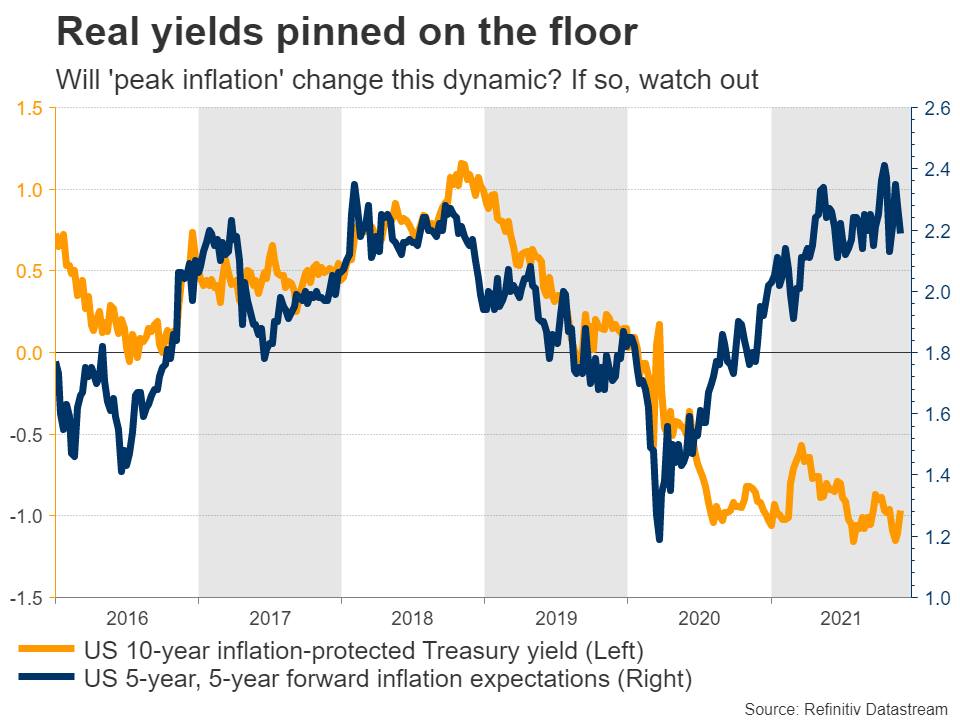

Of course, this has been the story for almost two years now. When extravagant government spending meets negative real interest rates from central banks, that is rocket fuel for markets. Interest rates are essentially the price of money. If that price is negative once you account for inflation, then everything else automatically becomes attractive.

