San Antonio, TX-based oil and natural gas explorer Abraxas Petroleum Corporation (NASDAQ:AXAS) recently entered into acquisition and divesture deals to boost its acreage in the prolific Permian on one hand and divest the non-core holdings on the other in Powder River Basin.

The company inked an agreement to acquire 973 net acres in the Delaware Basin, located in the Permian Basin oilfield in West Texas. The acquisition will add 445 acres in Caprito leasehold, 172 acres in Ward County and 356 acres in Reeves, Pecos and Winkler Counties. Production capacity of the acquired assets amounts to 130 barrels of oil equivalent per day. The acquisition will be funded by a combination of cash, stock and land. Abraxas will pay $4.3 million in cash and $2 million shares for the acquisition. In addition, it will trade around 12, 000 net acres and half of its mineral rights in Cayanosa land. Subject to satisfactory closing conditions and regulatory approvals, the deal is set to close in August.

The deal is expected to add to the 1894 acres acquired by the company in May for $20.9 million. The company currently owns 8497 acres in the oil-rich Bone spring and the Wolfcamp formations of the Delaware Basin. Abraxas is focusing on strengthening its foothold in the Permian Basin at a reasonable price which is likely to drive growth and earnings. The company intends to increase its capital expenditure to $120 million for the drilling and completion of wells.

In a separate deal, Abraxas has planned to offload acreage in Powder River Basin in Wyoming for $4.6 million to an undisclosed buyer. The proceeds from the divestment will be utilized to finance the cash portion of the acquired assets in Delaware Basin. Production capacity of the divested assets is 100 barrels of oil equivalent per day in March. The company has however retained around 948 net acres in Porcupine/Frazier Federal area of Wyoming. The transaction is expected to close by the end of July.

Zacks Rank and Key Picks

Abraxas is an independent energy company, which deals in the exploration, production and development of oil and natural gas. The company has its operations spread across Rocky Mountain, Permian Basin and South Texas regions of the U.S. Abraxas, which belongs to the Zacks categorized Oil and Gas - United States - Exploration and Production industry, presently carries a Zacks Rank #3 (Hold).

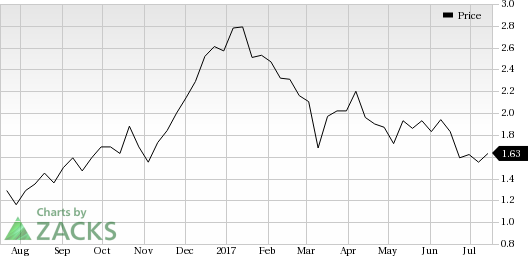

Abraxas Petroleum Corporation Price

Some better- ranked players in the same industry are Cheniere Energy, Inc. (NYSE:LNG) , Range Resources Corporation (NYSE:RRC) and Antero Resources Corporation (NYSE:AR) . While Cheniere Energy sports a Zacks Rank #1 (Strong Buy), Range Resources and Antero Resources carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cheniere Energy delivered a positive earnings surprise of 14% in the trailing four quarters.

Range Resources is expected to generate year-over-year growth of 129.95% and 96.36% in its revenues and earnings respectively in 2017.

Antero Resources delivered positive earnings surprise in each of the last four quarters, the average being 665.71%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Range Resources Corporation (RRC): Free Stock Analysis Report

Abraxas Petroleum Corporation (AXAS): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Original post

Zacks Investment Research