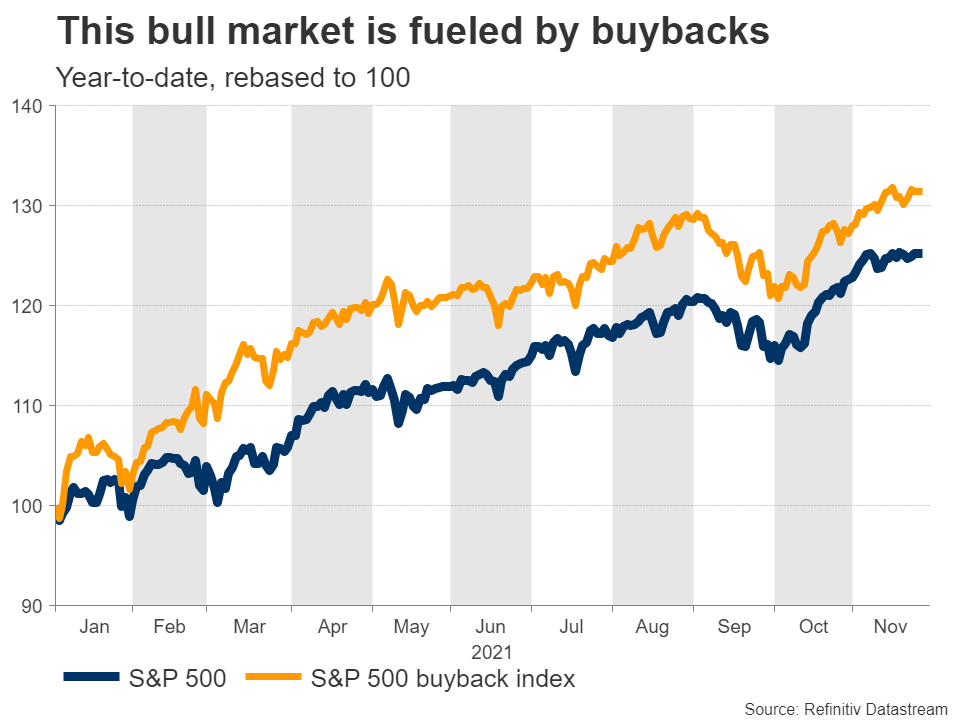

There’s also the powerful force of corporate buybacks, which are on track to hit new records this year, and the explosion in options trading. Since options have embedded leverage, betting that a stock will rally this way allows traders to ‘pack more punch’ in pushing the shares higher.

But when equity markets rally by almost 30% in a single year, it’s time to pause and reflect. Are these elements still in play or have investors taken their eye off the ball?

Fading support

Admittedly, the road forward seems much more challenging. The fastest pace of the economic recovery is probably behind us, while central banks and governments are both stepping back from the tremendous support they have provided so far.

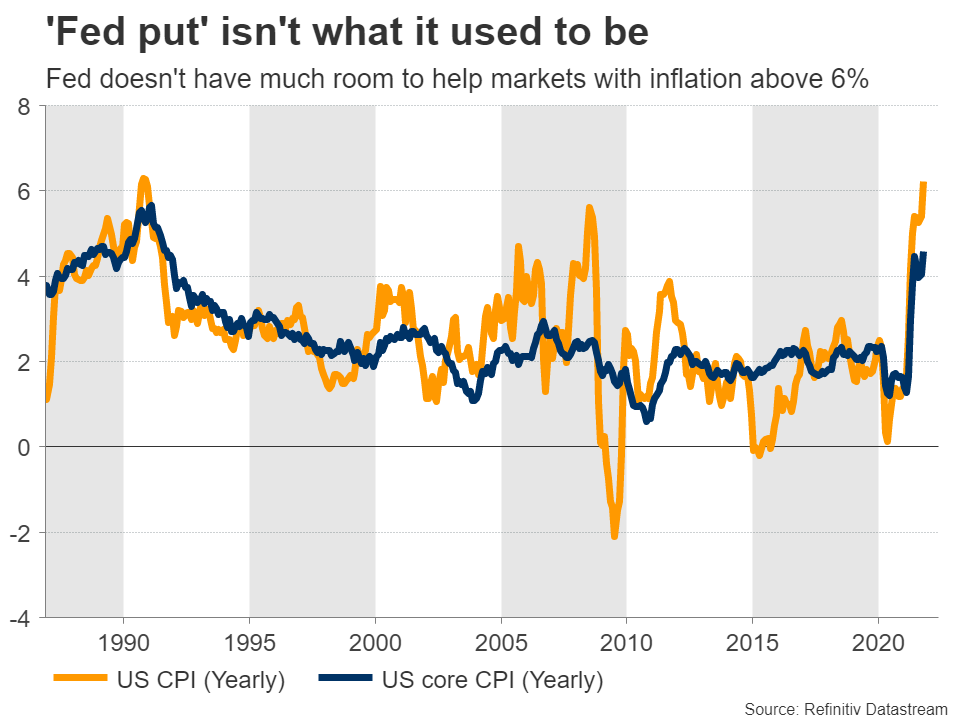

The surge in inflation has been a game changer for central banks. The long-standing assumption that the ‘Fed has our backs’ in the sense that any market decline would result in policy action that helps stocks bounce back, may not hold anymore. With US inflation running above 6%, the central bank doesn’t have much room for helping markets if a correction strikes.

On the fiscal front, there isn’t much political appetite anymore for huge stimulus packages. Most economies have stabilized and government debts have ballooned. Instead, corporate taxes are moving higher. The G20 nations have brokered a deal that would set a global minimum tax rate of 15% on large corporations, which is expected to come into force in 2023.

Another issue is the growth trends in China and Europe. Chinese economic growth is likely to slow down as the property sector deleverages, which is also bad news for Europe that relies on China to absorb many of its exports. The euro area faces the risk of new lockdowns too as infections are soaring again, and that’s even before the ‘Nu’ variant appeared.

Valuations aren’t cheap

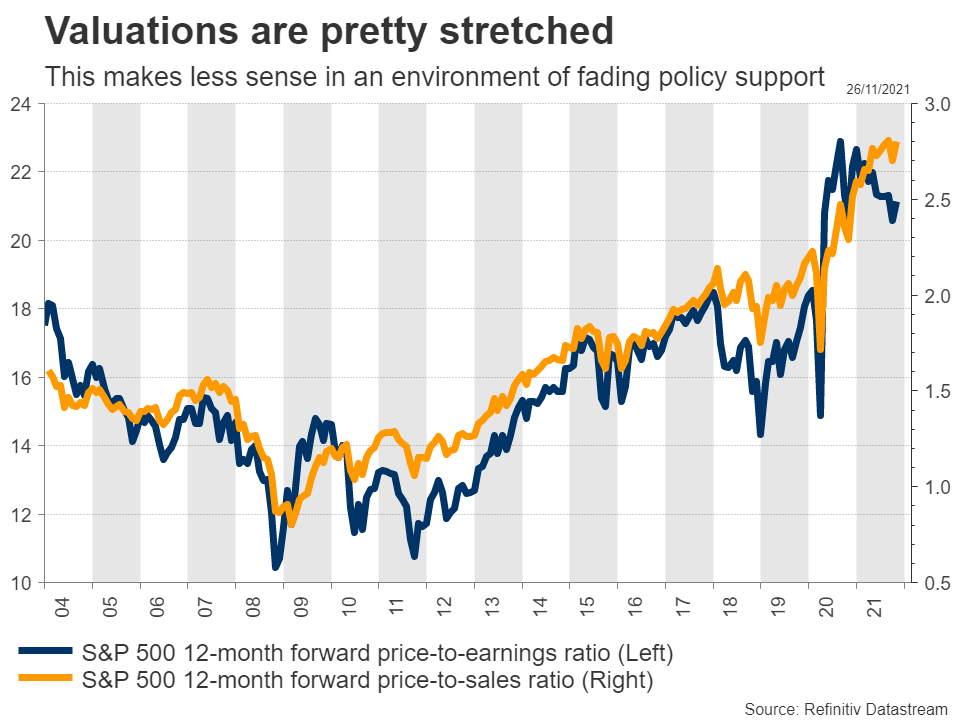

Most valuation metrics have corrected from their peaks earlier in the year, but remain in ‘danger zone’ territory. The 12-month forward price to earnings ratio for the S&P 500 stands at 21.5x, which is extremely elevated by historical standards.

The forward price-to-sales ratio is also inflated at 2.8x, while the famous Buffett indicator which measures the entire stock market capitalization relative to the US economy is far higher than any previous bubble. This indicator may not be so relevant anymore as US companies sell more abroad than in the past, but it still suggests the market is pretty expensive.

Here’s the problem - it’s one thing for the market to be overpriced when both fiscal and monetary policy are extremely loose. That’s natural. But when these forces are both fading and valuations remain this stretched, it’s a much bigger concern.

What’s next

Equity markets have displayed an incredible ability to absorb bad news without much damage. We probably have the storm of corporate buybacks and the depressed levels of real yields to thank for that.

But if real yields dare to rise from record lows, that could spark a reality check. We have already gotten a taste of that recently. While the major indices on Wall Street remain near record highs, there’s been a quiet massacre under the hood in cash-burning companies, mostly in the tech sector. Those are the most sensitive to rising yields.

The real question is, what could propel real yields higher? The answer may be ‘peak inflation’. With inflation roaring higher lately, investors are buying inflation-protected bonds in truckloads. This demand is keeping ‘real’ yields pinned on the floor. But once we see the first signs that inflation has actually peaked, this dynamic could change.

Ultimately, there’s nothing else

Now to be clear, all this argues for a correction, not a crash. Markets simply seem to have run too far ahead of fundamentals, projecting forward the favorable conditions that have dominated so far. But things are changing, especially on the policy front.

In the longer run, stock markets tend to follow the economy, which is healing quickly. Cheap money from central banks certainly helps a lot, but as the 2015-2019 experience showed, equities can flourish even with rising rates and fading liquidity.

After all, what else is there? Central banks have killed bonds as an asset class, while commodity and crypto markets are too small and volatile for ‘big money’. A correction may be overdue, but ultimately there’s just no alternative to stocks.